Being diagnosed with cancer is the worst news anyone could hear. With changing lifestyles and surroundings, the probability or risk of getting cancer is higher.The treatment of cancer puts a major blow on your financial set up. The financial burden can be eased out with Future Genrali’s Cancer Protect Plan, which offers benefits for multiple stages of cancer.

Get QuotePolicy Benefits

The Plan offers 2 Plan Variants

Option 1: Lump sum Cover

Option 2: Lump sum Cover with Income Benefits

Lump sum Benefit

Waiver of Premium Benefit

The premiums are waived off for next three years or till the end of the policy term, whichever is earlier.

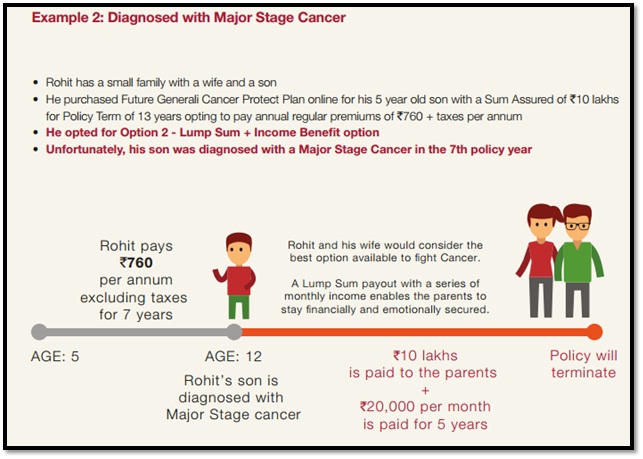

Income Benefit

Income of 2% of the cover amount (Sum Assured) per month for a period of 60 months on diagnosis of Major Stage Cancer.This benefit is exclusively available with option 2 plan variant only.

Death Benefit

There is no death benefit payable under this plan.

Maturity Benefit

There is no maturity benefit payable under this plan.

Surrender Benefit

The policy acquires a Surrender Value immediately only in case of single premium.The surrender value depends on the year of surrender.

How the Plan Works?

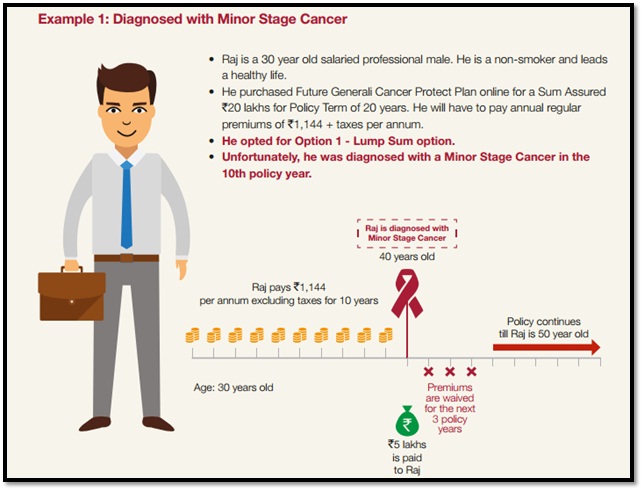

Let us understand the plan with the example of Mr. Raj

Life Insured: Mr. Bajaj

Age: 30 years

Term: 20 years

Sum Insured: Rs 20 lakh

Annual Premium: Rs 1,144 plus taxes

Value Added Benefits

Sub Limits

Waiting Period Clause

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years- For Major Life 1 Year- For Minor Life | 65 Years – For Major Life 17 Years- For Minor Life |

| Sum Assured | 10 Lacs - For Major Life 10 Lacs –For Minor Life | 40 Lacs - For Major Life 10 Lac- For Minor Life |

| Cover Type | Individual | - |

| Policy Tenure | 5 Years- Or Single Pay 10/15/20 Years- For Regular Pay | 80 Years Minus Age At Entry –Regular Pay |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Riders | Nil | - |

| Plan Type | Online | - |

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing