Reliance Nippon Life Education Plan is a non-linked, non-participating child insurance plan that don’t let you compromise for your child’s future. This plan helps you save and provide you the flexibility to choose your payouts depending on your child’s future needs.

Get QuotesIn case of unfortunate demise of the life insured within the term of the policy, immediate lump sum benefits is payable to the nominee as per the Death Benefit option chosen at the inception of the policy. The payment of future premiums cease immediately and all benefits under the plan will continue to be paid, depending on the Payout Option.

Option I- 100% of Death Benefit amount is paid immediately, to the nominee, on death of the Life Assured.

Option II- 50% of total Death Benefit amount is paid immediately on death and the balance amount is paid annually in equal installments over the period of next 10 years starting from the date of death. Each installment is equal to12.94% of the 50% of the total Death Benefit amount.

The Death Benefit amount is higher of the Sum Assured on Death or 105% of the premiums paid.

Sum Assured on Death for policy term less than 10 years, it is higher of 5 times of annualized premium or base sum assured or guaranteed maturity benefit.

Sum Assured on Death for policy term less than 10 years and age at entry less than 45 years, it is higher of 10 times of annualized premium or base sum assured or guaranteed maturity benefit. For age at entry 45 years & above, it is higher of 7 times of annualized premium or base sum assured or guaranteed maturity benefit.

At the end of the policy term irrespective of your survival, Guaranteed Maturity Benefit (GMB) is payable depends on the payout option chosen.

Guaranteed Maturity Benefit= Base Sum Assured + Guaranteed Addition + Guaranteed Maturity Addition.

Here, Guaranteed Addition= Guaranteed Addition of 2% of the Base Sum Assured is accrued to your Policy at the end of each Policy Year till the end of the Policy Term

Guaranteed Maturity Addition= 2% * Base Sum Assured * Policy Term

For self starter option, you receive a single lump sum to fund your child’s education.

For post graduate degree, you receive 2 annual payouts for your child’s post graduate studies.

For professional degree, you receive 4 annual payouts for your child’s professional studies.

For career starter, you receive 5 annual payouts for your child’s higher education and serves as a career launch pad.

No bonus is applicable under this plan, as it is a non-participating insurance plan.

The maximum loan amount available under this policy is 80% of the surrender value. The interest on the loan amount is payable at the prevailing rate of interest, which is 10.50% p.a.

Surrender Value is higher of Special Surrender Value or Guaranteed Surrender Value. Surrender Value is acquired on payment of at least 2 full policy year’s premium when premium paying term is less than 10 years and it can be acquired on payment of at least 3 full policy year’s premium when premium paying term is 10 years or higher.

Premiums paid under this policy and riders opted is eligible for tax benefits. Income Tax benefits under this plan and rider benefits are applicable as per the prevailing Income Tax Laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 20 Years (0 Year For Child) | 50 Years (18 Years For Child) |

| Age at Maturity | 29 Years (9 Years For Child) | 65 Years (30 Years For Child) |

| Policy Tenure | 9/12 Years | 20 Years |

| Premium Paying Term (PPT) | Regular Pay/5 Years/7 Years (9 Years Policy Term), 10 Years (12 Years Policy Term) | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | PPT 5 & 7 Years- Rs 35,000 PPT 9 & 10 Years- Rs 30,000 PPPT Over 11 Years- Rs 20,000 | No Limit |

| Base Sum Assured | Rs 50,000 | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted under this plan, on payment of additional rider premium.

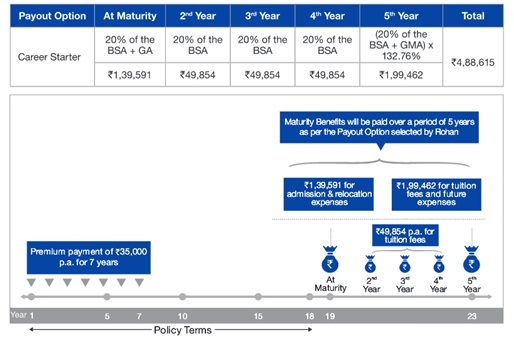

Rohan at 30 years of age, buys Reliance Nippon Life Education Plan with the policy term of 18 years, premium payment term of 7 years, base sum assured of Rs 2,49,270 and annual premium of Rs 35,000. He chooses a death benefit as option II and payout option as career starter.

Scenario A: Rohan Survives the Policy Term

In case Rohan survives till maturity of the policy term, with career payout option, he will receive the following amount.

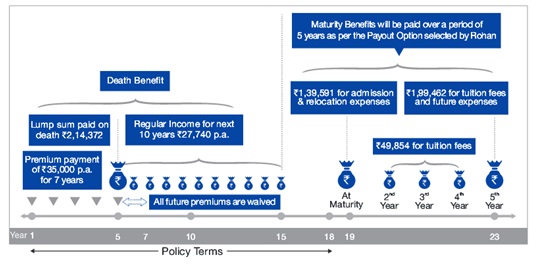

Scenario B: Rohan dies during the Term of the Policy

In the event of Rohan’s death during the 5th policy year, the death benefit payable is Rs 4,28,744. Upon choosing death benefit option II, 50% of Death Benefit as an immediate lump sum on Death i.e. Rs 2,14,372. Remaining Death Benefit amount will be paid as an annual income for next 10 years, with each installment equal to 12.94% of 50% of total Death Benefit, i.e. Rs 27,740 per annum.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing