MetLife Endowment Savings Plan is a non-linked, participating endowment plan that helps you meet various long term financial goals at an affordable premiums. This plan also provides the life cover, so that your family is financially secured, even when you are not around.

Long term savings plan

Maturity benefits with accrued bonuses

Get the death cover throughout the policy term

Flexible policy tenure to opt from

Flexibility to choose premium payment term

Avail tax benefits

Death Benefit

In case of death of the life insured, the death benefit payable is higher of death sum assured plus accrued simple reversionary bonus plus terminal bonus or 105% of the premiums paid. Death Sum Assured is higher of base sum assured or 10 times of the annualized premium.

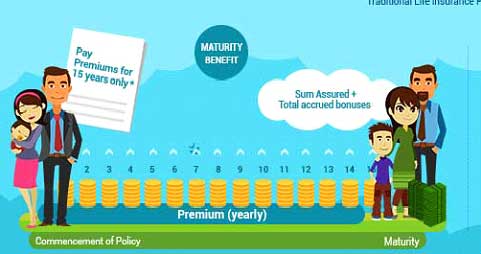

Maturity Benefit

If the insured survives till the end of the policy term, sum assured plus accrued simple reversionary bonus plus terminal bonus is payable.

Bonus

Simple Reversionary Bonus is declared from the 3rd year onwards and it is payable on death/surrender/maturity of the policy, whichever is earlier. Simple Reversionary Bonus is a percentage of the sum assured.

Terminal bonus is declared from 5th year onwards and it is payable along with maturity or death benefit. Terminal bonus is a percentage of the accrued simple reversionary bonus.

Loan Benefit

The plan offers a loan facility which is 90%of the special surrender value of the policy at the end of the relevant policy year less any unpaid premiums for that year.

Revival Benefit

A lapsed policy can be revived upon written request, produces evidence of insurability and on payment of all overdue premiums within 2 years from the date of first unpaid premium.

Surrender Value

Surrender value is the higher of guaranteed surrender value or special surrender value. Surrender value can be acquired on payment of all due premiums for at least 3 policy years (2 years for limited pay of 5 years).

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 20 Years | 60 Years (regular pay & 10 years limited pay), 54 Years (limited pay 5 years option) |

| Age at Maturity | - | 75 Years |

| Policy Tenure | 10 Years (regular pay & 5 years limited pay), 15 Years (10 years limited pay) | 30 Years (regular pay), 25 Years (10 years limited pay), 20 Years (5 years limited pay) |

| Premium Paying Term | Same as policy term, 5 years or 10 years Limited Pay | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly, & Monthly | - |

| Sum Assured | Rs 1.64 Lacs (5 years limited pay), Rs 2.57 Lacs (10 years limited pay), Rs 1.45 Lacs (regular pay) | - |

| Freelook Period | 15 days from the receipt of the policy | - |

| Grace Period | 30 days (15 days for monthly mode) | - |

| Plan Type | Offline | - |

No riders can be availed under this plan.

This policy provides tax benefits for the premiums paid under section 80C and maturity, surrender, or death benefit under section 10 (10D) of the Income Tax Act, subject to amendments in tax laws.

Let us understand the plan with the help of Raman’s example.

Mr. Raman opts to buy MetLife Endowment Savings Plan for base sum assured of Rs 5 Lacs with policy tenure of 15 years.

Scenario 1: Raman Survives the Policy Term

If Mr. Raman survives till maturity of the policy, he will receive the base sum assured which is Rs 5 Lacs plus accrued bonuses till maturity.

Scenario 2: Raman dies during the Policy Term

If Raman dies in the 11th policy year ,Raman’s nominee will receive a lump sum benefit of Rs 5 Lacs plus the accrued bonus till the date of death and the policy terminates.