Bajaj Allianz Young Assure is a traditional & participating regular and limited premium payment plan to ensure a bright future for your children. This plan provides the right financial support for your children to achieve their dreams irrespective of eventualities.

Get QuotesIn the event of death of the life insured during the term of the policy provided all due premiums are paid, the Sum Assured on Death, subject to the guaranteed death benefit of 105% of the total premiums paid till date of death, is payable immediately and the policy will be converted to a fully paid-up policy. Here, Sum Assured on Death is the higher of Sum Assured or the Guaranteed Maturity Benefit.

As a fully paid-up policy, all future Guaranteed Additions, Vested Bonus and Terminal Bonus will accrue in the policy.

In the event of Accidental Permanent Total Disability of the life insured during the term of the policy provided all due premiums are paid, the policy will be converted to a fully paid-up policy and continue to accrue all future Guaranteed Additions, Vested Bonus and Terminal Bonus.

If Accidental Permanent Total Disability Benefit has already received, on the death of the life insured, the death benefit is payable.

At the end of the policy term, the maturity benefit is payable. It is Guaranteed Maturity Benefit (GMB) plus Guaranteed Additions (GA) plus Vested Bonus (VB) plus Interim Bonus (IB) plus Terminal Bonus.

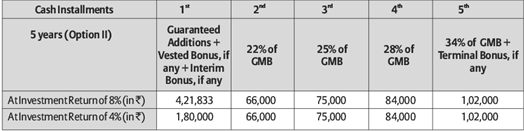

You have the option to take the maturity benefit in one of the three cash installment options as opted by you at the policy inception. These cash installment options are paid in annual installments. The first installment commences from the end of the policy term.

A total of 105%/109%/113% of GMB is payable, under option I/II/III respectively.

Guaranteed Addition is a percentage of Guaranteed Maturity Benefit. It is 15%/25%/40%/60%/90% attached at the end of the policy term for premium paying term of 5 years/7 years/12 years/15 years/20 years, respectively.

Compound Reversionary Bonus: It is a regular bonus rate expressed as a percentage of the Guaranteed Maturity Benefit. This percentage is applicable to the Guaranteed Maturity Benefit and the Vested Bonus under the policy to determine the amount of reversionary bonus to be added to the policy at the end of that financial year.

Interim Bonus: In case of death claim or maturity benefit part way through a financial year or before the valuation result is declared, the interim bonus is payable, as decided by the company.

Terminal Bonus: If the policy has completed 10 policy years and all due premiums have been paid, the Company will pay a Terminal Bonus, as a percentage of the Guaranteed Maturity Benefit.

Vested Bonus: It is attached to your policy every year, starting from the first policy year.

The maximum loan amount that can be borrowed under this policy is 90% of the surrender value. On surrender/maturity, the outstanding policy loan plus interest, will be deducted from the benefit amount payable.

Surrender Value is higher of Special Surrender Value or Guaranteed Surrender Value. Surrender Value is acquired on payment of first full policy year’s premium when premium paying term is less than 10 years and it can be acquired on payment of two full policy year’s premium when premium paying term is 10 years or higher.

Premiums paid for this policy is eligible for tax benefits under section 80C and Death/Maturity/Surrender benefit can avail tax benefits under section 10 (10D) of the Income Tax Act, subject to prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 50 Years |

| Age at Maturity | 28 Years | 60 Years |

| Policy Tenure | 10/15 Years | 20 Years |

| Premium Paying Term | 5/7 Years (10 Years Policy Term), 12/15 Years (15 Years Policy Term) | 12/15/20 Years (20 Years Policy Term) |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium | Based On GMB Chosen, Age, Policy Term, Premium Payment Term And Premium Payment Frequency | - |

| Sum Assured | 10 Times Of Annualized Premium | - |

| Guaranteed Maturity Benefit (GMB) | Rs 1,00,000 | No Limit (as Chosen) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online | - |

Following riders can be opted under this plan, on payment of additional rider premium.

Gautam at 35 years of age, opts to buy Bajaj Allianz Young Assure with the policy term of 20 years, premium pay term of 15 years and sum assured of Rs 2,43,630. He chooses a Guaranteed Maturity Benefit of Rs 3,00,000 and pays annual premium of Rs 24,363. He chooses cash installment option of 5 years.

Scenario A: Guatam Survives the Policy Term

On maturity, Gautam will receive cash installments as applicable.

The percentages of GMB as Cash Installments and on Maturity are guaranteed. Vested Bonus at investment return of 8% & 4% is not guaranteed and is for illustrative purpose only.

Scenario B: Guatam dies during the Term of the Policy

In the event of demise of Gautam during the 5th policy year, his son (nominee) will receive a Guaranteed Maturity Benefit of Rs 3,00,000.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing