Bharti AXA Life Child Advantage is a traditional participating savings plan with an in-built premium waiver benefit. Under this plan, you can avail the flexibility to choose between Money Back or the Endowment Option that helps you fulfill needs and career goals of your child. This child plan offers you guaranteed payouts at key milestones and waives all the future premiums in the event of your unfortunate demise, thus ensuring your child’s dreams are never compromised.

Get QuotesIn the event of death of the life insured during the term of the policy, the death benefit payable is higher of Sum Assured on Death or 105% of all premiums paid.

The Sum Assured on Death is higher of Sum Assured on Maturity, 11 times of Annualized Premium, or Sum Assured. Here, Sum Assured on Maturity is 110% of Sum Assured for Money Back Option or 125% of Sum Assured for Endowment Option.

In case of death of the life insured, all outstanding premiums are waived off and all the benefits under the plan would continue. Under Money Back Option, the Guaranteed Payouts already paid are not deducted from the Death Benefit.

Depending on the Maturity Benefit option chosen, benefits are paid to the life insured provided all due premiums have been paid and the policy is in-force. In the event of death of the life insured during the policy term, this benefit is also payable to the nominee.

Option 1- Money Back Option: 40% of Sum Assured is payable on maturity date of the policy. This option also offers Guaranteed Payouts.

Option 2- Endowment Option: 125% of Sum Assured is payable on maturity date of the policy. No Guaranteed Payouts are payable upon choosing this option.

The money back or endowment option needs to be chosen at the policy inception and it cannot be altered during the policy term.

The Guaranteed Payouts are payable to the life insured or nominee in the event of death of the life insured.

These Guaranteed Payouts are payable as under,

The Company may declare Non-Guaranteed Annual Simple Reversionary Bonus rate at the end of every financial year in accordance with its internal guidelines. It is declared as a percentage of Sum Assured and is calculated at a simple rate of interest. It shall accrue on the Policy Anniversary Date after declaration of any such bonus and will be payable on the maturity date.

Non-Guaranteed Terminal Bonus is payable on the date of maturity of the policy. It is a percentage of accrued Non-Guaranteed Annual Simple Reversionary bonuses.

In the event of surrender of the policy, the Surrender Value calculated on the accrued bonuses will be payable.

No loan benefit can be availed under this policy.

Surrender Value payable is higher of Special Surrender Value or Guaranteed Surrender Value. The policy will acquire a surrender value on payment of at least 2 full policy year’s premium, when premium payment term is less than 10 years and it can be acquired on payment of at least 3 full policy year’s premium, when premium payment term is 10 years or above.

You can avail tax benefits under section 80C & 10 (10D) of the Income Tax Act. Tax benefits are applicable, as per the prevailing tax laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 50 Years (regular Pay), 55 Years ( Limited Pay) |

| Age at Maturity | - | 71 Years (regular Pay), 76 Years ( Limited Pay) |

| Policy Tenure | 11 Years | 21 Years |

| Premium Paying Term (PPT) | Equal To Policy Tenure (regular Pay), Policy Term Minus 5 Years (limited Pay) | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Premium Amount | Depends On The Minimum Sum Assured | - |

| Sum Assured | Rs 25,000 | - |

| Freelook Period | 30 Days (online Policy)/ 15 Days (offline Policy) | - |

| Grace Period | 30 Days | - |

| Plan Type | Online | - |

Follwing riders can be opted, upon payment of additional rider premium.

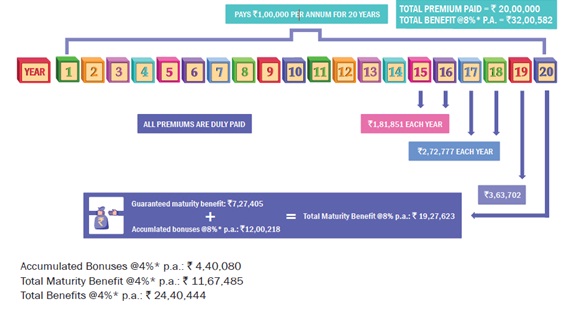

Mr. Karan at 35 years of age, opts to buy Bharti AXA Life Child Advantage (Money Back Option) with the policy term and premium payment term of 20 years, annual premium amount of Rs 1,00,000, and sum assured of Rs 18,18,512.

Scenario A: Karan Survives the Policy Term

40% of Sum Assured is payable on maturity date of the policy plus guaranteed payouts during the last 5 years before the maturity are also payable.

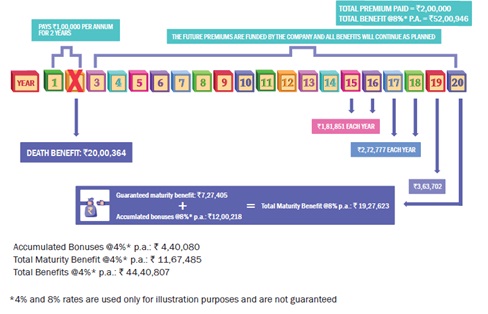

Scenario B: Karan dies during the Term of the Policy

In the event of death of Karan after paying 2 annual premiums, the death benefit payable is higher of Sum Assured on Death or 105% of all premiums paid.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing