Bharti AXA Life Triple Health Insurance Plan is the latest health product which offers you multiple critical illnesses claim up to a maximum of 3 claims. This plan pays you the lumpsum amount equal to the sum assured to help you meet unexpected medical expenses.

Get QuotePolicy Benefits

Lump Sum Benefit

Waiver of Premium Benefit

The future premiums are waived off after the first claim for the remaining policy term.

Death Benefit

There is no death benefit payable under this plan.

Maturity Benefit

There is no maturity benefit payable under this plan.

How the Plan Works?

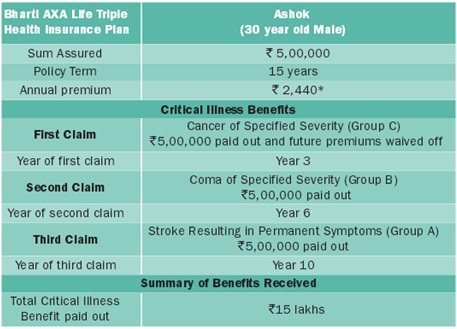

Let us understand the plan with the example of Mr. Ashok:

Life Insured: Mr. Ashok

Age: 30 years

Term: 15 years

Sum Insured: Rs 5 lacs

Annual Premium: Rs 2,440 plus taxes

Value Added Benefits

Sub Limits

Waiting Period Clause

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 65 Years |

| Sum Assured | 2 Lacs | 30 Lacs |

| Cover Type | Individual | - |

| Policy Tenure | 15 Years | 15 Years |

| Grace Period | 30 Days & 15 Days For Monthly Mode | - |

| Freelook Period | 15 Days | - |

| Riders | Bharti AXA Life Hospi Cash Rider | - |

| Plan Type | Offline | - |

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing