Shriram New Shri Life plan is a traditional, non linked endowment plan which will secure your family’s financial future. The plan acts as a systematic saving option to provide savings for future along with the life insurance coverage.

Get QuoteDeath Benefit

The death benefit is payable if the life insured dies during the term of the policy. The benefits payable to the nominee are Sum assured on death plus accrued reversionary bonus, if any, plus terminal bonus, If any will be paid. Death benefit will be at least 105% of all the premiums paid excluding any extra, rider premium and taxes.

Sum Assured on death shall be higher of

Maturity Benefit

Maturity benefit is payable on the survival of the Life Assured till the completion of the policy term. Maturity benefit is payable is the base Sum Assured plus accrued bonus and Terminal Bonus, (if any) and the policy terminates.

Settlement Option

Maturity benefits can be taken as installments spread over a period of 5 years with an addition of interest at a rate approved by IRDAI. Nominee can also choose to receive the death proceeds in installments over a period of five years with an addition of interest at a rate approved by IRDAI.

Bonus

Compounded Reversionary Bonus and Terminal Bonus are paid in the event of death or maturity as accrued in the policy.

Loan Benefit

Loan facility is available under this plan.The maximum loan amount which can be taken under this plan is 90% of the surrender value.Any outstanding loan amount is deducted from the policy proceeds of the policy.

Surrender Value

Policy is eligible for a non guaranteed special surrender value.Surrender value will generate if 3 full years premium are paid under regular pay and 2 years premium are paid for 5/7 pay options.

Tax Benefit

Plan offers tax benefits under section 80C and section 10 (10D) of the Income Tax Act,1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 30 Years | 60 Years |

| Age at Maturity | 18 Years | 75 Years |

| Policy Tenure | 10 Years | 25 Years |

| Premium Paying Term | Limited Pay- 7/10 Pay (for 10 Year Policy Term) Limited Pay- 5/7/10/15 Pay (for 15 Year Policy Term) Limited Pay- 5/7/10/20 Pay (for 20 Year Policy Term) Limited Pay- 5/7/10/15/25 Pay (for 25 Year Policy Term) | - |

| Premium Paying Mode | Annually,Semi Annually,Quarterly And Monthly | - |

| Premium Amount | - | - |

| Sum Assured | Rs 50,000 | No Limit (Subject To Underwriting) |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders are available with this plan

Let us understand the plan benefits with the help of an example:

Life Insured: Ankit , Age: 38 years, Sum Assured: Rs. 5 Lacs, Policy Term: 15 years, Limited pay option: 10 years

Scenario 1: Ankit survives the policy term

Base sum assured of Rs 5 Lacs is payable to Ankit along with accrued reversionary and terminal bonus, if any. Under settlement option, maturity benefits can also be taken as installments spread over a period of 5 years with an addition of interest at a rate approved by IRDAI.

Scenario 2: Ankit dies during the policy term

Sum Assured on death shall be higher of 10 times the annual premium (if age is less than 45 years or 7 times the annual premium- if age is 45 years and above) or twice the basic sum assured. Along with the death sum assured, accrued bonus amount is payable to the nominee.Nominee can also choose to receive the death proceeds in installments over a period of five years with an addition of interest at a rate approved by IRDAI.

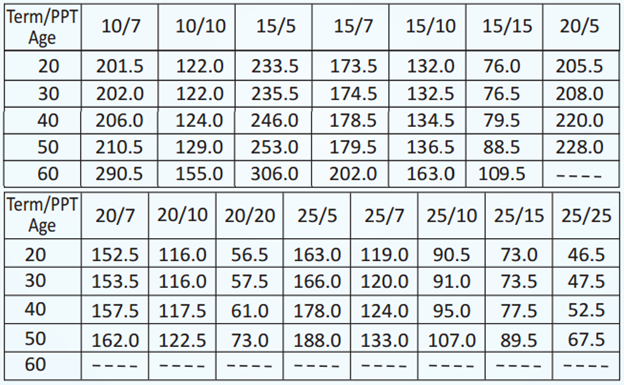

Illustrative premiums for sample ages/terms of sum assured of Rs 1,000are given below:

Premiums illustrated are exclusive of service tax and education cess.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing