Edelweiss Tokio Life CritiCare+ is a non-linked and non-participating Critical Illness health plan that provides coverage against 17 critical illnesses under 4 different group categories. Upon the onset of a critical illness, this plan covers health care expenses plus day-to-day hospital expenses. Under this plan, you have an option to make claims up to 3 times during the entire policy term. Edelweiss Tokio Life ensures that the future premiums are waived off after the first claim and the policyholder may continue to avail the benefit of protection.

Protection against 17 Major Critical Illnesses

Lump Sum Benefit on the diagnosis of Critical Illness

Claim upto 3 times under Multi Claim Option

Waiver of future premiums on occurrence of first claim

Discounts on opting Higher Sum Assured

Easy benefit design for better understanding of the product

Avail Tax Benefits

Following are the critical illness benefit options available under this plan.

1.Critical Illness Benefit- OPTION 1-Single Claim:

A lump-sum benefit (equal to the sum assured) is paid on the survival of life insured for 28 days after the date of the confirmed diagnosis of Critical Illness and policy terminates thereafter.

2.Critical Illness Benefit- OPTION 2-Multi Claim:

The insured can get claim benefits for up to 3 claims. The life insured can claim for Critical Illness only once from one group out of the 4 groups of categorized Critical Illness. Under this option, the claim is paid as a lumpsum benefit is paid on the survival of life insured for 28 days after the date of the confirmed diagnosis.The benefits you can avail under each claim are described below.

(Note: Claim for critical illness will only be accepted if the illness has occurred after the expiry of 90 days from the date of issue/date of revival of the policy. There is a survival period of 28 days and the waiting period between claims is 365 days)

No death benefit is payable under this plan.

No surrender benefit is payable under this plan.

| Feature | Specification |

| Age (as on last birthday) |

Minimum: 18 Years Maximum:65 Years |

| Age at Maturity | 70 Years |

| Policy Tenure |

Minimum: 5 Years Maximum: 30 Years |

| Sum Assured | Minimum: 5 Lacs Maximum: 100 Lacs |

| Premium Paying Term | Same as policy term Years |

| Premium Paying Mode | Annually |

| Maturity Proceeds | Nil |

| Plan Type | Online |

| Grace Period | 30 days |

There are no rider benefits available with this plan.

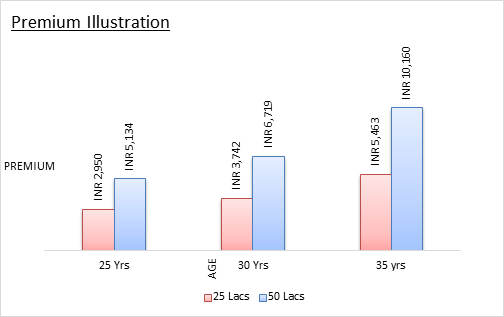

Sample illustration of the Premium Amount for an individual of age 25, 30 and 35 years, opting for a Critical Illness Cover of Rs 25 Lacs or Rs 50 Lacs as Sum Assured and 5 years as Policy Tenure.

|

|

25 years |

30 years |

35 years |

|

Sum Assured =Rs50 lacs |

Rs5,134 |

Rs6,719 |

Rs10,160 |

|

Sum Assured= Rs25 lacs |

Rs2,950 |

Rs3,742 |

Rs5,463 |

(Note: The illustration cited is for the single claim option, this premium amount is for a non smoker individual choosing single-claim option and keeping good health conditions at the time of buying this insurance plan)

Edelweiss Tokio Life CritiCare+ is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing