Bharti Axa Monthly Income Plan+ is a limited pay traditional participating life insurance plan. It offers the monthly advantage to offer you an extra monthly income. The plan helps you to fulfill the desire of your loved ones with an extra income source through this policy. It is an ideal plan for receiving an extra income to meet your family’s needs and goals at different milestones of life.

Get QuoteDeath Benefit

The death benefit is payable if the life insured dies during the term of the policy. The nominee from the next policy month onwards and continues for the next 8, 10 or 15 years,depending on the Policy Term option chosen at the inception of the policy. This payout is made over and above the Monthly Income payouts made before the death of the Life Insured.

|

Policy Term |

Death Benefit Period (in months) |

Death Benefit |

|

15 years |

96 |

165% of Monthly Income for Ages <45 150% of Monthly Income for Ages >=45 |

|

20 years |

120 |

140% of Monthly Income for all Ages |

|

30 years |

180 |

110% of Monthly Income all Ages |

The accrued Non-Guaranteed Annual Reversionary bonuses and Non-Guaranteed Terminal bonus are paid out on death as a lump sum along with the first monthly income Instalment.

Guaranteed Monthly Income

The life insured will start receiving Guaranteed Monthly Income after the completion of the Premium Payment Term, until Maturity, provided the policy is in force. After the completion of the premium payment term, the guaranteed monthly income is paid for 96 months for a 15 year policy term, for 120 months for 20 year policy term and for 180 months for 30 year policy term.

Maturity Benefit

Maturity benefit is payable on the survival of the Life Assured till the completion of the policy term . At Maturity, you receive Non-Guaranteed Annual Reversionary

Bonus

Non-Guaranteed vested simple Reversionary Bonuses and Non-Guaranteed Terminal Bonus is payable under this plan.

Loan Benefit

Loan facility is available under this plan. The maximum loan amount which can be taken under this policy should not exceed 70% of Surrender Value.

Surrender Value

Minimum guaranteed Surrender Value is 30% of all premiums paid till date, less all guaranteed monthly income pasid till date and excluding any extra premium paid.

Tax Benefit

The plan offers tax benefits under section 80C and section 10 (10D) of the Income Tax Act,1961.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 3 Years (for 15 Year Policy Term) 0 Years( For 20/30 Year Policy Term) | 65 Years (for 15 Year Policy Term) 60 Years (for 20 Year Policy Term) 50 Years (for 30 Year Policy Term) |

| Age at Maturity | 18 Years | 80 Years |

| Policy Tenure | 15/20 Years | 30 Years |

| Premium Paying Term | 7, 10 And 15 Years For 15, 20 And 30 Year Policy Term | - |

| Premium Paying Mode | Annually,Semi Annually, Quarterly And Monthly | - |

| Premium Amount | Rs 2,000 ( For 15 Year Policy Term) Rs 1,750 (for 20 Year Policy Term) Rs 750 (for 30 Year Policy Term) | - |

| Sum Assured | Rs 1,92,000 (for 15 Year Policy Term) Rs 2,10,000 (for 20 Year Policy Term) Rs 1,35,000(for 30 Year Policy Term) | No Limit (Subject To Underwriting) |

| Freelook Period | 15 Days/ 30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days & 15 Days (for Monthly Mode) | - |

| Plan Type | Offline | - |

Following rider is available with this plan

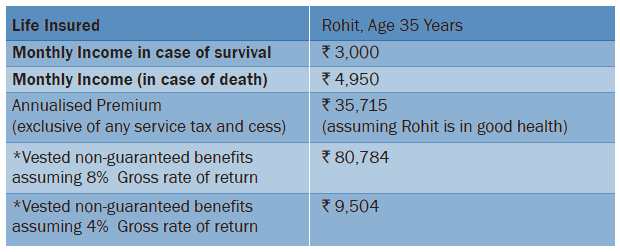

Let us understand the plan with the case study of Rohit

Rohit invest in this plan for a period of 15 years. He wishes to receive Rs 3,000 as Guaranteed Monthly Income. His premium payment term will be 7 years.

Plan Benefits:

1.Rohit starts receiving Guaranteed Monthly Income of Rs 3,000 by the time his son is 8 years old. With this Rohit can ensure that he fulfills the dreams and needs of his growing son.

2. In case something unfortunate happens to him, before Maturity of the policy,he secures his family as they receive Monthly Income of Rs 4,950 until 8 years.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing