In today’s life of hustle and bustle, nothing is certain and thus, it is quite important to ensure that your family is financially secure to lead a comfortable life in the event of any mishap. Aviva i-Life - a pure term insurance cover ensures to provide protection for your family at a nominal cost. Buy this plan at the click of your mouse. This plan is really affordable to get the family protection cover. You can buy it online.

Life cover at a nominal cost

Covers death by any reason

Rebate on large sum assured

Rebate on female lives

Premium payment frequency available: Half yearly and yearly

Dedicated claims assistance

In the event of an unfortunate demise of the life assured under the plan, the Sum Assured will be paid to the nominee.

| Feature | Specification |

| Age (as on last birthday) |

Minimum: 18 Years Maximum:55 Years |

| Age at Maturity | 70 Years |

| Policy Tenure |

Minimum: 10 Years Maximum: 35 Years |

| Sum Assured | Minimum: 25 Lacs Maximum: No Limit (subject to underwriting) |

| Premium Paying Term | Same as policy term Years |

| Premium Paying Mode | Semi Annually & Annually |

| Maturity Proceeds | Nil |

| Plan Type | Online |

| Grace Period | 30 days |

There are no riders benefits available with this plan.

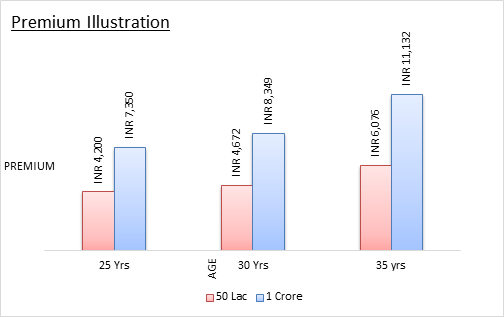

Sample illustration of the Premium Amount for an individual of age 25, 30 and 35 years, opting for a Life Cover of Rs. 50 lacs or Rs. 1 crore as Sum Assured and 25 years as Policy Tenure.

|

|

25 years |

30 years |

35 years |

|

Sum assured = Rs. 1 crore |

Rs. 7,350 |

Rs. 8,349 |

Rs. 11,132 |

|

Sum assured = Rs. 50 lacs |

Rs. 4200 |

Rs. 4,672 |

Rs. 6,076 |

(Note: Premium amount is for a non smoker individual keeping good health conditions at the time of buying this insurance plan)

Aviva i-Life is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing