Life Insurance

What is Life Insurance Plan?

Life sometimes brings unannounced uncertainties and hardships. Some events may have an

irreparable impact on your life and may leave your family in a turmoil both financial and

emotional. To reduce the financial worries that may erupt due to the unpredictable and

untimely demise of the earning member of the family, the life insurance comes to the rescue.

Life insurance is a vital form of investment that will act as financial aid or assistance to

your family when you are not around.

Life insurance plans are of various types out of which a few plans are pure protection plans

offering a death benefit, whereas the others are saving or investment plans offering death

and maturity benefit (whichever occurs first).

How does Life Insurance Work?

Life Insurance is a long term contract (known as LIFE INSURANCE POLICY) between the Life

Insurance Company (known as INSURER) and the person whose life is being insured (known as

LIFE INSURED) for a specified tenure (known as POLICY TERM) giving an amount of money equal

to the life cover (known as SUM ASSURED) by paying a cost (known as PREMIUM).

In the event of death of the Life Insured (known as DEATH CLAIM) during the policy term, the

insurance company passes on the requisite amount as policy proceeds (known as DEATH CLAIM

AMOUNT) to the specified family members (known as BENEFICIARY/NOMINEE) mentioned in the

contract and the policy terminates thereafter or in the event of life insured survives

through the policy term, the insurance company pays out the promised amount (known as

MATURITY CLAIM AMOUNT) to the policyholder and the policy terminates thereafter.

Why should I buy Life Insurance?

Life Insurance primarily covers the risk of ‘Dying too early’ or ‘Living too long’. The

listed reasons will highlight the need for life insurance for you and your family:

Financial Protection

A life insurance policy assures that your loved ones are financially covered in the event

of your untimely demise and to maintain the same lifestyle which they are used to even

when you are not around.

Meet Financial Obligation

A life insurance policy ensures that your children’s education, their marriage, and other

financial obligations like home loans, car loans, etc. are taken care of in your

absence.

Retirement

A life insurance policy helps you to gather a corpus for your better future and to attain

a regular source of income post-retirement and lead an independent life.

Ensure Guaranteed Income

It helps you and your family to possess a guaranteed income in case your regular inflow

of earnings are disrupted due to a severe illness or an accident.

Peace of Mind

A life insurance policy provides you the assured peace of mind. By buying the right life

insurance plan, your family’s financial needs are taken care of even when you are not

around.

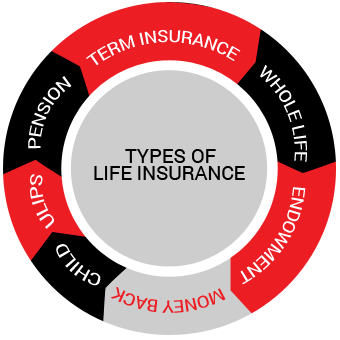

What kinds of Life Insurance Plans can I opt from?

There is a bundle of life insurance plans available in the market. It purely depends on which

one suits your need and requirement basis the benefits accrued or attached to a plan.

The term plan is a pure protection plan which covers the risk of ‘dying too early’. Term

plans provide the nominee with the sum assured as a financial indemnification in the

unfortunate event of your demise during the policy term and policy then terminates. A term

insurance plan safeguards your loved ones in your absence by shielding them with financial

backing as planned by you.

The whole life plan is an insurance plan which covers your life against the risk of “dying

too early” and “living too long” both, as the life cover is provided for the whole life

keeping maximum maturity age as 100 in most of the plans. This insurance company pays the

policy proceeds to your nominee in the event of your death during a policy term, but if you

survive till the maximum maturity age, the company will provide the maturity benefit as

well.

Endowment plan comes with the component of saving and insurance making it a twin benefit plan

under the policy. Endowment plans offer lump sum payout in the event of death or maturity,

whichever happens first. This life insurance plan can be opted to ensure a robust corpus and

regular savings to meet financial objectives in the future.

This policy offers a portion of the sum assured payout on regular intervals during the policy

term in terms of money backs or survival benefits, while the insured is alive. Once the

insured survives through the entire policy term, the remaining sum assured is paid back as

maturity benefit. In case the insured dies during the term of the policy, apart from the

money backs, the lump sum payout is given to the nominee also known as survival

benefits.

Child plans are a type of life insurance plans, which are taken with a specific objective of

giving unperturbed financial support to the child in terms of education, higher education,

marriage, etc. Child plans also offer death and maturity benefits (whichever happens

earlier). Usually, such plans come with an inbuilt waiver of premium benefit to continue the

policy to ensure coverage for your child.

ULIPs (Unit Linked Insurance Plans) provide the twin benefit of insurance and investment

opportunities under one umbrella. ULIPs are linked to the market, and the insured’s money is

invested in various funds (based on equities, debts, government bonds) as per the

risk-taking capacity of the insured. The lump-sum payout is given to the nominee in the

event of death, and the entire value of the fund is given to the insured if he survives the

policy term.

Such plans cover the risk of ‘Living too Long’. Pension plans enable to survive the same

lifestyle and allow financial independence after the retirement age. Regular payment of

premiums builds a financial corpus, which can be withdrawn partly and the remaining can be

utilized to provide pensions to the insured as stated in the policy.

What are the Benefits of Buying a Life Insurance?

Death Benefit

Life Insurance provides financial protection to your family in your absence by giving death

claim payout which is a lump sum Sum Assured plus accrued benefits/bonus basis the life

insurance plan opted.

Maturity Benefit

Life Insurance provides the insured a lump sum payout as applicable under the policy

conditions on the completion of the policy term as Maturity claim payout. The maturity

benefit is payable if the insured survives the policy term.

Rider Benefit

With your Life Insurance plan, you may opt for additional coverage or riders like Accidental

Death Benefit, Disability rider, Income benefit rider, Critical Illness rider, etc. to give

you added protection along with your base policy.

Surrender Benefit

Life insurance provides you the option to surrender your policy partially or fully in the

event of any urgent fund requirements. However, the surrender value is very less as compared

to the premiums paid till that time.

Loan Benefit

Some of the endowment life insurance policies offer the loan facility. The insured has to pay

the applicable interest and repay the loan amount as per policy conditions.

Tax Benefit

Premium paid towards the insurance policy taken for yourself, spouse or kids avail tax

benefits under section 80C, and the proceeds of the insurance policy are tax-free as per

section 10(10) D of the Income Tax Act,1961 as per the conditions laid.

How is my Premium Calculated?

The Premium for your Life Insurance policy is calculated, basis the following factors:

Current Age

Age plays the most imperative role in deciding the premium amount. For younger life

premiums are low, and for older people premiums are high. The insurance companies

underwrite the case basis the risk involved in the customer’s life as per the age. So,

it’s prudent to buy life insurance at an early stage.

Life Cover

The higher life cover or Sum Assured policies will have a higher cost or premium amount

to cover the risk by the insurer. However, some insurers offer you the discounts on

premium for choosing the higher life cover.

Smoking/Drinking Habit

Intake of cigarettes, tobacco, alcohol, and other nicotine products will attract high

premiums as such products are harmful to health and elevate the risk of an individual’s

life. So insurers cover high-risk lives by charging more premiums or may decline the

proposal.

Present Health Status

Your health status also determines the amount of premium to be paid by you towards your

life insurance policy. In case you possess diabetes, high blood pressure, non-standard

BMI, or suffering from some severe disease will attract a higher amount of premium as

compared to other healthy life of your age.

Gender

As per statistics, women tend to live more than men. The life expectancy of women is

higher, so the mortality component of the premium amount is lesser for women as compared

to men when applying for a life insurance policy.

Job Profile

Your occupation also plays a crucial role in determining the premium amount. A risky

occupation like people working in the mining industry, oil, and gas, fisheries or any

other dangerous profession increases the premium amounts for your policy.

What are some Smart Buyings Tips?

Start Early: Life insurance premium most importantly depends on the age at

which you are buying the policy. Starting early can save a lot on the premium amount

throughout the policy term. It’s prudent to get a Life Insurance at the earliest to protect

the financial interest of your loved ones.

Assess your Life Cover Accurately: It is imperative to assess the life cover

or Sum Assured, based on the number of dependents you have, how much money you require to

meet your financial goals like building a house, child’s education, child’s marriage and how

much debts/liabilities you need to pay.

Check for Claim Settlement Ratio: Many insurers offer a variety of

innovative life insurance plans. The entire purpose of taking the policy gets defeated if

the insurer does not settle the claim in the event of your unfortunate demise. So check on

the claim settlement ratio of the insurance company before buying an insurance plan.

Keep Inflation in Mind: It’s imperative to take a cover keeping inflation in

mind. A life cover of Rs 30-40 Lakhs may not be of the same value down the years say after

20 years. So it’s prudent to keep in mind the inflation factor that will affect your

financial needs later in the future.

Compare & Buy Online: The internet has made buying so easy. Online buying of

insurance policies is much cheaper as there is no intermediary in-between. It is hassle-free

to buy with a few clicks which allow quick policy issuance. You can compare policies online

and choose the best fit as per your need and requirement.

Read the Fine Print: You may get excited to buy the cheapest plan offering

a bundle of benefits, but don’t forget to read between the lines. Study the terms and

conditions of the policy contract carefully before buying to avoid any issues later. Your

insurer also provides you with a free look period of 15 to 30 days wherein if you are not

satisfied with the plan you have opted, you can get it canceled and get back your premium

amount.

Opt for Requisite Riders: Riders offer additional coverage to your policy.

It’s wise to opt for only requisite riders as opting for too many riders will elevate the

premium amount and that may not be required.

Is there any Add on Cover/Rider with Life Insurance Policy?

Riders are additional benefits attached to your base policy which will offer you enhanced

benefits apart from your base policy. Various insurers offer multiple riders which can be

attached with the main policy as per the policy conditions. Riders come with additional

costs.

Accidental Death Benefit Rider

An additional death benefit is paid to your nominee apart from the base policy payout. The

nominated beneficiary/ nominee can receive term rider sum assured if you have taken this

rider to your base policy.

Term Rider

An additional death benefit is paid to your nominee apart from the base policy payout.

The nominated beneficiary/ nominee can receive term rider sum assured if you have taken

this rider to your base policy.

Critical Illness Rider

There are severe illnesses which disable an individual temporarily or permanently

resulting in loss of earnings. The treatment cost of such illnesses is massive due to

medical cost inflation. You can choose a critical illness rider to take care of the

medical cost involved in such illnesses like Heart attack, Cancer, Paralysis, Coronary

artery bypass surgery, Major organ transplant and many more.

Waiver of Premium Rider

As the name suggests, the future premiums are waived off in the events like death or

disability of the insured or policyholder as per the policy contract. The policy

continues to survive till the end with the waiver of future premiums.

Income Benefit Rider

Life Insurance benefits are usually given to the nominee/s as a one-time lump sum, and

income benefit rider allows your nominee to receive the policy benefits in installments

as a regular income. This rider allows you to regulate the dispersal plan of policy

proceeds that suits best for your family in your absence.

Disability Rider

Disability rider replaces your income for the specified tenure in the event of permanent

or temporary total or partial disability due to an accident. The payout varies with the

kind of disability occurred and also basis the insurer’s rider conditions. In case of

total disability, the payout is the full sum assured whereas, in case of partial

disability, the payout is the partial sum assured.

(Note: The rider benefit, conditions, and eligibility criteria may vary from insurer

to insurer.)

What is NOT included in the Life Insurance Plan?

Your life insurance plan excludes the following:

Aviation Clause

This clause states that the policy benefits are paid out only in the event where the life

insured is killed in a commercial plane crash while traveling. But if the life insured dies

as a passenger in a private plane insurance company will not entertain the claim.

Dangerous Adventure Sports

This exclusion says that in the event the death of the life insured happens due to the

involvement in certain dangerous adventure activities like auto racing, rock climbing,

hang-gliding, etc., the payment of the policy proceeds will not be paid.Some insurer’s cover

death arising out of such activities at a very high premium rate.

Act of war exclusion

This exclusion provides that the insurer will not pay if the cause of death is a result of

the war.

Do’s and Dont’s in a Life Insurance Plan

Read the do’s and dont’s related to your Life Insurance Plan.

| Do’s |

Dont’s |

| Assess your needs and requirements in order to buy the right sum assured and right

plan type

|

Ask your agent to fill the proposal form |

| Compare,choose and buy the plans online and save on cost |

Leave any column blank in the proposal form |

| Fill the proposal form yourself.Mention the complete and corr ct details in the

form

|

Conceal and misrepresent the facts, as it could lead to disputes during the time of

claim settlement

|

| Retain a copy of your duly filled proposal form for your own records |

Make payment in the name of your agent advisor rather it has to be done in the

insurer’s name

|

| Read the fine print thoroughly before making payment |

Buy a life insurance policy without comparing online |

FAQ's

Q: What is life insurance?

Ans: Life insurance provides the life cover and it assures you to pay the chosen sum assured amount to your nominee/ beneficiary in the event of your demise during the time policy is in active state. Life insurance is considered as the most economical way to secure the future of your family when you are not around.

Q: How a life insurance policy works?

Ans: A life insurance policy offers the cover against the life-related uncertainties. In the event of your unfortunate death during the coverage term, the insurance company will pay the sum assured amount to your nominee which ensures a comprehensive financial protection for your family.

Q: Do I really need life insurance?

Ans: You need life insurance, if any of the family members would be put at risk or suffer financially in the event of your death. If there are family members who are financially dependent on you, it is extremely essential to buy life insurance with a comprehensive cover.

Q: Which life insurance is best?

Ans: The motor insurance premium is calculated on the basis of some key factors like

IDVWhen you are seeking to buy the best life insurance policy for you & your family, you firstly need to assess the future financial needs of your family and then pick the coverage accordingly. Also, check whether you need only the life coverage or looking for maturity benefit that will help to pick the life insurance policy such as term insurance, endowment, money back, etc.

Q: How much cover amount under life insurance is sufficient for my family?

Ans: When you are seeking to get the right life cover for your family to ensure they can lead a decent lifestyle even after your demise, you are advised to identify your family’s financial needs and then pick a life insurance cover accordingly.

Q: What are the benefits of having a life insurance policy?

Ans: Upon buying a life insurance policy, you will be entitled to receive the following benefits.

- Death Benefit: Sum Assured is paid to the family on your demise.

- Maturity Benefit: Lump sum payout on completion of the policy term, depending on the policy chosen.

- Loan Benefit: Some of the life insurance policies such as endowment policy offers the loan facility.

- Rider Benefit: Choose additional coverage through riders like accidental death benefit, disability rider, critical illness rider, etc.

- Tax Benefits: Premiums paid u/s 80C & policy benefits payable are eligible u/s 10(10D).

Q: What kinds of deaths are covered under life insurance?

Ans: Following are the types of deaths that are covered under a life insurance policy.

- Natural death or death due to health-related issues

- Death by suicide after 1 year of commencement of the policy

- Accidental death

Q: What are the tax benefits for buying a life insurance policy?

Ans: Premium paid towards a life insurance policy taken for yourself, spouse or kids avail tax benefits under section 80C, and the benefits payable under the insurance policy are tax-free as per section 10(10D) of the Income Tax Act,1961.

Q: For how long should I continue the life coverage?

Ans: Life insurance provides coverage against the life risk and you should continue the life insurance coverage for at least 65 years of age. Although, the time duration till you need the coverage may vary depends on the circumstances and responsibilities that you have.

Q: What are the exclusions in a life insurance plan?

Ans: There are some exclusions for which an insurance company will not cover under a life insurance plan.

- Death of the life insured happens due to the involvement in certain dangerous adventure activities

- Cause of death is a result of the war

- Death of the life insured due to lifestyle diseases that are not disclosed to the insurer.

Life Insurance Glossary

Bonus: An extra amount provided by the life insurance company over and

above

the base sum assured either on maturity of the policy or death of the policyholder.

Claim: The insured event where the insurance company will pay the policy

proceeds under the contract.

Insurer: The Insurance Company is known as the insurer.

Insured: The individual whose life is being insured under the life

insurance

contract.

Insurability: It means all conditions that are related to the health and

life expectancy of an insured.

Insurable Interest: This means that there should be some financial loss

to

the policyholder who is taking an insurance policy on the insured. Without insurable

interest an insurance contract holds invalid.

Misrepresentation: Statements of any kind that does not hold true or are

manipulated, which affects the insurance policy contract.

Moral Hazard: Wrong intentions or representation by a person to seek the

life insurance benefits.

Nominee: The beneficiary or a family person entitled to be the recipient

to

get the policy proceeds declared by the insured.

Premium: The policyholder agrees to pay a cost for seeking life cover

from

the insurance company as consideration for buying the insurance policy.

Policy Term: The specified number of years for which the policyholder is

insured with the insurance company.

Sum Assured: The life cover which the person has taken under his life

policy

which is payable in the insured event.

Riders: The additional benefits linked with the base policy taken by

paying

extra premium by the policyholder.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing