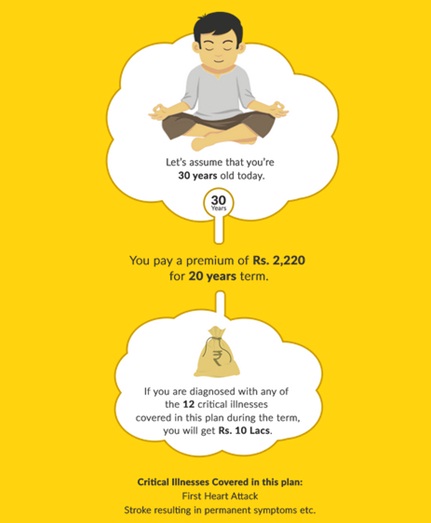

The kind of lifestyle and stress, which is there has made us vulnerable to the critical illnesses. The cost and treatment of such illnesses are enormous which creates a dent in our finances. Aviva Health Secure plan offers a lumpsum benefit to the insured in the event where the insured is diagnosed with any of the 12 Major Critical Illness plans.

Get QuotePolicy Benefits

Lump Sum Benefit

Lump sum amount equal to the sum assured is payable in the event being diagnosed with any of the 12 specified critical illnesses.

Death Benefit

There is no death benefit payable under this plan.

Maturity Benefit

There is no maturity benefit payable under this plan.

How the Plan Works?

Value Added Benefits

Sub Limits

Waiting Period Clause

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 55 Years |

| Sum Assured | 5 Lacs | 50 Lacs (including Critical Illness Cover Taken Under Other Policies) |

| Cover Type | Individual | - |

| Policy Tenure | 10 Years | 30 Years |

| Grace Period | 30 Days | - |

| Freelook Period | 30 Days | - |

| Riders | Nil | - |

| Plan Type | Online | - |

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing