Accelerated critical illness offers a lump sum payout in case the insured is being diagnosed with the specified critical illnesses listed. There are 40 critical illnesses that are covered under this insurance cover. This benefit can be attached to Max Life Online Term Plus or Smart Term Plan.

Get QuotesAccelerated Benefit payable on diagnosis of any of the specified Critical Illness during the policy term, provided the policy is in-force. This feature will cease after payment of claim and the base policy will continue with reduced premium i.e premium for the base plan. The benefit is payable, on first occurrence of any of the covered 40 illnesses. Only 1 claim will be paid for CI during the policy term.

The CI benefit is accelerated and not an additional benefit which means the policy will continue with the death benefit reduced by the extent of CI benefit paid. Premium payment on account of CI benefit will cease after payout of CI benefit and future premiums payable under the policy for death benefit will reduce proportionately by the extent of premium paid towards CI benefit. Base policy will continue with reduced sum assured and premium. The reduction in premium will be basis the following formula:-

Base Plan Premium X Critical Illness Sum Assured Paid/Base Plan Sum Assured (inception)

Waiting period is defined as the period of 90 days after the date of commencement of risk or date of reinstatement, whichever is later, wherein no benefit shall be paid if the critical illness is diagnosed.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 60 Years – Regular Pay Option 50 Years – Pay Till 60 Option |

| Age at Maturity | - | 75 Years |

| Rider Term | 10 Years | 40 Years (Rider Term Will Be Equal To Base Plan Premium Payment Term Subject To Minimum And Maximum Limits Defined) |

| Premium Paying Term | Same As Base Policy Term | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly (as Chosen Under Base Plan) | - |

| Sum Insured | Rs 5 Lakh | Up To 50% Of Sum Assured Or Rs. 50 Lac, Whichever Is Lower ( In The Interval Of 5 Lakhs) |

The tax benefit is payable under section 80D for the premium paid towards availing critical illness benefit.

This benefit can be attached to Max Life Online Term Plan Plus or Smart Term Plan.

Let us understand it with the example of Mr. Gupta.

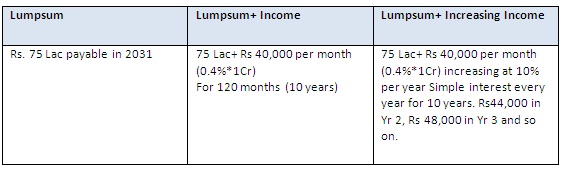

Mr Gupta, 35 years old, buys Max life Online term Plan Plus (M) in Jan 2017 for Rs. 1 Cr Sum Assured (original sum assured) with 30 years term with CI option of Rs. 25 Lacs amounting to Rs. X annual premium. In 2020, Mr Gupta suffers a critical illness due to which a CI claim of Rs 25 Lacs is paid to him. For the balance 27 years, Mr Gupta will have total cover of 75 Lacs (towards death benefit) and his premium will reduce accordingly (by the extent of premium paid towards CI benefit). Mr. Gupta dies in 2031.The Death Benefit under various options will be paid out as shown below

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing