Aviva iGrowth is a non-participating savings oriented unit linked insurance plan that helps accelerate your savings. This plan also provides comprehensive protection for you & your family. This plan is available online can be bought via hassle-free procedure. No medical examination is required for buying this plan.

Get QuotesThis policy offers following 3 investment funds, you can invest with that suit your investment objectives.

In the event of death of the life assured during the policy term and the policy is in-force, the nominee will receive the higher of Sum Assured or 105% of the total premiums paid or the Fund Value along with Loyalty additions.

In the event of accidental death of the Life Insured, an amount equal to base sum assured of the policy in addition to death benefit mentioned above is payable, subject to maximum of Rs 50 Lacs.

In case of death of Life Insured after discontinuance of a policy within lock-in period of first five policy years, the policy gets terminated by paying the fund value as per the discontinued policy fund to the nominee.

On survival of the life assured till end of the policy term, Fund Value along with Loyalty additions is payable.

Loyalty additions are payable on last 3 policy anniversaries of your policy. It is added as 1.25%/2.70%/3% during the last three policy years for policy term of 10/15/20 years, respectively.

There is an option to reduce sum assured after 3 policy years, provided you have opted for life cover of 20 times the Annual Premium.

The Sum Assured can be reduced to 10 times the Annual Premium on any policy anniversary by giving a written notice at least 15 days prior the policy anniversary.

You can switch between fund options to capitalize market opportunities. The minimum amount switched and the balance left in the fund after such switching, should be Rs 5,000.

Premium Re-direction is used to modify the allocation proportion of future premiums to various funds and it is available up to 2 times during a policy year. The minimum allocation in each selected fund must be 10%.

Partial Withdrawal is allowed up to 4 times during a policy year and it is available after completion of first 5 policy years. The minimum partial withdrawal amount is Rs 5,000, provided the minimum balance after such withdrawal should not be less than 2 times of annual premium.

The plan is not eligible for the bonuses as it is a non-participating life insurance plan.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years and on complete withdrawal from the policy, the fund value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund’ and it is refunded upon completion of lock-in period.

Upon surrendering the policy after the lock-in period of 5 years and on complete withdrawal from the policy, the total fund value as on the date of surrender is payable.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 50 Years |

| Age at Maturity | - | 60 Years |

| Policy Tenure | 10/15 Years | 20 Years |

| Premium Paying Term (PPT) | Equal To Policy Tenure | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Annual Premium | Rs 35,000 | Rs 5 Lacs (if 10 Times Cover Is Opted And 18-40 Years Entry Age), Rs 2.5 Lacs (if 20 Times Cover Is Opted And 18-40 Years Entry Age) Rs 3 Lacs (if 10 Times Cover Is Opted And 41-50 Years Entry Age), Rs 1.5 Lacs (if 20 Times Cover Is Opted And 41-50 Years Entry Age) |

| Sum Assured | Rs 3.5 Lacs | 10* Annual Premium Or 20* Annual Premium |

| Freelook Period | 30 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online | - |

No rider is available under this plan.

Premium Allocation Charges: This charge is deducted from the premium paid and the balance is invested in various funds, as opted by you. For policy term of 10/15 years, it is 5%/4.5% for policy 1st to 4th/5th policy year, respectively. For policy term of 20 years, it is 4%/3% for policy 1st to 4th/5th policy year, respectively.

Policy Administration Charge: Monthly policy administration charge is levied by the redemption of units under the policy. It is 0.10%/0.30% of annualized premium for 1st to 5th/6th policy year onwards, respectively. This charge is applicable through the entire policy term and it cannot exceed Rs 400 per month.

Mortality Charges: Mortality charge is applied on Sum at Risk (SAR) and it is deducted on each Policy Month Anniversary. If Sum at Risk is zero or negative, mortality charge shall not be applicable. In addition to this mortality charge, Rs 0.60 p.a per 1000 of accidental sum assured is levied for in-built accidental death benefit.

Fund Management Charges: Fund management charge for all funds except Discontinued Policy Fund is 1.35% p.a, for Discontinued Policy Fund, it is 0.50% p.a.

Discontinuance Charge: Discontinuance charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure. No discontinuance charge is levied on top-up premium fund value.

Switching Charge: You can avail 12 free switches in a policy year and upon exercising more switches, the amount is levied @0.50% of the amount switched, subject to a minimum of Rs 25 and maximum of Rs 500 per switch.

Miscellaneous charge: The alteration fee of Rs 100 will be charged for change in premium frequency. Taxes are also levied, as notified by the government.

Tax benefits can be availed as applicable under the Income Tax Act, subject to change in tax laws.

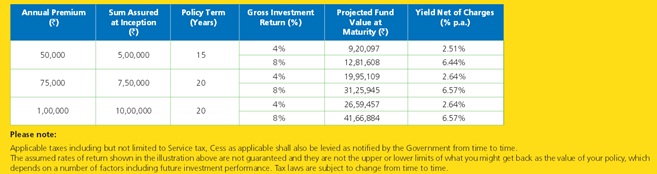

Mr. Raman aged 35 years, is leading a happy life with his wife ananya and a daughter sanya. He wants to build a corpus amount, so his family can achieve their dreams such as sanya’s education, her marriage, etc. He also wants to ensure financial security of the family, in case of a mishap. He thus opts for Aviva iGrowth with the policy term of 15 years, annual premium of Rs 50,000, and the sum insured is Rs 5 Lacs.

Scenario A- Maturity Benefit: If Mr. Raman survives till maturity of the policy, he will receive the Fund Value along with Loyalty additions.

Scenario B- Death Benefit: In the event of non-accidental death of Mr. Raman during any policy year, the higher of Sum Assured or 105% of the total premiums paid or the Fund Value along with Loyalty additions is payable to the nominee.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing