Exide Life Jeevan Uday is a non-linked participating life insurance plan that helps you realize your dreams with a disciplined approach to savings. This plan thus ensures a happier future of you & your family. Your family is also financially secured, in case you are not there.

Get QuoteDeath Benefit

Sum assured on death plus simple reversionary bonus plus terminal bonus is payable. Here, Sum assured on death is higher of sum assured on maturity or multiple of annualized premium. Multiple of annualized premium is 10 times or 7 times of annualized premium, when age of entry is less than 45 years or age of entry is 45 years or more, respectively.

The death benefit, not in any case, is less than 105% of the total premiums paid (as on the date of death).

With extended life cover, if you have paid 1 full years’ premium and further premiums are not paid, the life cover still continues for 1 year following the date of first unpaid premium due date. In case of death of the life insured during the extended life cover period, full life cover would be payable.

Maturity Benefit

Sum assured on maturity plus simple reversionary bonus plus terminal bonus is payable as maturity benefit, subject to a minimum of 101% of the base premium payable.

Bonus

Simple reversionary bonus is declared as a percentage of sum assured on maturity and it is payable at maturity or death, whichever occurs earlier.

Terminal bonus is declared from 10th policy year onwards and it is payable at maturity or death.

Loan Benefit

Loan can be availed up to 90% of the available surrender value under the policy.

Surrender Value

Surrender value is higher of guaranteed surrender value or special surrender value, after deducting the loan amount (if any). Under this policy, surrender value can be acquired on payment of all the due premiums for one full policy year and it is payable at the end of the 2nd policy year or payable immediately on surrender, whichever occurs later. Policy will terminate on payment of the surrender value.

Tax Benefit

Under this policy, premiums paid get the tax benefit u/s 80C and maturity proceeds is also eligible for tax benefit u/s 10 (10D) of the Income Tax Act.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 0 Year | 55 Years |

| Age at Maturity | 18 Years | 70 Years |

| Policy Tenure | 10/15 Years | 20 Years |

| Premium Paying Term | 10 Years | - |

| Premium Paying Mode | Annually & Semi Annually | - |

| Premium Amount | Rs 6,000 (Annually), Rs 4000 (Semi Annually) | Rs 9,600 (Annually), Rs 4800 (Semi Annually) |

| Sum Assured | Rs 42,000 | No Limit (subject To Underwriting) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days | - |

| Plan Type | Offline | - |

No rider(s) is available under this plan.

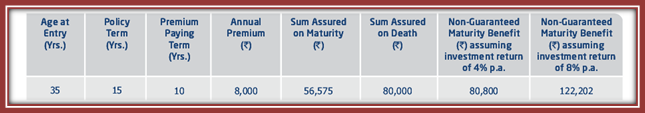

Ramesh, 35 years of age, living with his wife and 3 years old daughter, is looking to get the systematic savings and ensure the family’s happiness in future. He, thus opts for Exide Life Jeevan Uday with policy term of 15 years, annual premium of Rs 8000 for 10 years.

Scenario I: In case of survival of Ramesh, he will receive guaranteed sum assured maturity of Rs 56,575, simple reversionary bonus of Rs 59,404 (@8% investment return) and terminal bonus of Rs 6,223 (@8% investment return).

Scenario II: In the event of death of Ramesh, the policy pays his family the sum assured on death of Rs 80,000 and vested bonus till the date of death.

Please Note: Returns mentioned above are calculated @4% & 8% per annum and these are non-guaranteed. Service tax and education cess is charged in extra, as applicable.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing