You must want to secure the financial future of your family, irrespective of any eventuality. Tata AIA iRaksha Supreme is a non-linked, non-participating term plan that will ensure your peace of mind. It’s an online term plan available at an extremely attractive and affordable price. Get this term plan at the click of your mouse. Buy this plan online at the convenience of your location and time.

Flexibility to choose from different premium payment options

Preferential premium rates for non-smokers

Special premium rates for female policyholders

Discounted premium rates for SA Rs.75 lacs and above

Hassle free buying, as its available online

In the event of demise of the life assured during the policy term, the death benefit will be paid to the nominee. The Death benefit will be the higher of one of the following:

It is recommended to continue the policy and even then, you are unable to continue the policy, it can be surrendered.

Surrender Benefit= Surrender Value Factor * (Outstanding Policy Term / Policy Term) * Total Premiums Paid

If not paying the premiums during the grace period, your policy will acquire a paid-up value incase full premiums have been paid up to 3 and 7 years for 5 and 10 policy terms.

Paid-up Sum Assured = (Number of Premiums Paid / Total Number of Premiums Payable) * Sum Assured

| Feature | Specification |

| Age (as on last birthday) |

Minimum: 18 Years Maximum:70 Years |

| Age at Maturity | 80 Years |

| Policy Tenure |

Minimum: 10 Years Maximum: 40 Years |

| Sum Assured | Minimum: 50 Lacs Maximum: No Limit (subject to underwriting) |

| Premium Paying Term | Regular, Single and Limited paying term Years |

| Premium Paying Mode | Semi Annually & Annually |

| Maturity Proceeds | Nil |

| Plan Type | Online |

| Grace Period | 30 days |

There are no riders benefits available with this plan.

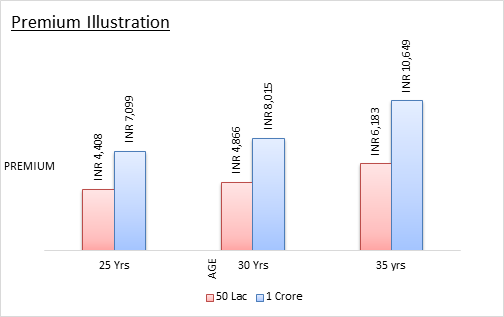

Sample illustration of the Premium Amount for an individual of age 25, 30 and 35 years, opting for a Life Cover of Rs. 50 lacs or Rs. 1 crore as Sum Assured and 25 years as Policy Tenure.

|

|

25 years |

30 years |

35 years |

|

Sum assured = Rs. 1crore |

Rs. 7,099 |

Rs. 8,015 |

Rs. 10,649 |

|

Sum assured = Rs. 50 lacs |

Rs. 4,408 |

Rs. 4,866 |

Rs. 6,183 |

(Note: Premium amount is for a non smoker individual keeping good health conditions at the time of buying this insurance plan)

Tata AIA iRaksha Supreme is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing