ICICI Prudential Future Perfect plan is a non-linked endowment plan which secures the future of your loved ones by providing a safe journey. This plan helps you to achieve your life goals like buying a house, securing kids future needs, saving for old age, etc. ICICI Pru Future Perfect plan helps you to plan systematically to achieve the bigger financial objectives in life.

Get QuoteDeath Benefit

On the death of the life insured during the policy term in an active policy, the payout to the nominee will be higher of Sum assured plus accrued bonuses or 105% of all premium paid till date.

Maturity Benefit

Maturity benefit is payable on survival of the policy term which is higher of (Guaranteed Maturity Benefit (GMB) + accrued Guaranteed Additions and bonuses plus terminal bonus, if any or 100.1% X (annualized premium plus loadings for modal premiums, if any).

Bonus

Bonuses comprise of vested reversionary bonuses, interim bonus and terminal bonus, as applicable. Reversionary bonus is declared for the first policy year annually during the term of the policy. The bonuses declared under this plan may vary as per the premium payment term options.

Loan Benefit

The policyholder is eligible for loans up to 80% of the Surrender Value.

Surrender Value

On policy surrender, the policyholder will get higher of Guaranteed Surrender Value (GSV) or Special Surrender value. If the PPT (premium paying term) is 10 years or more, the policy will acquire a surrender value after payment of three full years’ premium. If PPT is less than 10 years, the policy will acquire a surrender value after payment of two full years’ premium.

Tax Benefit

Premiums paid, are eligible for the tax benefits as per Section 80C and the death benefit qualify for tax benefits under section 10 (10D) of the Income Tax Act.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 91 Days | 58 Years |

| Age at Maturity | 18 Years | 70 Years |

| Policy Tenure | 10 Years | 30 Years |

| Premium Paying Term | Limited Pay( 5/7/10/15/20) Only | - |

| Premium Paying Mode | Monthly, Semi Annually & Annually | - |

| Premium Amount | Rs 12,000 | No Limit (subject To Underwriting) |

| Sum Assured | Rs 84,000 | Rs 4 Lacs |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

No Riders are available under this plan.

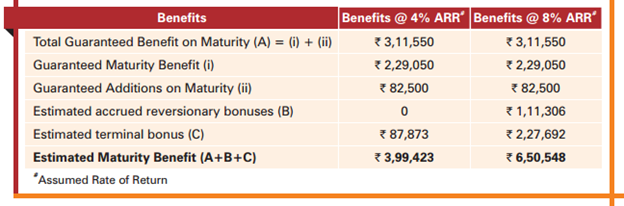

Let us understand with the help of an illustration of ICICI Pru Future Perfect – Limited Pay

Age at entry: 35 years

Policy term: 20 years

Premium paying term: 10 years

Premium paying mode: Yearly

Annual premium: Rs 30,000

Sum Assured on Death: Rs 3,00,000

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing