SUD Life Guaranteed Pension Plan is a non-linked & non-participating deferred pension plan that helps you to plan well for post retirement life. This plan also helps you to fulfill both the planned and unplanned financial needs. With this plan, you can generate a retirement corpus that can be used to receive lifelong income.

Get QuotesIn the event of the demise of the life insured within the policy term, Assured death benefit is payable to the nominee/beneficiary. Assured death benefit is higher of total premiums paid accumulated @6% compounded annually or 105% of the total premiums paid till the date of death.

The nominee has the option to use the death benefit through the following two ways:

In case of survival of the life insured till vesting/maturity of the policy, Assured vesting benefit which is equal to total premiums paid * vesting benefit factor is payable. Vesting benefit factor varies from 130% to 175%, depending on the premium payment term chosen.

The vesting benefit can be utilized in the following two ways:

You have the option to take up to 1/3rd of the benefit as tax-free lump sum as per the current income tax regulations.

No bonuses are payable, as it is a non-participating pension plan.

No loan can be availed under this policy.

For single premium, Surrender Value can be acquired from the date of commencement of the policy. For 5 years limited pay policies, you can acquire the Surrender Value after payment of at least first two full policy years. For 10/15 years limited pay policies, you can acquire the Surrender Value after payment of at least first three full policy years.

Surrender Value payable is higher of Guaranteed Surrender Value or Special Surrender Value.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 35 Years (varies With The Policy Term Opted) | 65 Years |

| Age at Vesting | 55 Years | 70 Years |

| Policy Term | 5/10 Years (single Premium), 10 Years (5 Year Pay), 15 Years (10 Year Pay), 20 Years (15 Year Pay) | - |

| Premium Payment Term | Single Premium, 5/10/15 Years Limited Pay | - |

| Annual Premium Amount | Rs 1,00,000 (single Premium), Rs 30,000 (5 Year Pay), Rs 20,000 (10 Year Pay), Rs 20,000 (15 Year Pay) | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Freelook Period | 30 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

No rider can be opted under this plan.

Premium paid under this policy is eligible for tax benefits under section 80C & vesting benefit as applicable under section 10(10A)(iii) of the Income Tax Act, 1961. Tax benefits applicable are subject to prevailing tax laws.

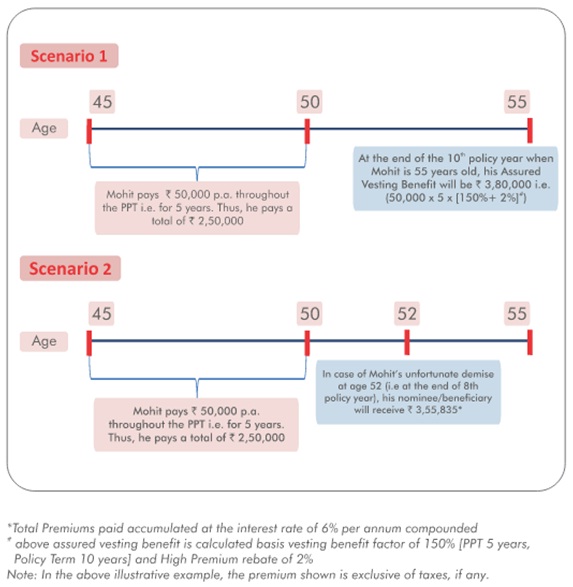

Rajesh at 45 years looking to buy a plan that accumulates a retirement corpus, which enables him to receive income for lifetime. He thus buys SUD Life Guaranteed Pension Plan with a policy term of 10 years and premium paying term of 5 years with the annualized premium of Rs 50,000.

Scenario 1: On Survival of Rajesh till Maturity

In case of survival of Rajesh, Assured vesting benefit i.e., Rs 3,80,000 is payable. This payout can be utilized as Commutation to the extent allowed and use the remaining amount for buying an immediate annuity product or Utilize the entire proceeds to purchase a single premium deferred pension/immediate annuity plan.

Scenario 2: On demise of Rajesh within the policy term

In case of demise of Rajesh at age 52 years, Assured death benefit i.e., Rs 3,55,835 is payable to the nominee/beneficiary.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing