Tata AIA Life Insurance Fortune Pro is a non-participating Unit Linked Insurance Plan that helps grow your money. By investing in this plan, you can easily meet your medium to long term goals such as children’s education & marriage, retirement planning, etc. This plan also provides life protection that ensures your family’s financial security.

Get QuotesThis policy offers following 11 investment funds, you can invest with that suit your investment objectives.

You can choose from 11 investment fund options or Enhanced Systematic Money Allocation & Regular Transfer (Enhanced SMART). Enhanced SMART option allows a customer to enter the volatile equity market in a structured manner under the Regular/Single Premium Fund. Enhanced SMART strategy offers a systematic way of rupee cost averaging.

In the event of death of the life assured during the policy term and policy is in-force, the nominee will receive the higher of Basic Sum Assured less all Deductible Partial Withdrawals, 105% of the total Regular/Single premiums paid, the Regular/Single Premium Fund Value, or 10 times of the annualized premium.

Additionally, the higher of Approved Top-up Sum Assured, 105% of the total Top-up Premiums paid or Top-up Premium Fund Value is also payable, provided the Policyholder has a Top-up Premium Fund Value.

On survival of the life assured till end of the policy term, Total fund value at applicable NAV is payable on the date of maturity.

Loyalty Additions @0.20% of units in each of the funds under the Regular Premium Account is credited to the respective funds. This benefit is payable in every policy anniversary, starting from 11th policy anniversary till end of the policy term.

If chosen the single pay option, the additional units @0.35% of units in each of the funds under the Single Premium Account is credited to the respective funds, payable every policy anniversary, starting from the 6th policy anniversary, till the end of the policy term.

This benefit is credited, subject to the policy being in-force.

You can withdraw money after completion of 5th policy year. For Regular Premium policy, minimum partial withdrawal amount is Rs 5,000 subject to Total Fund Value post such withdrawals should not be less than an amount equal to one year’s regular premium. For Single Premium policy, minimum partial withdrawal amount is Rs 5,000 subject to Total Fund Value post such withdrawals shoule not be less than an amount equal to 5% of single premium paid.

You have the option to pay additional premium as Top-up Premium any time except during the last five years of the policy term. You can exercise this option up to 4 times during a policy year. The minimum Top-up amount is Rs 5,000.

Your Sum Assured will increase by Top-up Sum Assured. For entry age less than 45 years, Top-up Sum Assured is 1.25 times the Top-up Premium and for entry age 45 years or more, Top-up Sum Assured is 1.1 times the Top-up Premium.

You may choose to receive the maturity amount either as a lump sum or installment over a period of time, termed as Settlement Period. The frequency and amount of the installments can be chosen by you at the time of maturity while exercising this option.

You can switch among the available ULIP fund options. Switching option is not available, when you choose Enhanced SMART option.

Premium Re-direction helps you allocate future premiums to a different fund or set of funds.

Premium Re-direction is not available, when you choose Enhanced SMART option.

The plan is not eligible for the bonuses as it is a non-participating life insurance plan.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years, the fund value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund II’. The ‘Proceeds of the Discontinued Policy’ plus entire income earned after deduction of the fund management charges, subject to a minimum guarantee of interest @4% per annum is payable.

Upon surrendering the policy after the lock-in period of 5 years, the total fund value as on the date of surrender is payable.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 30 Days | 59 Years |

| Age at Maturity | 18 Years | 75 Years |

| Policy Tenure | 15 Years | 40 Years |

| Premium Paying Term | Single Pay, Limited Pay (5/7/10 Years), Regular/Limited Pay (15/20 Years) | - |

| Premium Paying Mode | Single, Annually, Semi Annually, Quarterly, & Monthly | - |

| Annual Premium | For Single Pay- Rs 1 Lac, For Limited Pay- Rs 50,000 | For Single Pay- Rs 5 Lacs, For Limited Pay- Rs 5 Lacs |

| Basic Sum Assured | For Single Pay- 1.25 Times The Single Premium, For Limited Pay- Higher Of (10 Times The Annualized Premium) Or (0.5 * Policy Term* Annualized Premium) | For Single Pay- 1.25 Times The Single Premium, For Limited Pay- Depends On Multiple Of Annualized Premium |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted, on payment of additional premium.

For Regular/Limited Pay:

Tata AIA Life Insurance Waiver of Premium (Linked) Rider

Tata AIA Life Insurance Waiver of Premium Plus (Linked) Rider

Tata AIA Life Insurance Accidental Death and Dismemberment (Long Scale) (ADDL) Linked Rider

For Single Pay:

Tata AIA Life Insurance Accidental Death and Dismemberment (Long Scale) (ADDL) Linked Rider

Premium Allocation Charges (PAC): For single pay, Premium allocation charge is 3% of the single premium. For Regular/Limited Pay, For Limited Pay, PAC is 6% for 1 or 2 years PPT, 5.5% for 3 to 5 years PPT, 4.5 % for 6 to 7 years PPT, 3.5% for 8 to 10 years PPT & 2% for PPT of 11 years onwards. Top-up Premium Allocation Charge is 1.5% of Top-up premium. The regular/single premium and top-up premium allocation charges are levied throughout the policy term.

Policy Administration Charge: For single pay, it is 0.90% p.a. of Single Premium throughout the policy term and For Regular/Limited Pay Option, it is 0.75% p.a. of Annualized premium throughout the policy term. Monthly policy administration charge is deducted by cancelling Units from the Fund Value of the policy. This charge may be increased up to a maximum of 5% per annum compounded annually, subject to a maximum of Rs 6,000 per annum.

Mortality Charges: Mortality charge is equal to Sum at Risk (SAR) * applicable Mortality Rate for the month, based on the attained age of the Life Assured. Mortality charge is deducted on each Policy Month Anniversary.

Fund Management Charges (FMC): FMC is 1.20% p.a for Multi Cap Fund, India Consumption Fund, Top 50 Fund, Top 200 fund, Super Select Equity Fund, large cap equity fund & whole life mid-cap equity fund, 1.10% p.a for whole life aggressive growth fund, 1% p.a for whole life stable growth fund, 0.80% p.a for whole life income fund, & 0.65% p.a for whole life short term fixed income fund. Fund Management Charges are subject to revision, with prior approval from IRDAI.

Discontinuance Charge: You have the option to discontinue the policy anytime during the policy term by intimating to the Company. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure. No discontinuance charges are applicable on the Top-up premium Fund Value.

Switching Charge: You can avail 12 free switches in a policy year and upon exercising more switches, Rs 100 per switch, subject to a maximum of Rs 250 may be levied.

Partial Withdrawal Charge: Four partial withdrawals are available during a policy year. No partial withdrawal charges are levied under this plan.

Premium Re-direction Charge: There is no Premium Re-direction Charge.

Tax benefits under section 80C towards the premiums paid and the policy proceeds are eligible for tax benefits under section 10 (10D) of the Income Tax Act, subject to amendments from time to time.

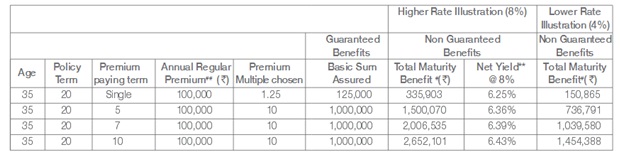

Mr. Rakesh aged 35 years, looking to build a corpus amount, so his family can achieve their dreams such as her daighter’s education, marriage, etc. He also wants to ensure financial security of the family, in case of a mishap. He thus chooses to buy Tata AIA Life Insurance Fortune Pro, with the policy term of 20 years, premium paying term of 5 years, annualized regular premium of Rs 1 Lac, premium multiple chosen is 10, and the basic sum assured is Rs 10 Lacs. Fund Allocation: 50% in Large Cap Equity Fund and 50% in Whole Life Mid cap Equity Fund.

Scenario A- Maturity Benefit: If Mr. Raman survives till maturity of the policy, he will receive the Total Fund Value at applicable NAV. This maturity benefit helps meet your financial obligations.

Scenario B- Death Benefit: In the event of death of Mr. Raman during any policy year, higher of Basic Sum Assured less all Deductible Partial Withdrawals, 105% of the total Regular/Single premiums paid, the Regular/Single Premium Fund Value, or 10 times of the annualized premium. Additionally, the higher of Top-up Premium Fund Value, Approved Top-up Sum Assured, or 105% of the total Top-up Premiums paid is also payable, provided the Policyholder has a Top-up Premium Fund Value.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing