Tata AIA Life Insurance Monthly Insurance Plan is a Non Linked & Participating Endowment Assurance Plan that helps you save monthly for a limited period, so you can build a corpus to fulfill your future needs such as planning for children’s education, marriage, owning a house, retirement, etc. This plan also provides Guaranteed Yearly Additions and Bonuses that helps enhance your savings. The life cover is also available with this plan that ensures financial security for the family.

Get QuoteDeath Benefit

On the occurrence of the demise of the life assured during the term of the policy, the death benefit payable is higher of 105% of the total premiums paid, or sum assured on death plus accrued guaranteed yearly additions plus vested compound reversionary bonus plus terminal bonus.

In the event of death during the last policy year, the accrued guaranteed yearly additions are not payable, as it is paid at the beginning of the year.

Here, Sum Assured on Death is higher of absolute amount assured to be paid on death, 10 times of annualized premium, or guaranteed sum assured on maturity. The absolute amount assured to be paid on death is the basic sum assured.

Maturity Benefit

In case the life assured survives till the end of the policy term, the sum of Guaranteed Sum Assured on Maturity, Vested Compound Reversionary Bonuses and Terminal Bonus is payable.

Survival Benefit

A guaranteed yearly addition which is equal to one month premium is accrued to the policy at the beginning of each policy year starting from the first policy year. The accrued guaranteed yearly additions are payable at the beginning of the last policy year.

Bonus

Compound Reversionary Bonus (CRB) is accrued every year from the first policy anniversary and it is declared annually by the company and credited on the policy anniversary. Accrued CRB is payable on maturity, surrender, or death.

Terminal Bonus is declared as a percentage of Vested Compound Reversionary Bonus. It is payable on surrender or death, if it takes place after 8 or 11 years for 7 or 10 years premium paying term, respectively.

Loan Benefit

Policy loan can be availed up to a maximum of 65% of surrender value.

Surrender Value

Surrender Value is higher of Guaranteed Surrender Value or Special Surrender Value. Under this policy, Surrender Value can be acquired on payment of first full policy year’s premium.

Tax Benefit

By opting for this policy, you can get the tax exemption under section 80C & 10 (10D) of the IT Act, subject to amendments from time to time.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 30 Days | 50 Years |

| Age at Maturity | 18 Years | 70 Years |

| Policy Tenure | 15 Years | 20 Years |

| Premium Paying Term | 7 Years (policy Term-15 Years), 10 Years (policy Term-20 Years) | - |

| Premium Paying Mode | Monthly Only | - |

| Premium Amount | Rs 2,000 | No Limit (subject To Underwriting) |

| Sum Assured | Rs 1,14,482 | Depends On Maximum Premium |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 15 Days | - |

| Plan Type | Offline | - |

You can opt for the following rider, on payment of additional rider premium.

Tata AIA Life Insurance Accidental Death and Dismemberment (Long Scale) (ADDL) Rider.

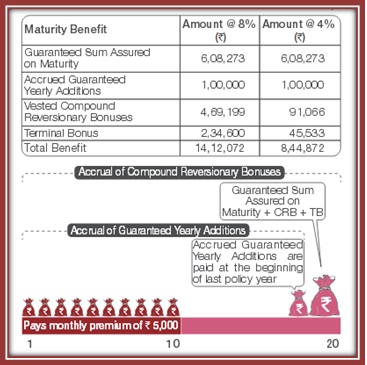

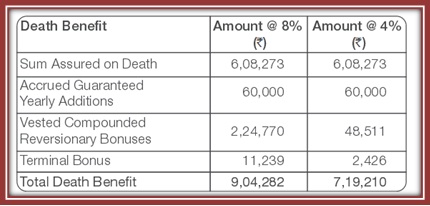

Raman at 35 years, working in an automobile manufacturing company, is married and has a 5 years old daughter. He wants to build a corpus for his daughter’s higher studies that would require disciplined savings. He then decides to buy Tata AIA Life Insurance Monthly Insurance Plan with 20 years policy term, pays Rs 5000 monthly premium.

Scenario A: Raman Survives the Policy Term

If Mr. Raman survives till the maturity of the policy term, he gets Guaranteed Sum Assured on Maturity, Accrued Guaranteed Yearly Additions, Vested Compound Reversionary Bonuses, and Terminal Bonus, as the maturity benefit.

Scenario B: Raman dies during the Term of the Policy

In the event of demise of Mr. Raman during the 12th policy year, a lump sum amount is payable as the death benefit to the nominee. This payout provides financial cover for the family.

Please Note: The bonus illustration mentioned above has been determined by assuming investment returns of 8% and 4% respectively. These rates of return are non-guaranteed and these are not the upper and lower limits of the returns you might back at maturity.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing