HDFC Life Click2Protect 3D Plus plan is a non-linked & non-participating term insurance plan. It is a simple protection plan to get comprehensive protection at the most affordable price. This term plan safeguards your family against the financial downturn due to the uncertainties of life like death, terminal illness, disease, disability, accident, etc. It offers a range of protection options to fulfill you & your family's protection needs.

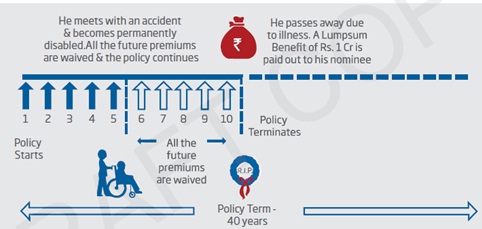

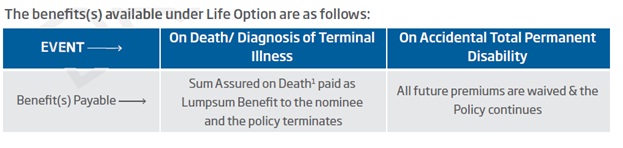

Get QuotesUnder this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. In addition to the death benefit, the future premiums are waived off in case of Accidental Total Permanent Disability.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability

Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. In addition to the death benefit, the future premiums are waived off in case of Accidental Total Permanent Disability and upon diagnosis of the specified critical illness.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability + Waiver of Premium upon diagnosis of the specified critical illness

Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. The future premiums are waived off in case of Accidental Total Permanent Disability.Additional sum assured is payable to the nominee in case of an accidental death.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability + Accidental Death Benefit

Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. The future premiums are waived off in case of Accidental Total Permanent Disability.

Additionally, under this option the nominee will receive a regular stream of Income in the event of death of the life insured.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability + Regular Income to the nominee (as per plan specifications)

Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. The future premiums are waived off in case of Accidental Total Permanent Disability.

Additionally, under this option the nominee will receive a regular stream of Income in the event of death of the life insured. Also, an additional sum assured is payable to the nominee in case of an accidental death.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability +Accidental Death Benefit+ Regular Income to the nominee(as per plan specifications)

Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. The future premiums are waived off in case of Accidental Total Permanent Disability.

Additionally, under this option the nominee will receive a regular stream of Income in the event of death of the life insured.This plan option ensures that your nominee continues to receive the income stream (Level/Increasing) even in your absence. The income will continue till the end of the policy term, subject to minimum term of 4 years.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability + Regular Income to the nominee(Level/Increasing)

Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. The future premiums are waived off in case of Accidental Total Permanent Disability.

In case the life insured survives the policy term, he/she is gets the return of premiums as maturity benefit.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability + Return of Premiums (in case life assured survives the policy term)

The protection offered under this plan is for the whole life.Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. The future premiums are waived off in case of Accidental Total Permanent Disability. The Premium Payment term is calculated as 65- Age at Entry.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability+Protection for whole life

The protection offered under this plan is for the whole life.Under this option Lumpsum Benefit on death or diagnosis of Terminal Illness is payable to the nominee. In addition to the death benefit, the future premiums are waived off in case of Accidental Total Permanent Disability and upon diagnosis of the specified critical illness. The Premium Payment term is calculated as 65- Age at Entry.

Death Benefit + Terminal Illness+ Waiver of Premium for Accidental Total Permanent Disability+Protection for whole life + Waiver of Premium upon diagnosis of the specified critical illness+Protection for whole life

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years, 25 Years – For Life Long Protection & 3D Life Long Protection Option | 65 Years |

| Age at Maturity | 23 Years | (85 Years For-Life Option, Extra Life Option ,Income Option, Extra Life Income Option), (75 Years For-3D Life Option, Income Replacement Option, Return Of Premium Option ), (Whole Life - For Life Long Protection & 3D Life Long Protection Option) |

| Policy Tenure | 5 Years | (50 Years For-Life Option, Extra Life Option, Income Option, Extra Life Income Option), (40 Years-3D Life Option, Income Replacement Option, Return Of Premium Option ), ( Whole Life - For Life Long Protection & 3D Life Long Protection Option) |

| Premium Paying Term | Single, Limited,Regular Pay | 65- Age At Entry (For Life Long Protection & 3D Life Long Protection Option) |

| Premium Paying Mode | Single,Monthly,Semi Annually,Quarterly & Annually | - |

| Sum Assured | Rs 10 Lakh | Subject To Underwriting |

| Grace Period | 30 Days/ 15 Days (for Monthly Mode) | - |

| Plan Type | Online | - |

The following additional benefits can be taken as add on benefits on payment of additional premium:

1. Life Stage Protection: Under this feature, you have the option to increase the basic Sum

Assured without underwriting on any of the below-specified events in the life of the Life Assured:

2. Top Up Option: he policyholder may opt for a systematic increase of your cover from 1st policy anniversary onwards. The policyholder has the option to exit this option at any time during the remaining policy term.

Let us understand this with the example of Mr. Raj

Plan Details of Mr. Raj:

Age: 25 years

Plan Option: HDFC Click2Protect 3D Plus- LIFE OPTION

Sum Assured:1 Crore

Premium paying term: 40 years (Regular Pay)

Policy Term: 40 years

HDFC Click2Protect 3D Plus Term Plan is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing