Pension Plan

What is Pension Plan?

Retirement is a phase when you want to relax and enjoy your life after continuous, long and

hectic professional life. On the financial front, your regular income also stops. Managing

post retirement expenses may become hard for you with growing inflation. Only 4% of the

total working population of India is covered by a pension scheme, usually government

employees. The remaining population is either salaried or self employed who do not have the

provision of a formal pension scheme.

Ideally, life insurance covers the risk of “dying too early “ or “living too long”. Pension

Plans being a part of life insurance products cover the risk of living too long. Insurance

companies provide the dual benefits of pension and insurance cover under pension plans.

Pension plans help individuals to plan for their retirement effectively and provide

individuals with a regular income for their post retirement years. Also, in the event of the

death of the insured, the amount specified as per the policy is paid to your nominee. A

pension plan helps you achieve the financial stability after your retirement. You need to

infuse a specific amount of money during your working phase to build a corpus.

These plans are best for those planning a secure future. Retirement plans are a decisive way

of safeguarding that your current lifestyle is maintained even after you stop working.

Why should I buy Pension Plan?

Here are the top reasons as to why you should buy Pension Plan.

Lead an Independent Life

The days are gone, when retirees used to depend on their children or other relatives.

Now, people are looking to lead an independent life and for this, there is a need for

enough savings. You need to invest prudently with the best pension plan that is the best

fit.

To Attain Surplus Funds

Investing with your employer-run pension scheme is a wise move, but unfortunately, the

corpus it provides may not be enough to maintain your lifestyle post retirement. That’s

why you should go ahead to invest in a pension plan.

To Get Dual Benefit

Pension plan offers a dual benefit of insurance and pension both, out of your invested

amount towards the pension plan.

Not Enough Govt. Schemes

Not all of the Indian population is covered under the social security schemes, and the

schemes are also limited. Thus, there is an urgent need to invest and buy the best

retirement plan that can provide you a corpus at the retirement to meet any

contingency.

To Confront Inflation

Inflation has a double impact on your savings. Inflation affects your current purchasing

power and also augments financial requirements for the future. Saving appropriate amount

regularly towards pension plan will help you confront the impact of inflation.

Increased Life Expectancy

Improved and easy access to the advanced medical and healthcare facilities has helped

people to live longer. After the retirement, you also need to acquire enough savings to

survive a good life. Pension plans cover the risk of living too long.

Phases in a Pension Plan

Pension plans offered by insurance companies provide the dual benefits of investment and

insurance. A pension plan includes two phases.

Accumulation Phase: In this phase, you tend to invest and accumulate the

wealth during the term of the policy. Your funds are invested in securities or other

investment avenues as approved by the insurance regulator, IRDAI by the insurance company.

Distribution Phase: In this phase, you tend to consume the already

accumulated wealth. This phase most probably begins at the time of your retirement. Some may

prefer to withdraw the money even before their retirement.

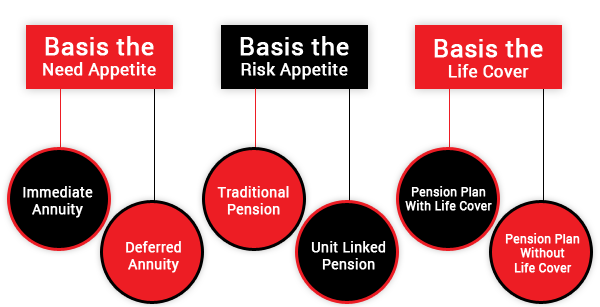

What kinds of Pension Plans can I opt from?

There are types of pension plans available basis the following parameters

1. Basis the Need Appetite

Basis the need and requirement, you may choose the annuity type out of immediate annuity or

deferred annuity pension plan.

• Immediate Annuity Plans: Under this plan, the annuity/pension commences

immediately after the payment of premium in one lump sum. You will start getting your

annuity/pension on an immediate basis after giving the lump sum amount to the insurer.

• Deferred Annuity Plans: As the name suggests defer means to postpone, so

under this pension plan, you pay the premiums for a specific time period as per your chosen

retiring or vesting age. The money accumulated is then used to pay annuities that help you

as a regular source of pension.

2. Basis the Risk Appetite

Basis the risk appetite, you may choose to opt to buy either a traditional pension plan (low

risk) or unit linked pension plan (high risk).

• Traditional Pension Plans: Such pension plans are for those who are

looking for a safe and secure return on the money paid towards buying a pension plan. When

you opt a traditional pension plan, your money is majorly invested in government bonds and

securities by the insurer. The insurer pays a steady return on your investment. In case you

have a conservative approach and want your money to be safe, it is prudent to go for the

traditional plans.

• Unit Linked Pension Plans: These plans are market linked pension plans.

For people having a higher risk appetite, this is the ideal pension plan for them. Under

this plan, the investment steering is in your hands and not in the hands of the insurer. You

may choose between debt or equity or balanced fund for the growth of your invested amount

towards pension. The pension is paid out of the total fund value created at the end.

3. Basis the Need for Life Cover

• Pension Plan With Life Cover: When you choose a pension plan with life

cover. You get insurance and pension benefit together under one umbrella product. Premium

paid will have the component of insurance (for life cover) and investment (for building the

corpus for pension). So in the event of death during the policy term, the nominees will

receive the sum assured opted under as life cover.

• Pension Plan Without Life Cover: When you choose a pension plan without

life cover, the premium you pay will entirely be utilized for the purpose of building a

corpus for pension pool. In the event of the death of the policyholder, your insurer will

pay the corpus accumulated in the pension plan to the nominee. It does not provide any sum

assured as such policies are without life cover.

What are the different Annuity/Pension Options

There are five annuity/ pension options you can choose from.

1. Annuity payable for Life: under this annuity option, the fixed annuity

amount is paid to the annuitant throughout his/ her lifetime. The pension benefits cease

after the death of the annuitant/pension seeker.

2. Life Annuity with a return of Purchase Price: Upon choosing this option,

the annuitant receives annuity/pension till he/she is alive. In the case of death of the

annuitant, the purchase price (maturity amount) is given to the nominees/beneficiaries.

3. Life Annuity with a Guaranteed Period: With this chosen option, the

annuity is paid for a guaranteed period or throughout your life (whichever is later). In the

case of death of the annuitant, the annuity is paid for the guaranteed period like 10, 15,

20 years (as chosen by the policyholder/Annuitant) and after that, the annuity ceases unless

the annuitant has mentioned to pay the annuity/pension to his spouse/nominee.

4. Increasing Annuity: This option provides you with the increase in the

annuity amount every year. It usually increases at a specified rate on annually to cater to

the growing inflation.

5. Joint life annuity: Under this option, the annuitant receives pension

till he/ she is alive. In the event of death of the annuitant, his spouse is entitled to

receive the pension.

What are the Benefits of Buying a Pension Plan?

There are several benefits of buying a Pension Plan.

Maturity/Vesting Benefits

In pension plans, you have the option to withdraw the one-third of the corpus at the maturity

known as “Commutation”. The remaining two-third of the entire amount is used to pay annuity

that you would receive as a monthly income after the retirement.

Annuity Benefits

On the attainment of the vesting age, a pension plan provides you the annuity benefits with

which you can get a regular pension amount monthly. Annuity benefits are payable as per the

annuity option is chosen by you at the inception of the policy.

Death Benefits

The accumulated corpus in a pension plan is paid to the nominee in the case of the death of

the life insured as Assured Death Benefit with guaranteed returns. The nominee can opt in

most of the plans to utilize the death benefits in two ways. Either by taking the death

benefit as a lump sum or take the requisite amount of pension out of the total corpus

available in the policy.

Surrender Benefits

Pension plans do offer surrender value or benefits in times of exigencies after paying

applicable surrender charges, if any.

Tax Benefits

The premium amount paid towards a pension plan is eligible for tax deduction under Section 80

CCC. Under a pension plan, the one-third of the total accumulated amount at its maturity is

treated as tax free and can be withdrawn by the policyholder before starting of the

pension.

Simple Steps towards buying a Pension Plan

You can follow the simple steps to get a right Pension plan for yourself.

Step1: Choose the Vesting Age

Ascertain the vesting age, which is the age at which you want your pensions to be started.

Usually, the vesting age chosen is same as the retirement age of the person.

Step 2: Use the Annuity Calculator

Annuity Calculator will help you calculate the present value of your future requirements. It

will suggest the amount you need to invest to get the defined amount of pension on attaining

the vesting age.

Step 3: Choose the Sum Assured/ Premium

Decide on the Sum Assured amount or the premium amount you can accommodate or are comfortable

paying towards your pension plan to build the desired corpus. Accordingly the pension amount

will be assessed.

Step 4: Choose from the Annuity Options

Pick the suitable annuity option ranging from the annuity for life to joint life and other

options as well depending upon your needs, requirements and family set up post

retirement.

How is my Premium Calculated?

You need to infuse regular savings towards your pension plan. Here are some key factors that

determine your premium amount for a pension plan.

Type of Plan

If you buy a pension plan with life cover, you need to pay higher premiums, as it

provides additional benefits of insurance, the rate of premium charged by your insurer

depend on the type of plan and its benefits offered.

Age

The age when you start investing with a pension plan also plays a key role in determining

the premium amount. The premium charged by your insurer would be higher at the advanced

age as compared to one who begins investing at a younger age.

Sum Required

The amount you need in your retirement also plays a key role in determining the premium

amount. Higher the sum required, more is the premium amount and vice versa.

Policy Term

The tenure of your policy also matters. If the policy term is for a lesser period, you

need to pay higher premiums to achieve a targeted financial goal at the maturity.

What are Some Smart Buyings Tips?

Following are some of the key tips you can consider for investing in a Pension Plan.

Systematic & Early Planning: Planning early for retirement will be

beneficial in your favour as starting early will enable you cost effective pension plan

options. Systematic investment towards pension plan will enable you to accumulate a robust

corpus by the time you will retire.

Appropriate Pension Amount: It is prudent to assess the appropriate amount

of the annuity you would need to lead a comfortable living post retirement. Take into

aspects such as inflation, increased living costs, elevating medical costs. Decide on your

pension need considering your current lifestyle.

Choose the Right Vesting Age: Opt for a pension plan with a vesting age that

fits your needs. There are some pension plans with vesting age starting at 40 years. So if

you want an income stream that early on in life, go for such a plan. On the other hand,

there are plans with vesting age at 85 years, which is suitable if you plan to retire later.

Right Pension Option: Choose the apt pension plan with suitable pension

options like Annuity payable for Life, Life Annuity with Guaranteed Period, Increasing

Annuity or Joint life annuity, etc. meeting your requirement.

Use Annuity Payout Calculator: The annuity payout calculator displays how

much pension you will receive in payment over a decided period of time. It has the provision

to administer the inflation rate to the annuity payout calculator to get a fair amount of

what the annuity payout will really worth over the time.

Is there any Add on Cover/Rider with Pension Plan?

With a pension plan, only a few insurer’s offer limited riders.

(Note:The rider benefit, conditions and eligibility criteria may vary from insurer to

insurer.)

What is Not included in the Pension Plan?

If a policyholder commits suicide within one year of commencement of a pension plan, no or

limited benefits will be payable.

Do’s and Dont’s in Pension Plan

Read the do’s and dont’s related to your Pension Plan.

| Do’s |

Dont’s |

| Start saving for your pension plan at an early stage. The earlier you act, higher

will be your pension funds.

|

Hesitate in clarifying any query regarding your pension plan. |

| Study about the fees and charges levied on your pension plan. You may ask your

pension provider to get the details regarding charges levied on your account.

|

Forget to read the fine print of your pension plan. Any negligence today may cost

your savings for tomorrow.

|

| Make additional top up contributions to boost your pension savings. |

Feel coerced by a financial advisor to buy a pension plan which is not best fit for

you.

|

| Monitor the performance of your pension fund. |

Allow agent advisor to fill the pension proposal form. Fill it in by yourself. |

| Opt for the pension option as per your post retirement needs. |

Take a risk with your pension fund. Invest as per your risk appetite. |

Pension Plan Insurance Glossary

Here are the basic terminologies related to pension.

Actuarial Present Value: It is the value of an amount payable or receivable

on a specific date.

Annuity: A financial product wherein an investor has to provide a specific

amount on a regular basis to a pension plan provider and in exchange, they assure you to pay

the periodic payments usually monthly.

Annuity Plans: Plans which provide insurance plus pension to cater to the

post retirement expenses on payment of a specified premium to the insurance company.

Asset Allocation: It determines how your funds will be invested among

different asset classes.

Automatic Investment Plan (AIP): It enables the investors to contribute

small amounts at regular intervals towards the plan. Funds are deducted automatically from

the investor’s savings account or cheque and then invested in a retirement/pension account.

Commutation: It is a part of your pension benefit which you can take as

lumpsum at the completion of your pension plan tenure. Usually, one third of the total fund

can be commuted as lumpsum.

Compounding: It refers to earning money on a principal amount. It is

calculated on a monthly or annual basis. It helps to create wealth.

Contributory Pension Plan: A pension plan wherein the employee makes

contributions. In some plans, employers also make contributions to increased benefits.

Contingent Beneficiary: Usually, the investor nominates their spouse as a

primary beneficiary. But in the case, both the owner and spouse die due to a mishap, the

plan benefits are then transferred to their children or maybe the trusts that are designated

as contingent beneficiaries.

Deferred Annuity: this pension plan, you pay the premiums for a specific

time period as per your chosen retiring or vesting age. The money accumulated is then used

to pay annuities that help you as a regular source of pension.

Defined Benefit Pension Plan: A pension plan wherein an employer promises to

provide a fixed monthly benefit after retirement of the employee. Under this plan, the

monthly benefit is defined on the basis of certain factors such as employee’s earnings

history, age, and tenure of service.

Defined Contribution Pension Plan: This plan provides pension benefits to

the employee for services rendered. This plan provides an individual account for every

participant and it also defines contributions to an individual account. An individual’s

benefit depends on the amount contributed and the investment performance of that pension

plan.

Immediate Annuity: Under this plan, the annuity/pension commences

immediately after the payment of premium in one lump sum.

Life Annuity Payment: There are several options available to an annuitant

when it comes to receiving payment after the retirement. Under the Life Annuity payment

option, the payments continue throughout the life of the annuitant.

Life Expectancy: It refers to the average time one is expected to live.

Primary Beneficiary: It refers to a person or entity who is named by the

owner of the retirement plan to receive the plan benefits in the event of his/ her death.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing