Reliance Online Term is an ideal insurance solution for the present generation. It offers you with an extensive e cover at a lower cost, with the suitability of buying it online which is a hassle free process. This plan is a simple term life insurance plan with an intention to provide financial benefits to your loved ones in your absence.

Flexibility to determine Sum Assured based on your needs

Rewards for healthy lifestyles by offering lower premiums

Simple and convenient online application process

Option to get medical tests done on your doorstep

In the event of the death of the Life Assured during the policy term, the nominee is entitled to receive as death benefit is maximum of:

The policy will be terminated once the death benefit is paid.

| Feature | Specification |

| Age (as on last birthday) |

Minimum: 18 Years Maximum:55 Years |

| Age at Maturity | 75 Years |

| Policy Tenure |

Minimum: 10 Years Maximum: 35 Years |

| Sum Assured | Minimum: 25 Lacs Maximum: No Limit (subject to underwriting) |

| Premium Paying Term | Same as policy term Years |

| Premium Paying Mode | Annually Only |

| Maturity Proceeds | Nil |

| Plan Type | Online |

| Grace Period | 30 Days |

There are no riders benefits available with this plan.

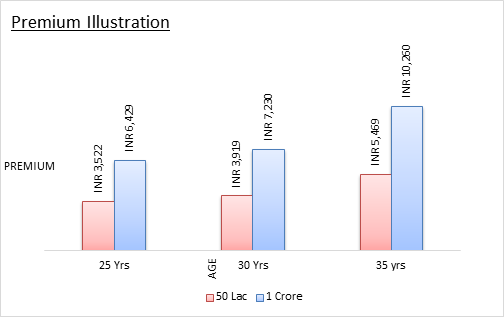

Sample illustration of the Premium Amount for an individual of age 25, 30 and 35 years, opting for a Life Cover of Rs 50 lacs or Rs 1 crore as Sum Assured and 25 years as Policy Tenure.

|

|

25 years |

30 years |

35 years |

|

Sum assured = Rs. 1 crore |

Rs. 6,429 |

Rs. 7,230 |

Rs. 10,260 |

|

Sum assured = Rs. 50 lacs |

Rs. 3,522 |

Rs. 3,919 |

Rs. 5,469 |

(Note: Premium amount is for a non smoker individual keeping good health conditions at the time of buying this insurance plan)

Reliance Life online Term Plan is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing