Tata AIA Money Back Plus is a non linked, participating, money back insurance plan. The plan ensures that you have periodic payouts cater to different milestones of your life with life cover.The plan offers you the flexibility to choose your policy term to build a strong saving foundation with adequate financial protection to make your future bright and protected.

Get QuotesIn the event of an unfortunate demise of the life insured, the nominee will receive the Death sum assured along with the compound, reversionary and terminal bonus, if any. This aggregate amount will be subject to a minimum of 105% of total Premiums Paid, as on the date of death. Where, "Sum Assured on death' shall be the higher of the following:

The above Death Benefit will be payable irrespective of the Regular Payouts (survival benefits) already paid.

In the event of an accidental death of the life insured, an additional amount equal to the basic sum assured is payable to the nominee.

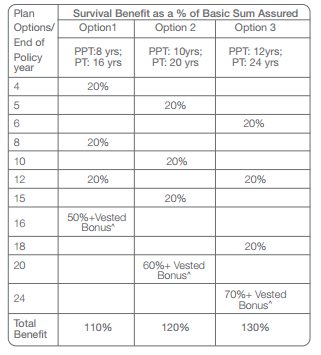

The plan offers survival benefit as a percentage of basic sum assured at regular intervals on the condition that all due premiums are duly paid.

The survival benefits payable are as follows:

Maturity benefit is payable on the survival of the life assured till the end of the policy term. The Maturity benefit payable is the "Guaranteed Sum Assured " which is defined as a percentage of the Basic Sum Assured, depending on the option chosen, as provided below:

The plan is eligible for bonus as it is a participating plan which offers reversionary and terminal bonus as and when due.

The policy offers loan benefit up to 65% of the surrender value.

The policy can be surrendered any time during the term of the policy, provided at least first full year's premium has been paid. The surrender value payable is higher of the Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV).

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 2 Years | 51 Years |

| Age at Maturity | 18 Years | 75 Years |

| Policy Tenure | 16/20 Years | 24 Years |

| Premium Paying Term | 8 Pay (for 16 Year Policy Term) 10 Pay (for 20 Year Policy Term) 12 Pay (for 24 Year Policy Term) | - |

| Premium Paying Mode | Annually, Semi Annually, And Monthly | - |

| Premium Amount | - | - |

| Sum Assured | Rs 2,00,000 (in The Multiples Of 1,000) | No Limit Subject To Underwriting |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

No additional riders are available under this plan.

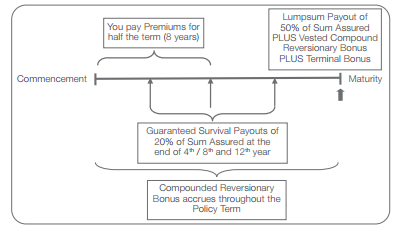

Let us understand how the plan works:

Let us assume you have opted for a policy term of 16 years with premium payment term of 8 years.The policy works as follows:

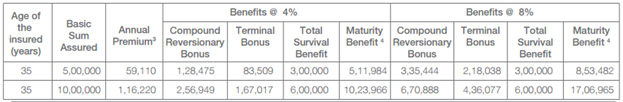

Benefit Illustration:

Following are the benefits payable at the given ages for policy term 20 years and premium payment term 10 years for a healthy life and for standard age proof:- All amount in INR:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing