Pramerica Life e-Save Plan is a non-participating endowment insurance plan that offers guaranteed maturity and death benefit. This plan helps build wealth, so you can meet financial obligations for key milestones such as child’s higher education & marriage, retirement, etc.

Get QuoteDeath Benefit

In the event of death of the insured during the policy term, Death Sum Assured plus Accrued Annual Guaranteed Additions is payable. If the age at entry is less than 45 years, the Death Sum Assured is higher of 10 times of Annualized Premium or Base Sum Assured. If the age at entry is 45 years or more, the Death Sum Assured is higher of 7 times of Annualized Premium or Base Sum Assured

The Death Sum Assured is subject to a minimum of 105% of all the premiums paid.

Maturity Benefit

On survival of the life Insured till the end of the policy term, Base Sum Assured along with the Accrued Annual Guaranteed Additions is payable.

Annual Guaranteed Additions

Annual Guaranteed Addition is a percent of cumulative Annualized Premium. Annual Guaranteed Additions rate is 7%, 8%, 9% or 10%, depends on the Premium band opted.

Loan Benefit

Loan is available up to 80% of the Surrender Value for Pramerica Life e-Save Plan.

Surrender Value

Surrender Value is higher of Special Surrender Value or Guaranteed Surrender Value. Surrender Value can be acquired on payment of all premiums for at least two consecutive policy years.

Tax Benefit

This policy provides tax benefits under section 80C & 10(10D) of the Income Tax Act, subject to prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 55 Years (policy Term 10 Years), 50 Years (policy Term 15 Years), 45 Years (policy Term 20 Years) |

| Age at Maturity | - | 65 Years |

| Policy Tenure | 10/15 Years | 20 Years |

| Premium Paying Term | Equal To Policy Tenure | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Rs 20,000 | No Limit (subject To Underwriting) |

| Sum Assured | Depends On Age At Entry, Annualized Premium And Policy Term Opted | No Limit (subject To Underwriting) |

| Freelook Period | 30 Days From The Receipt Of The Policy | - |

| Grace Period | 30 Days | - |

| Plan Type | Online | - |

No riders can be attached to this plan.

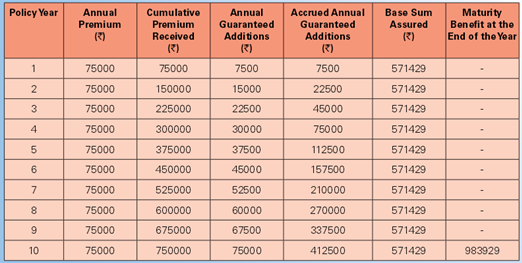

Raman at 35 years, opts for Pramerica Life e-Save Plan with the policy term of 10 years, annual premium of Rs 75,000. Annual Guaranteed Additions is 10% on cumulative Premiums paid.

Scenario A: Raman Survives the Policy Term

If Mr. Raman survives till the maturity of the policy term, he receives a lump sum amount as a Base Sum Assured opted along with the Accrued Annual Guaranteed Additions. The maturity amount helps fulfill your financial objectives.

Scenario B: Raman dies during the Term of the Policy

In the event of demise of Mr. Raman during any policy year, the nominee will receive Death Sum Assured plus Accrued Annual Guaranteed Additions. This payout provides financial cover for the family.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing