Edelweiss Tokio Life – Immediate Annuity Plan is a traditional non-participating Single Premium Plan that caters to the need of retirement funding. Under this plan, you need to pay only once and start receiving pension immediately for the lifetime.

Get QuotesFollowing are the annuity options available under this plan:

No bonus is applicable, as it is a non-participating Annuity Plan.

This policy does not offer policy loan.

No surrender value is payable under this plan.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years* | 85 Years |

| Premium Paying Term | Single Pay | - |

| Purchase Price/Premium Amount | Rs 1,00,000 | No Limit |

| Annuity Payout Frequency | Annually, Semi Annually, Quarterly Or Monthly | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | Nil | - |

| Plan Type | Offline | - |

No rider can be opted under this plan.

This plan offers tax benefits, subject to prevailing tax laws.

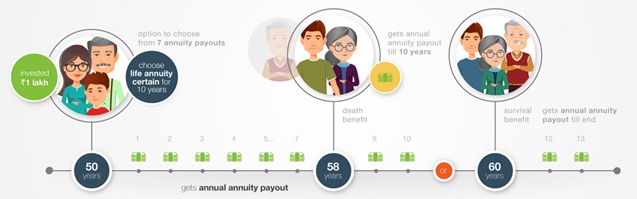

Rohit at 50 years of age is planning for his retirement and looking to accumulate corpus that can fulfill the need of retirement funding. He opts for Edelweiss Tokio Life – Immediate Annuity Plan with ‘Life Annuity Certain for 10 Years’ annuity option chooses the purchase price of Rs 1,00,000.

Scenario I: On Survival of Rohit

In case of Rohit’s survival, he receives annuity payout at a constant rate for the first 10 policy years and thereafter, the annuity is payable in case the life insured survives beyond the period of 10 years.

Scenario II: Rohit dies during the Term of the Policy

On death of Rohit at 58 years, the annuity is payable till the end of the 10th year.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing