Kotak Premier Life Plan is a non-linked participating, limited premium paying whole life plan that offers life protection till 99 years of age. This plan also provides bonus payouts after completion of premium payment term. This life insurance plan helps grow your savings that can further be utilized to meet financial obligations or create a retirement corpus.

Get QuotesIn the event of death of the life insured during the premium payment term, Sum Assured on death plus Accrued Simple Reversionary Bonuses plus Terminal bonus is payable to the nominee. In the event of death of the life insured after the premium payment term & during the policy term, Sum Assured on death plus Accrued Paid-Up Additions plus Terminal bonus is payable to the nominee.

Sum Assured on death is higher of Sum Assured on maturity, 11 times of Annualized Premium, or 105% of the premiums paid.

The life insured can get the Survival Benefit as Cash Payout or Paid-Up Additions, as per the option chosen. This option can also be altered by giving a written request within three months before end of premium payment term.

On survival of the life Insured till the end of the policy term, Sum Assured on maturity plus Cash Bonus plus Accrued Paid-Up Additions plus Terminal bonus is payable.

Simple Reversionary Bonus is a percentage of the Sum Assured on maturity and it is declared regularly at the end of each financial year during the premium payment term. These bonuses are vested from the first policy year till end of premium payment term.

Cash Bonus is declared at the end of each financial year after the premium payment term. It is payable till maturity, death, or surrender whichever is earlier.

Interim Bonus on Sum Assured on maturity and accrued Paid-Up Additions (if applicable) may be payable at a rate as decided by the company.

Terminal Bonus is expressed as a percentage of the Sum Assured on maturity and it is payable, in the event of death after 10 policy years. It is also payable on Maturity.

The loan amount that can be availed is 80% of the Surrender Value, subject to the minimum loan amount of Rs 10,000.

In case of policies with premium paying term of less than 10 years, the Surrender Value is acquired after paying at least two full policy years’ premium. In case of policies with premium paying term of 10 years or more, the Surrender Value is acquired after paying at least three full policy years’ premium. Upon surrendering the policy, a Guaranteed Surrender Value is acquired.

You can avail tax benefits under section 80C & 10 (10D) of the Income Tax Act, subject to change in tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 3 Years | 55 Years (8 Years PPT), 53 Years (12 Years PPT), 50 Years (15 Years PPT), 45 Years (20 Years PPT) |

| Age at Maturity | - | 99 Years |

| Policy Tenure | 99 Years Minus Entry Age | - |

| Premium Paying Term (PPT) | 8/12/15 Years | 20 Years |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Depends On The Basis Of Sum Assured On Maturity, Entry Age, Gender And Premium Payment Term | No Limit (subject To Underwriting) |

| Sum Assured on Maturity | Rs 2 Lacs | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be opted, on payment of additional rider premium.

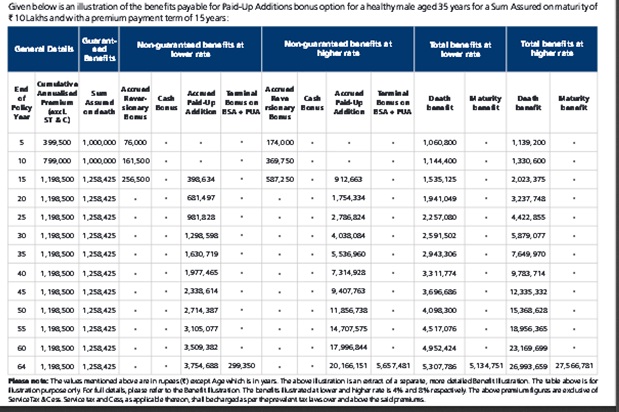

Raman at 35 years, wants to buy Kotak Premier Life Plan to gain control over savings with whole life protection. He opts the plan with the premium paying term of 15 years, Sum Assured on Maturity is Rs 10,00,000.

Scenario A: Raman Survives the Policy Term

If Mr. Raman survives till the maturity of the policy term, he receives Rs 10,00,000 plus Cash Bonus plus Accrued Paid-Up Additions plus Terminal bonus. The maturity benefit helps fulfill your financial objectives.

Scenario B: Raman dies during the Term of the Policy

In the event of demise of Mr. Raman during the premium payment term, the Death Benefit payable is Rs 10,00,000 plus Accrued Simple Reversionary Bonuses plus Terminal bonus. In the event of death of the life insured after the premium payment term & during the policy term, Rs 10,00,000 plus Accrued Paid-Up Additions plus Terminal bonus.

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing