HDFC Life Click 2 Protect Plus is a term insurance plan which offers a complete defense at an affordable price to safeguard your family financially in your absence. This plan is intended to shield you and your family against the various unpredictable uncertainties in life. This term life insurance plan offers various comprehensive protection options for you & your family.

Get QuotesFollowing are the death benefit options available under this plan.

1. Death Benefit –OPTION 1 – Life Option:

In the event of death of the life Insured the death benefit mentioned below is paid as a lump sum on death,

For Single Pay Premium Policy: Higher of :

For Regular /Limited Pay Premium Policy: Higher of :

Life Stage Protection: To possess adequate cover as your financial situation changes as you go on to accomplish different milestones in your life like upon your marriage, birth of a child. With Life Stage Protection benefit the policyholder can increase your Sum Assured (by paying revised extra premium) or reduce the additional cover later during the policy term (which will result in a proportional decrease in future premiums).

2. Death Benefit –OPTION 2 – Extra Life Option:

3. Death Benefit –OPTION 3 – Income Option:

In the event of death of the life Insured the death benefit Under Income Option is:

4. Death Benefit –OPTION 4 – Income Plus Option:

In the event of death of the life Insured the death benefit Under Income Plus benefit is:

In the event of Single Pay as premium payment mode, this Plan has a Surrender Value = 70% x Single Premium x (Unexpired Coverage Term / Original Coverage Term), but not for regular pay and limited pay.

Q: What coverage is available under HDFC Life Click2protect Plus Plan?

Ans: HDFC Life Click2protect Plus is a term insurance plan that offers the comprehensive financial protection to your family against the uncertainties of life. Being a pure protection plan, you will get the life cover at an affordable premium.

Q: Whether I have the flexibility to choose from cover options?

Ans: With HDFC Life Click2protect Plus Plan, you have the option to choose from 4 different coverage options. You will have the flexibility to choose from Life, Extra Life, Income & Income Plus option.

Q: At what age, can I buy Click2protect Plus Plan?

Ans: You can buy HDFC Life Click2protect Plus Plan from 18 years to 65 years of age. The maximum maturity age for this plan is 75 years of age.

Q: Is there any tax benefit available with this term plan?

Ans: Under HDFC Life Click2protect Plus Plan, the premiums paid qualify for tax benefits under section 80C of the Income Tax Act. The death benefit is also entitled for tax benefit under section 10 (10D) of the Income Tax Act.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 65 Years |

| Age at Maturity | - | 75 Years |

| Policy Tenure | 10 Years | 40 Years |

| Premium Paying Term | Regular, Limited Or Single Pay Years | - |

| Premium Paying Mode | Monthly, Quarterly, Semi Annually & Annually | - |

| Sum Assured | 25 Lacs | No Limit (subject To Underwriting) |

| Maturity Proceeds | Nil | - |

| Plan Type | Online | - |

You may opt for the following rider:

Income Benefit on Accidental Disability Rider: Additional protection in case of accidental disability which is monthly income security, i.e regular monthly income equal to 1% of Sum Assured for a fixed period of 10 years.

Critical Illness Plus Rider: This rider provides additional critical illness rider sum assured in case, diagnosed with any of the listed 19 Critical Illnesses.

(Riders are optional and are available at an extra cost.)

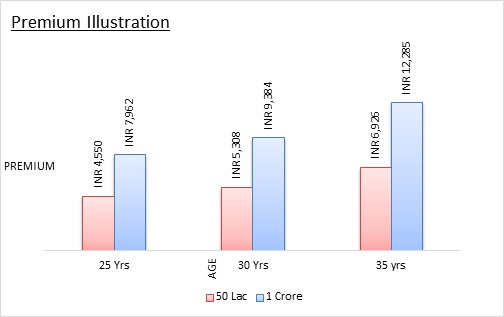

ample illustration of the Premium Amount for an individual of 25, 30 and 35 years, opting for a Life Cover of Rs 50 lacs or Rs 1 crore as Sum Assured and 25 years as Policy Tenure.

|

|

25 years |

30 years |

35 years |

|

Sum assured = Rs. 1 crore |

Rs. 7,962 |

Rs. 9,384 |

Rs. 12,285 |

|

Sum assured = Rs. 50 lacs |

Rs. 4,550 |

Rs. 5,308 |

Rs. 6,926 |

(Note: Premium amount is based on the Death benefit- Option-1 “ Life Option” for a non smoker individual keeping good health conditions at the time of buying this insurance plan)

HDFC Click to Protect Plus Term Plan is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing