If you are the only earning member of your family, you must want to ensure their financial protection, so they can maintain a healthy lifestyle even after your unfortunate death. Tata AIA iRaksha TROP is an online term plan that also ensures the return of premium. It is a non-linked non-participating term plan assures you for financial protection of your family plus return the total premiums paid.

Avail dual benefits of financial protection and return of premium

Choose from different premium payment options

Preferential premium rates for non-smokers

Special premium rates for female policyholders

Special discounts on premium rates higher life cover

Hassle-free procedure to buy the plan online

In case of the unfortunate death of the insured, the sum assured will be the amount which is higher of basic sum assured, 105% of total premium paid, 10 times of the annualized premium, or maturity benefit.

Get back the total premiums paid, if the insured survives till end of the policy term.

It is not recommended to surrender the policy, however, if it needs to be surrendered, you can enjoy the surrender benefit.

Surrender benefit= Higher of (Cash surrender value or Guaranteed surrender value)

| Feature | Specification |

| Age (as on last birthday) |

Minimum: 18 Years Maximum:65 Years |

| Age at Maturity | 75 Years |

| Policy Tenure |

Minimum: 10 Years Maximum: 30 Years |

| Sum Assured | Minimum: 50 Lacs Maximum: No Limit (subject to underwriting) |

| Premium Paying Term | Regular, Limited and Single pay Years |

| Premium Paying Mode | Semi Annually & Annually |

| Maturity Proceeds | If the insured survies the policy term, the company shall pay the entire premiums paid. |

| Plan Type | Online |

| Grace Period | 30 days |

There are no riders benefits available with this plan.

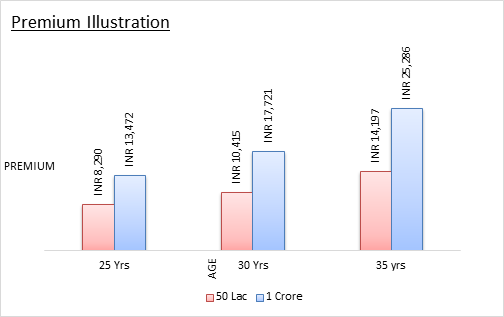

Sample illustration of the Premium Amount for an individual of age 25, 30 and 35 years, opting for a Life Cover of Rs. 50 lacs or Rs. 1 crore as Sum Assured and 25 years as Policy Tenure.

|

|

25 years |

30 years |

35 years |

|

Sum assured = Rs. 1 crore |

Rs. 13,472 |

Rs. 17,721 |

Rs. 25,286 |

|

Sum assured = Rs. 50 lacs |

Rs. 8,290 |

Rs. 10,415 |

Rs. 14,197 |

(Note: Premium amount is for a non smoker individual keeping good health conditions at the time of buying this insurance plan)

Tata AIA iRaksha TROP is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing