Aviva Affluence is a unit linked non-participating insurance plan that helps optimize your wealth and you can easily meet long term milestones such as children’s education/marriage, retirement etc. This plan also provides the life cover that ensures financial security for the family.

Get QuotesThis policy offers following 7 investment funds, you can invest with that suit your investment objectives.

You have the option to choose Systematic Transfer Plan that helps switch your money between Debt and Equity Fund in a systematic manner. This facility is available, in case at least 10% of premiums are allocated to Protector Fund-II.

In the event of death of the life assured during the policy term and the policy is in-force, the nominee will receive the higher of Sum Assured, 105% of the regular premiums paid, or the regular premium Fund Value.

In case top-up premiums were paid, an additional payout of top-up sum assured, 105% of the top-up premiums paid, or the top-up premium Fund Value, whichever is higher is payable.

In the event of an accidental death between 18 to 60 years of age, an additional payout as accidental death benefit equal to the base sum assured, subject to a maximum of Rs 50 Lacs is also payable.

On survival of the life assured till end of the policy term, Total fund value related to regular/top-up premiums plus maturity booster additions.

Maturity booster addition is calculated as a percentage of fund value related to limited/regular premium. It is 0.60%/0.65%/0.70%/0.75%/0.80% for PPT of 5 years/7 years/10 years/15 years/16 years & above.

Increasing Milestone Boosters (IMB) is available when the due premiums are paid. IMB additions are a percentage of fund value related to limited/regular premium. IMB is 0.50%/0.55%/0.60%/0.65% of fund value is payable on 10th/15th/20th/25th policy anniversary, respectively.

You have the option to pay additional premium as Top-up Premium and you can exercise this option any time, except the last 5 years of the policy. The minimum Top-up premium allowed is Rs 5,000.

Top-up Sum Assured is 1.25 times the Top-up Premium.

You can switch between fund options to capitalize market opportunities.

Premium Re-direction is used to modify the allocation proportion of future premiums to various funds.

Partial Withdrawal is allowed up to 4 times during a policy year and it is available after completion of first 5 policy years. The minimum partial withdrawal amount is Rs 5,000.

Systematic Partial withdrawal is also available after the first 5 policy years, except during the last 3 policy years. This option can be exercised, in case fund value is Rs 5 lacs or higher.

The plan is not eligible for the bonuses as it is a non-participating life insurance plan.

No loan benefit can be availed under this plan.

Upon surrendering the policy with-in the lock-in period of 5 years and on complete withdrawal from the policy, the fund value less applicable discontinuance charges is credited to the ‘Discontinued Policy Fund’ and it is refunded upon completion of lock-in period.

Upon surrendering the policy after the lock-in period of 5 years and on complete withdrawal from the policy, the total fund value as on the date of surrender is payable.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 2 Years | 50 Years |

| Age at Maturity | 18 Years | 60 Years (5 Years PPT), 65 Years (7/10/15 Years PPT), 70 Years (16 To 30 Years PPT) |

| Policy Tenure | 15 Years | 30 Years |

| Premium Paying Term (PPT) | 5/7/10/15 Years Or Equal To Policy Tenure | - |

| Premium Paying Mode | Annually Only | - |

| Premium Amount | For Regular Premium-Rs 1 Lac, For Top-up Premium- Rs 5,000 | No Limit (subject To Underwriting) |

| Sum Assured | < 45 Years Age: Sum Assured Multiple =higher Of 10 Or 0.5 * Policy Term >= 45 Years Age: Sum Assured Multiple: 10 | < 45 Years Age: Sum Assured Multiple =higher Of 10 Or 0.5 * Policy Term (for 5/7/10 Years PPT), Sum Assured Multiple =Policy Term (for 15 To 30 Years PPT), >= 45 Years Age: Sum Assured Multiple = 10 (for 5/7/10 Years PPT), Sum Assured Multiple = Policy Term Assured Multiple ( For 15 To 30 Years PPT) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days | - |

| Plan Type | Offline | - |

No rider is available under this plan.

Premium Allocation Charges (PAC): This charge is deducted from the premium paid. PAC is 2% for top-up premium, for regular premium, it is 9%/7%/6%/2% during the 1st/2nd/3rd to 10th/11th policy year onwards, respectively.

Policy Administration Charge: Monthly policy administration charge is levied by the redemption of units under the policy. It is 0.02%/0.20% of annual premium during 2nd to 5th/6th policy year, respectively. No such charges are levied during the 1st policy year. Policy administration charge of 0.20% of annual premium per month is increased by 2.50% p.a on each policy anniversary from 7th policy year onwards. This charge cannot exceed Rs 400 per month.

Mortality Charges: Mortality charge is applied on Sum at Risk (SAR) and it is deducted on each Policy Month Anniversary. In addition to this mortality charge, Rs 0.60 per 1000 of accidental sum assured is levied for in-built accidental death benefit.

Fund Management Charges: Fund management charge for all funds except Discontinued Policy Fund is 1.35% p.a, for Discontinued Policy Fund, it is 0.50% p.a.

Discontinuance Charge: This charge is levied, in case the policy is discontinued during the first 5 years. This charge is levied as applicable under the policy terms & conditions. For more details, please refer the policy brochure. No discontinuance charge is levied on top-up premium fund value.

Switching Charge: You can avail 12 free switches in a policy year and upon exercising more switches, the amount is charged @0.50% of the amount switched, subject to a minimum of Rs 25 and maximum of Rs 500 per transaction.

Premium Re-direction: This facility is available free of cost.

Tax benefits can be availed as applicable under the Income Tax Act, subject to change in tax laws.

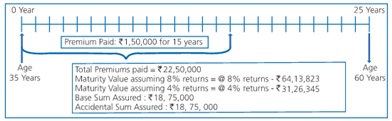

Mr. Raman aged 35 years, is leading a happy life with his wife ananya and a daughter sanya. He wants to build a corpus amount, so his family can achieve their dreams such as sanya’s education, her marriage, etc. He also wants to ensure financial security of the family, in case of a mishap. He thus opts for Aviva Affluence with the policy term of 25 years, premium payment term of 15 years, annual premium of Rs 1.5 Lacs.

Scenario A- Maturity Benefit: If Mr. Raman survives till maturity of the policy, he will receive the Total fund value related to regular/top-up premiums plus maturity booster additions.

Scenario B- Death Benefit: In the event of death of Mr. Raman during any policy year, the higher of Sum Assured, 105% of the regular premiums paid, or the regular premium Fund Value is payable to the nominee.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing