Kotak Gramin Bima Yojana offers you the maturity benefits which are guaranteed along with providing the protection against uncertainties. The plan is a Single Pay plan which makes the plan all the more convenient. This product will address to the needs of rural and social sector customers.

Get QuoteDeath Benefit

In the unfortunate event of the life insured during the policy term, Sum Assured on Death equal to 500% of Single Premium will be payable to the beneficiary.

Maturity Benefit

At the end of the policy term you will receive the Sum Assured on Maturity which is equal to 200% of Single Premium paid.

Bonus

The plan is not eligible for Bonus.

Loan Benefit

No loan facility is available.

Surrender Value

Guaranteed surrender value (GSV) plus the surrender value of the bonuses, which is a percentage of accrued bonuses is payable if at least three full years premiums have been paid. The GSV shall vary as per he year of surrender.

Tax Benefit

The plan offers tax benefits under section 80C and section 10 (10D) of the Income Tax Act, 1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 45 Years |

| Age at Maturity | - | 60 Years |

| Policy Tenure | 15 Years | - |

| Premium Paying Term | Single Pay | - |

| Premium Paying Mode | - | - |

| Premium Amount | Rs 1,500 | Rs 20,000 |

| Sum Assured | - | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

No riders are available with this plan.

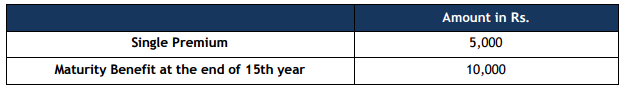

Let us understand the plan with an illustration

Ram Singh wants to invest in a plan that gives him maturity benefit as well as a life insurance cover. He therefore decides to invest Rs. 5000 in Kotak Gramin Bima Yojana, for a term of 15 years. In case of Ram Singh's unfortunate death in the 10th policy year, his family would receive Rs. 25,000

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing