MetLife Easy Super is a unit linked life insurance plan that helps you create wealth, so that you can give wings to your family’s dreams. This plan not only helps you meet long term financial goals, it also provides the life cover and thus, protects the future of your family.

Investment cum protection plan

Affordable annual premiums

Manage investment risk with auto rebalancing option

Choose from 6 Self Managed investment funds

Ease of liquidity

Enjoy switching/premium redirection benefit

Avail tax benefits

Metlife Smart One offers 2 investment strategies to manage funds:

1. Self Managed Option

The insured has an option to invest in one of the following investment funds:

You can also choose Systematic Transfer Option under self managed option which will allow you take the benefit of the market volatility by taking advantage of the rises and fall in the market with the benefit of rupee cost averaging.

2. Auto Rebalancing Option

This option is appropriate for the customers who don’t want to manage their investment portfolio directly or regularly. Under this option, the customer may choose between the 2 funds which are Flexi Cap Fund and Protector ll Fund. In case of extreme market movements,the mix of both the funds is automatically rebalanced as per the ratio chosen between the funds at the time of taking the policy.

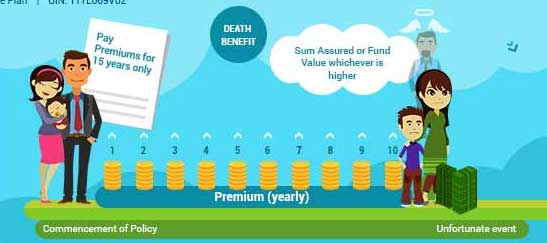

Death Benefit

In case of demise of the insured prior to the date of maturity, the nominee will receive the death benefit.

Maturity Benefit

The fund value is payable at the date of the maturity. If you wish to defer your maturity proceeds, you may choose to do so with the Settlement Option.

Settlement Option

On the date of maturity, you can choose the settlement options for receiving the maturity benefit.

Partial Withdrawal

Partial withdrawal under this policy is allowed after 5 policy years and one partial withdrawal during a policy year is free of charge. The minimum amount for partial withdrawal is Rs 5,000 and the remaining amount after any withdrawal should be the sum of 120% of annualized base premium plus premium discontinuance charges (as applicable).

Switching

Up to 4 partially or fully switching between the unit linked funds during a policy year is available free of charge. The minimum value of every switching should be Rs 5,000. Switching when made online is free of charge for any number of switches.

Premium Redirection

Premium redirection can be used to alter the allocation of future premiums and the proportion for any chosen fund should be the minimum of 20%.Premium redirection can be exercised once during a policy year, free of charge. Any subsequent change in premium allocation is considered as miscellaneous charges.

Revival Benefit

Option to revive the policy can be exercised within a period of 2 years (before the first five policy years) from the date of premium discontinuance.

Loan Benefit

No loan benefit is applicable under this plan.

Surrender Value

Total fund value is payable after the deduction of the applicable surrender charges.The surrender can be done after a lock in period of 5 years from the date of policy inception.Refer brochure for more details.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 60 Years (15 year policy term), 55 Years (20 year policy term) |

| Age at Maturity | - | 75 Years |

| Policy Tenure | 15 Years | 20 Years |

| Premium Paying Term | Equal to the Policy Term | - |

| Premium Paying Mode | Annually Only | - |

| Annualized Premium | Rs 12,000 | Rs 1,20,000 |

| Sum Assured | 10 times of the annualized premium | - |

| Freelook Period | 15 days from the receipt of the policy | - |

| Grace Period | 30 days | - |

| Plan Type | Offline | - |

No riders are applicable under this plan.

Premium Allocation Charges: Premium allocation charge is 9.15% of the premium amount for the 1st policy year, 6.90% for 2nd to 5th policy year, 5% from 6th policy year onwards.

Policy Administration Charge: No such charge is applicable.

Mortality Charge: Mortality charge depends on the age of the insured person, gender, and the sum assured chosen.

Fund Management Charges: 1% per annum for Preserver II and Protector II fund, 1.15% per annum for Balancer II fund, 1.25% per annum for Flexi Cap, Virtue II, and Multiplier II fund, 0.50% per annum for discontinued fund.

Premium Discontinuance Charges: Premium discontinuance charges are applicable depending on the annual premium and the policy year in which you discontinued the policy.

Switching Charges: A charge of Rs 250 is levied upon each switching after 4 free switches in a policy year. These charges are deducted by cancelling the number of units available in the fund. No charges when switching is done online.

Partial Withdrawal Charges: Rs 250 is charged after one free partial withdrawal during a policy year. These charges are deducted by cancellation of the number of units.

Miscellaneous Charges: Rs 250 is charged towards premium redirection, reinstatement of the policy, change in base sum assured, or additional service requests.

Tax benefits are applicable under section 80C & 10 (10D) of the Income Tax Act, 1961 and are subject to prevailing tax laws.

Let us understand the plan with the help of Raman’s example.

Raman at 35 years of age, wants to grow his wealth plus ensure protection for his family. He wants to fulfill his family’s dreams and thus, he thus opts for MetLife Easy Super by paying premiums for 15 years.

Scenario 1: Raman Survives the Policy Term

In case of survival of Mr. Raman till the end of the policy term, the fund value is payable at the maturity of the policy. Raman may exercise one of the settlement options to receive the maturity benefits under the policy.

Scenario 2: Raman dies during the Policy Term

In the event of unfortunate demise of Raman during the 10th policy year, the death benefit payable is higher of fund value, 105% of the total premiums paid, or sum assured. The death benefit provides financial protection for the family, in case of the insured’s death.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing