SUD Life AASHIRWAAD is a non-linked & non-participating Plan, which ensures that your child’s dreams are not compromised, even in your absence. This plan is flexible enough to keep pace with your child’s ever changing dreams and they don’t need to give up on their dreams. It secures your children’s future against all financial uncertainties.

Get QuotesIn the event of unfortunate death of the life insured during the policy term, the nominee or beneficiary will receive Death Sum Assured immediately on death. Guaranteed Additions as 4% of Basic Sum Assured * Policy Term is payable as a lump sum at the end of the policy term. Guaranteed Maturity Sum Assured is also payable to the nominee/beneficiary, depending on the Payout Option chosen by the life insured.

Death Sum Assured payable is higher of 10 times the Annualized Premium or 105% of all the premiums paid till the date of death or Guaranteed Maturity Benefit (Basic Sum Assured + Guaranteed Additions), or Absolute amount assured to be paid on death (Basic Sum Assured).

On survival of the life insured till maturity of the policy, he/she will receive Guaranteed Maturity Benefit which consists of Guaranteed Additions and Guaranteed Maturity Sum Assured.

There are 5 maturity payout options. It is expressed as a percentage of Basic Sum Assured.

Self Starter: 100% at the end of the policy term.

Professional: 50% at the end of the policy term and 53% at 1 year after end of the policy term.

Foundation: 33% at the end of the policy term, 35% at 1 year after end of the policy term and 38% at 2 years after end of the policy term.

Technical: 20% at the end of the policy term, 25% at 1 year after end of the policy term, 30% at 2 years after end of the policy term and 35% at 3 years after end of the policy term.

Career Builder: 20% at the end of the policy term, 21% at 1 year after end of the policy term, 23% at 2 years after end of the policy term, 24% at 3 years after end of the policy term and 25% at 4 years after end of the policy term.

In addition, Guaranteed Additions equal to 4% of Basic Sum Assured * Policy Term is also payable in a lump sum at maturity of the Policy.

In case, the Life Insured wants to receive the future outstanding benefits as lump sum benefit at any time during the payout period, discounted value of the remaining outstanding benefits will be paid and the policy terminates immediately. The lump sum benefit is calculated by discounting the future outstanding benefit at interest rate of 5.75% p.a.

In case of demise of the life insured during the payout period, the payout will continue to be paid to the beneficiary. Beneficiary can exercise an option to receive th discounted value of future outstanding benefits in lump sum.

No bonuses can be availed, as it is a non-participating insurance plan.

Loan amount can be availed up to a maximum of 50% of the acquired surrender value.

The Surrender Value payable is higher of Special Surrender Value and Guaranteed Surrender Value. The Surrender Value can be acquired on payment of at least 2 full policy years premium, when the premium payment term is 5/7 years. In case, the premium payment term is 10/15 years, the Surrender Value can be acquired on payment of at least 3 full policy years premium.

You can avail tax benefits under section 80C & 10 (10D) of the Income Tax Act. Tax benefits are applicable, as per the prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 50 Years |

| Age at Maturity | - | 70 Years |

| Policy Tenure | 10 Years | 20 Years |

| Premium Paying Term (PPT) | 5/7/10 Years | 15 Years |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Basic Sum Assured | Rs 4 Lacs | Rs 100 Crores |

| Freelook Period | 30 Days | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted, on payment of additional rider premium.

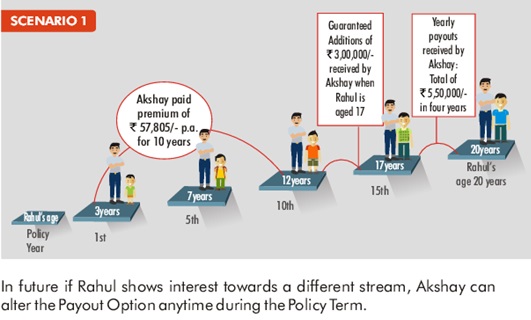

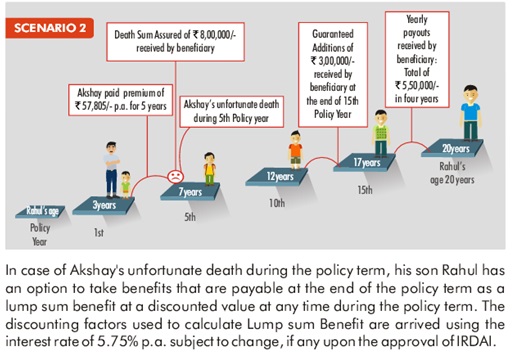

Akshay aged at 35 years, opts to buy SUD Life AASHIRWAAD to secure his son, Rahul’s future educational needs. Akshay purchases this plan with the policy term of 15 years, premium payment term of 10 years, annual premium of Rs 57,385 and the basic sum assured is Rs 5,00,000. He chooses technical maturity option under the policy.

Scenario 1: Akshay Survives the Policy Term

On survival of the life insured till maturity of the policy, 20% at the end of the policy term, 25% at 1 year after end of the policy term, 30% at 2 years after end of the policy term and 35% at 3 years after end of the policy term. A total of Rs 5,50,000 is payable in four years. In addition, Guaranteed Additions of Rs 3,00,000 received by Akshay when Rahul is aged 17.

Scenario 2: Akshay dies during the Term of the Policy

In the event of unfortunate death of the life insured during the policy term, the nominee or beneficiary will receive Death Sum Assured immediately on death. Guaranteed Additions plus Guaranteed Maturity Sum Assured is also payable to the nominee/beneficiary.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing