Canara HSBC OBC Life Smart Immediate Income Plan is a non-linked & non-participating Immediate Annuity Plan that ensures a regular guaranteed income after the retirement. This plan provides annuity installments for your lifetime, so you don’t have any financial worries and enjoy your post retirement years.

Get QuotesLifetime annuity with Return of 100% of purchase price on death: A regular annuity at a constant rate is payable through the entire life of the annuitant. On death, the annuity payment will cease and the purchase price is payable.

Joint Life, Last survivor with 100% annuity to the secondary annuitant on death of the primary annuitant with Return of 100% of purchase price on the death of the last survivor: The annuity installments are payable at a constant rate till survival of any one of the two annuitants. On the demise of the primary annuitant, surviving annuitant will receive 100% of the annuity installment throughout life. On the demise of the last survivor, 100% of the purchase price is payable.

An Annuity option once chosen at the inception of the policy cannot be altered at a later date.

In the event of the demise of the annuitant (single life) or last survivor (Joint life), the purchase price is payable by the company. Any remaining annuity installments till the date of death is also payable with the Death Benefit.

No maturity benefit is applicable.

No bonus is payable, as it is a non-participating annuity plan.

No loan facility is available under this policy.

No Surrender Value can be acquired under this policy.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 30 Years | No Limit |

| Purchase Price (Single Premium) | Rs 2,00,000 | No Limit |

| Annuity Term | Till The Death Of The Annuitant (single Life) Till The Death Of The Last Survivor (joint Life) | - |

| Annuity Payout Frequency | Annually, Semi Annually, Quarterly & Monthly | - |

| Annual Annuity Installment | Rs 12,300 (Single Life), Rs 13,494 (Joint Life) | - |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | Nil | - |

| Plan Type | Offline | - |

No rider is available for this plan.

This policy provides tax benefits as prescribed under the Income Tax Act, subject to prevailing tax laws.

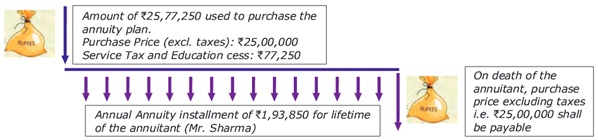

Dhruv Singh, aged at 60 years is seeking for a plan that can ensure immediate annuity guaranteed for life. He thus opts for Canara HSBC OBC Life Smart Immediate Income Plan with ‘Lifetime annuity with Return of 100% of purchase price on death’ annuity option. He purchases an immediate annuity with the single premium of Rs 25,00,000 (excluding taxes).

Scenario A: On survival of Dhruv

Regular annual annuity i.e., Rs 1,93,850 is payable at a uniform rate throughout the life of the annuitant, as long as he is alive.

Scenario B: On demise of Dhruv

On the unfortunate death of Dhruv, the annuity payment will stop and the purchase price i.e., Rs 25,00,000 is payable.

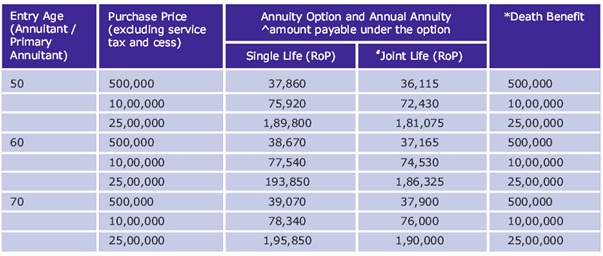

Benefit Illustration:

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing