Car Insurance

What is Car Insurance Plan?

A Car Insurance Plan provides cover against the financial risk that may occur due to the

damage caused to the car. It covers damage when caused due to an accident, natural or

man-made calamity. It also provides financial cover against the third-party liability that

arises due to bodily injury/ property damage to a third party.

Get Quotes

Why should I buy Car Insurance?

Here are some top reasons why you need to buy Car Insurance

Legal Requirement

Buying a car insurance in India is mandatory on the legal ground under Motor Vehicle Act,

1988. To drive a car on the road, you need to possess a valid insurance policy that

provides a cover against third party damage at least.

Pays for Third Party Liability

If you have a car insurance policy, you don’t need to pay for damages caused to a

third-party, when you are found guilty of. Your insurer will pay off for these damages

subject to the terms of the insurance contract.

Pays for Own Damages

A comprehensive car insurance policy also pays for damages that are caused due to fire,

theft, accident and natural calamities such as earthquake, flood, landslide, cyclone,

etc. By purchasing a car insurance, comprehensive policy, you can claim the costly

repairs for your car through your insurer. It also helps you to maintain the resale

value of your vehicle.

No Financial worries

By buying a car Insurance policy, you need not have to pay from your own pocket towards

any third party liability or own damages. With a car insurance policy, you can get rid

of any financial worries.

What kinds of Car Insurance can I opt from?

There are basically two types of Car Insurance Plans you can choose from.

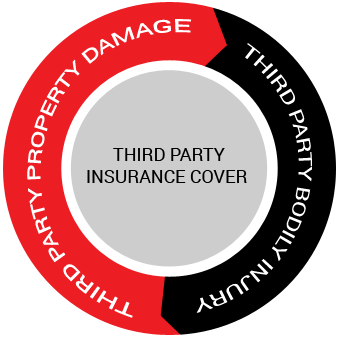

1. Third Party Insurance Cover (Liability only Policy)

This policy provides cover against any legal liability that may arise due to damages caused

to a third party (third party bodily injury or property damage) by your vehicle. Having a

third party insurance is a legal requirement in India and administered under the Motor

Vehicles Act. On the legal grounds, you need to carry a minimum third party car insurance

cover damages caused to others. A third party insurance does not provide cover against

damage to your own car. As it covers only the third party damage, the premium is also less

as compared to a comprehensive insurance.

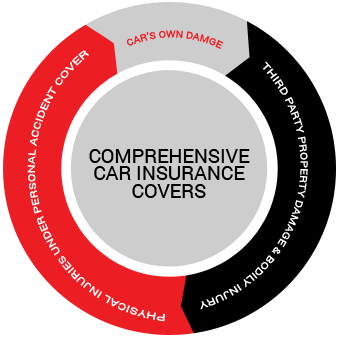

2. Comprehensive Insurance Cover (Package Policy)

Unlike a third party insurance, a comprehensive car insurance offers three components under

this kind of car insurance which are:

• Third Party Liability ( Which is mandatory by law)

• Own Damage (OD)

• Personal Accident Cover

Comprehensive Car Insurance provides cover against third property damage, bodily injury

caused to a third party. Moreover, this car insurance also pays towards damage to your own

vehicle which may be caused due to natural calamities such as fire, lightning, flood,

hurricane, cyclone, hailstorm, explosion, inundation, frost, and landslide and man-made

calamities which include burglary, theft, riot, etc. Also, this policy covers bodily injury

to you as well under personal accident cover.

What are the Benefits of Buying a Car Insurance Policy?

Following are the key benefits of having a Car Insurance.

Legal Protection

Running your car with a valid insurance is a legal requirement under The Motor Vehicles Act.

By buying car insurance, you are on the safe side and legally protected in any

adversity.

Covers Third Party Damage

A third party car insurance policy provides a financial guard against the third party

liability that may arise due to property damage/ bodily injury caused to a third party.

Covers Own Damage

Comprehensive car insurance policy covers both third party and own damage. So your car is

covered against loss/damage caused to your own vehicle. It provides overall protection

against damages to your car and is extensive in nature. It covers damages to car, theft,

legal liability to third parties and cover for personal accident cover as well.

Cover for Personal Accident

The comprehensive car insurance cover provides mandatory personal accident cover for the

individual owners of the car while driving.

Cashless Claim Facility

Insurer's offer cashless claim facility if the repairs are done in the empaneled garages

known as Network Garages. Garages where insurers have tie ups to provide a cashless facility

under which the bills are settled directly by the insurer with the garages.

Enhance Coverage with Add ons

There are various add on/ riders like Zero Dep Cover, engine protector, NCB protect,

available with your car insurance policy to enhance the coverage and gain holistic

protection for your car.

Cover for Personal Accident

The comprehensive car insurance cover provides mandatory personal accident cover for the

individual owners of the car while driving.

No Claim Bonus (NCB)

If the policyholder does not make any claim during a policy period, a No Claim Bonus (NCB) is

provided by an insurance company on renewals, if you have not made any claim in the previous

year(s), you earn NCB for every claim free year. The total NCB percentage accrued over the

years, which can go maximum up to 50 percent, and can be redeemed on renewal or can be

transferred to another vehicle. It stays with the customer.

Additional Discounts

Car insurance policies offer premium discounts like being a member of the automobile

association, and you are entitled to avail discount on premium cost for own damage cover. By

installing safety features like anti - theft devices in your car can offer you some

specified amount of discount on premiums for your car.

Get Quotes

How is my Car Insurance Premium Calculated?

Several factors that help determine the premium amount for your Car Insurance are:

Insured’s Declared Value (IDV)

Your Insurance company may charge you the premium amount at a higher rate if your car has

a higher value. Insured Declare Value (IDV) is a term that determines the value of your

vehicle and deemed sum assured for your car insurance policy. The higher the IDV, more

will be the premium amount. IDV is calculated on the foundation of the current day's

showroom price of the car multiplied by the depreciation rate that is set by the TAC at

the inception of each policy period.

Year of Manufacture

Manufacturing year of the car and its registration date also plays a key role in

determining the premium amount. For old cars, premium amount is lesser.Moreover, the

vehicle’s expensive spare parts contribute to increase in the premium rate.

Fuel Option

When opting for diesel, CNG or LPG based car, an insurance company will charge the

premium amount at a higher rate compared to a petrol car. The reason being, diesel-run

vehicles usually have higher usage and more wear & tear.

Cubic Capacity (CC)

The premium amount of your car is based on the engine capacity of your vehicle. More the

cubic capacity the higher will be the car insurance premium amount and vice versa.

Insurance Zones

Insurance companies have defined zones, each having a different rate of premium. There is

Zone A (metro cities) and Zone B (rest of India). The registration location is taken

into consideration while determining your insurance zone. If you have registered your

car in Zone A, you need to pay higher premium compared to Zone B. These insurance zones

are defined depending on the vulnerability of your vehicle to accidents and theft.

Safety Devices

Car manufacturers nowadays are attentive to the safety of the passengers and thus, they

equip cars with advanced and ultra-modern safety devices like advanced braking systems,

robust locks, airbags, and anti-theft devices. Cars with more safety devices attract a

discount on premium, thereby leading to a lower premium amount.

What are some Smart Buying Tips?

Here are some key tips that help you make a smart move while buying an insurance policy for

your car.

Opt for Right Car Insurance: When you are looking to buy a car insurance, it

is primarily important to assess, which car insurance will be the right fit. If you are

looking to buy an insurance cover, it’s wise to go for the comprehensive cover that includes

both the third-party liability and damage to your own car. For older cars you may only opt

for Third party car insurance, which is cheap and cost effective. Choose a value for money

car insurance plan which will benefit you in the event of a claim.

Appropriate Valuation: Valuation of different cars would be different. The

sum assured amount for your car may also vary. While buying a car insurance online or

offline, look for an insurance provider that offers higher valuation for your car. The more

the valuation amount more will be the benefits in the event of a claim.

Choose Add-ons Wisely: When you are attentive to ensure protection for your

car, you can go to attach add-ons with your existing car insurance policy or buy it at the

inception of the policy. Add-on covers enhance protection, and you need to assess accurately

the benefits associated with a particular add-on cover and then make a decision to buy.

Compare & Buy Online: When you want to have car insurance, why not compare

it online and get the best car insurance policy. Insurance web aggregators provide online

portals for comparisons among car insurance plans from leading insurer’s online and you can

easily compare and buy at your own convenience. By purchasing insurance online, you can also

avail a discounted premium rate that makes your policy cost-effective as well.

Hunt for Discounts: As discussed earlier also there are certain discounts

which you can get on your car insurance premium like installing safety features, being a

member of any automobile association, preserving your no claim bonus. Look for such

discounts and lower your car insurance premium.

Decide Prudently on Voluntary Excess: Car insurance premium can be lowered

by enhancing the deductible amount. The voluntary deductible oe excess is the amount that

you accept to bear while making a claim. It is to be noted that you need to keep this amount

in your affordable financial limits so as reap the benefit of car insurance. Car insurance

policies are renewed yearly, you may begin with lower amount initially and then enhance it

gradually on subsequent renewals.

Is there any Add on Cover/Rider with Car Insurance?

Various Add-on covers, you may opt from to avail enhanced protection to your car.

Zero Depreciation Cover

Depreciation is termed as a decrease in the value of the asset due to frequent usage. Your

car is also an asset and is subject to depreciation. If opting for this cover, your insurer

will provide a claim without deducting the depreciation amount on the value of parts

replaced. This cover also provides cover against the repairing costs of glass, rubber parts,

fibre, and plastic parts.

Engine Protector Cover

This add-on provides protection against damage to your car engine and electronic circuit

caused due to flooding, or water logging. This cover helps you avoid huge repair costs, as

your insurance company will pay off for the damages. It’s quite useful, especially during

the monsoon season.

No Claim Bonus Protector

This add-on helps in saving your NCB upto one or two claims (depending on the insurer) during

the policy period. It’s highly advisable to opt for this add on in case your accumulated NCB

is above 25%.

Roadside assistance Cover

There are stances when you have to face major issues in your car such as a mechanical

breakdown. In this scenario, you don’t know how to resolve the car issue. With this add-on

cover, you are provided with 24x7 roadside assistance to help resolve any mechanical issues

with your car. This add-on is available at a nominal extra premium.

Passenger Accidental Cover

Long journeys in your own car with your loved ones are exciting. To protect your family or

passengers in the car from any accidental expenditures, you may opt for this add on. Adding

a passenger cover may slightly increase your premium.

Loss of Personal Belongings

This add-on enables you to claim for any apparent loss or theft of personal belongings such

as an electronic equipment from a locked vehicle. The range of personal belonging, loss

cover may differ from insurer to insurer.

Medical Expenses Rider

In the case of medical emergencies, this rider pays for the ambulance charges and medical

expenses that are incurred after the accident.

Key Replacement Cover

In case of car keys being misplaced or left in the car, key replacement cover efficiently

assists you to unlock the vehicle in such scenarios. This add- on cover includes the cost of

making a duplicate key if the key is lost and also the cost of lock if the lock needs to be

replaced following the loss of a key.

(Note: The riders specified above may vary from insurer to insurer and can be bought by

payng additional premium charges)

Get Quotes

What is Not Included in the Car Insurance Plan?

Your Car Insurance does not cover:

• Steady wear & tear.

• Loss/damage when driving under the influence of alcohol.

• Loss/damage when driving with an invalid driving license.

• Loss due to war, civil war, etc.

• Mechanical and electrical breakdown.

• Consequential loss.

• Claims that don’t include under the terms of the contract.

• Use of vehicle for any other purpose as mentioned under ‘limitations as to use’.

(Note: Read the policy terms of your car insurance to understand what is not included in

your car plan.)

Do’s and Dont’s in Car Insurance

Read the Do’s and Dont’s related to your Car Insurance.

| Do’s |

Dont’s |

| Compare car insurance plans online and avail discounts |

Be forced to get the insurance from your vehicle dealer, you have the option to buy

it online

|

| Disclose all the information related to your car to the insured accurately |

Choose too many riders or add ons. Excess of everything might not be beneficial |

| Read the fine print carefully |

Let your No claim bonus affected for minor claims |

| Opt for riders prudently to enhance coverage |

Forget to renew the policy after expiry of the policy period |

| Retain a copy of the duly filled proposal form for your own records |

Undervalue your car to get a reduction in the premium. This may prove worse in times

of claim.

|

Car Insurance Glossary

Here are the basic terminologies used in a Car Insurance.

Accident: An unforeseen event or circumstances resulting from carelessness

or ignorance.

Act of God: An extraordinary disruption caused by a natural mean such as a

flood, earthquake, storms, lightning, etc. that cannot reasonably be foreseen or prevented.

Accessory: It refers to parts of a motor vehicle which are not provided by

the manufacturer along with the vehicle. These parts are also not essential for running of

the vehicle.

Arbitration: It is a common way of resolving motor insurance disputes rather

than filing a lawsuit. Both the aggrieved party and the insurance company agree that a third

party can look into the dispute and make a decision to resolve it.

Anti-Theft Device: It is a device that prevents your car from being stolen.

By installing high-tech anti-theft devices in your car, you can avail low premium for your

policy.

Break-in Insurance: If you don’t renew the car insurance and your policy

lapses, it results to ‘Break-in Insurance’. The renewal of your car is done after the proper

vehicle inspection and payment of pending premiums.

Comprehensive policy: This car insurance policy covers both the Third party

and Own damage losses.

Compulsory Deductibles: When you claim for accidental damage to your car,

you have to bear some small portion of the cost incurred and this amount is called to be

‘Compulsory Deductibles’. It is determined on the basis of the cubic capacity of the car

insured.

Cubic Capacity: It defines the engine capacity of your car. It is one of the

key factors that determine the premium amount for your car insurance.

Endorsement: Any alterations in your insurance policy are done through an

endorsement.

Insured’s Declared Value (IDV): IDV refers to the ‘Sum Insured’, which is

payable on theft/total loss of the car. IDV is determined on the basis of the manufacturer’s

current market value of the car and depreciation based on the Age of your car.

If your car is fitted with accessories that don’t include under the manufacturer’s listed

selling price, you need to insure it separately.

NCB (No Claim Bonus): When you don’t make a car claim for a previous year,

you can avail NCB benefits. You can avail No Claim Bonus to get discounts on the ‘Own

Damage’ premium of the policy.

Third Party Liability: It refers to the property damage and/or bodily injury

caused to a third party on the part of your fault.

Voluntary Deductibles: When you buy a car insurance, you have the choose the

co-pay. Co-pay is a part of the total claim amount that you have to bear, after deduction of

the compulsory deductibles. If you exercise this option, you become eligible to avail

discounts towards the ‘Own-Damage’ car premium.

Windshield Cover: If the Windscreen glass of your car accidentally breaks

and requires repair, your insurer allows such repair without NCB getting affected. It is

treated as ‘own damage’ claim.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing