The Kotak assured savings plan offers affordable protection and also helps you save and accumulate wealth for attaining the financial goals of your life. This plan suits the best if someone wants to take an active role in reaching your financial objectives.The plan offers guaranteed benefits with guaranteed yearly additions and maturity benefits.

Get QuoteDeath Benefit

In the event of death of the life insured,the benefits payable to the nominee will be Basic Death Benefit, Plus guaranteed yearly additions accrued as on the date of death.

Death Benefit payable is higher of:

Maturity Benefit

Maturity benefit is payable on the survival of the Life Assured till the completion of the policy term. Guaranteed Maturity benefit is a sum of Basic Sum Assured plus Accrued guaranteed additions plus guaranteed loyalty additions.

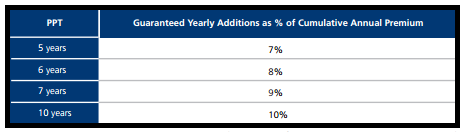

Guaranteed Yearly Additions

Guaranteed Yearly Additions are expressed as a % of Cumulative Annual* Premium paid every year. The benefit will accrue throughout the premium payment term and will be given out in the evnt of Maturity or on Death.The rate of such additions is based on the opted premium payment term, which is as follows:

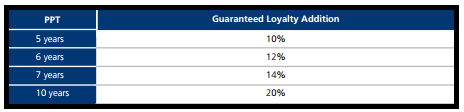

Guaranteed Loyalty Additions

Guaranteed Loyalty Addition will be calculated as a % of Basic Sum Assured and be paid out at Maturity. The rate of such addition will be based on the opted premium payment term, which is as follows:

Loan Benefit

Loan facility is available under this plan. The policyholder can avail loan up to 50% of the Surrender Value subject to the minimum loan amount of Rs 10,000 and as per applicable terms and conditions.

Surrender Value

Guaranteed surrender value (GSV) plus the surrender value of the bonuses, which is a percentage of total premiums paid. For policies with premium payment term of less than 10 years, the policy acquires surrender value after full payment of due premiums for two policy years and for policies with premium payment term of 10 years, the policy acquires surrender value after full payment of due premiums for three policy years.

Tax Benefit

The plan provides tax benefits under section 80C and section 10 (10D) of the Income Tax Act, 1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 3 Years | 60 Years |

| Age at Maturity | 18 Years | 75 Years |

| Policy Tenure | 10 Years | 20 Years |

| Premium Paying Term | 5 Pay – For 10/15 Year Policy Term 6 Pay – For 12/18 Year Policy Term 7 Pay – For 14/20 Year Policy Term 10 Pay – For 15/20 Year Policy Term | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly And Monthly | - |

| Premium Amount | Rs 20,000 | No Limit (subj To Underwriting) |

| Sum Assured | - | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

Following riders can be taken to enhance the policy coverage:

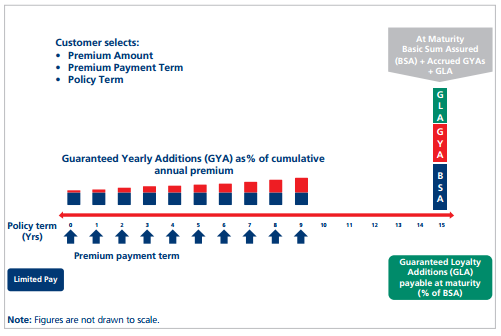

Let us understand the plan with an illustration

You pay premiums every year for selected premium payment term. After expiry of premium payment term, the policy continues till maturity. At maturity, you will receive Guaranteed Maturity Benefit i.e. Sum of Basic Sum Assured (BSA), Accrued Guaranteed Yearly Additions (GYA) and Guaranteed Loyalty Addition (GLA). Basic Sum Assured (BSA) will be based on the Premium, Policy Term, Premium Payment Term and Age of the Life Insured.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing