Tata AIA Life Insurance Saat Saath is a non-linked, non-participating Endowment Micro Insurance Plan that provides return of a percentage of total premiums paid at the time of maturity. With life cover, your family’s financial security is also ensured, in the event of your unfortunate death.

Get QuoteDeath Benefit

In case of an unfortunate demise of the life Insured during the policy term, Sum Assured on Death is payable to the nominee. Sum Assured on death is higher of Basic Sum Assured, Maturity Sum Assured, or 10 times the annualized premium. The death benefit under this plan is subject to a minimum of 105% of total premiums paid. The Policy terminates on the death of the life insured and no other benefit is then payable.

Maturity Benefit

On survival of the life Insured till end of the policy term, Maturity Sum Assured which is equal to Maturity Benefit factor * Premium Paying Term * Annualised Premium is payable, provided the policy is in-force. Here, Maturity benefit factor varies from 100% to 135% of the total premiums paid, depending on the sum assured opted.

Loan Benefit

Policy Loan is not available under Tata AIA Life Insurance Saat Saath plan.

Surrender Value

Surrender Value is higher of Guaranteed Surrender Value or Special Surrender Value. The surrender value can be acquired, on payment of all the premiums of at least first full policy year.

Tax Benefit

This policy provides tax benefits for the premiums paid under Section 80C of the Income Tax Act and the death/maturity/surrender benefit can also avail tax benefits under Section 10(10D) of the said act.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 50 Years |

| Age at Maturity | - | 60 Years |

| Policy Tenure | 10 Years | - |

| Premium Paying Term | 7 Years | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | - | - |

| Sum Assured | Rs 10,000 | Rs 2 Lacs |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

No riders can be attached with this plan.

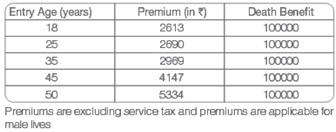

Raman at 35 years, wants to buy Tata AIA Life Insurance Saat Saath to save regularly with the life cover. He opts this plan with the policy term of 10 years, annual premium of Rs 2969 and the basic sum assured of Rs 1 Lac.

Scenario A: Raman Survives the Policy Term

If Mr. Raman survives till the maturity of the policy term, Maturity Sum Assured as applicable is payable under the policy. The maturity benefit helps build the savings.

Scenario A: Raman dies during the Policy Term

If Mr. Raman dies during the policy term, his nominee will receive Rs 1 Lac as death benefit. This death benefit provides financial cover for his family.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing