We always want to get protection at all stages of our life, but getting the protection for the lifetime is quite precious. Bajaj Allianz Life Secure is a non-linked whole life term plan offering protection for a lifetime. This term insurance plan provides you complete protection till 100th birthday, so you can lead a worry-free life.

Three coverage options to choose from:

Option I - Death Benefit

Option II - Death Benefit plus Accidental Death Benefit

Option III - Death Benefit or Accelerated Critical Illness plus Waiver of Premium Benefit

Get QuotesOn the death of the life insured during the policy term (after receiving critical illness benefit), the insurer pays the remaining sum assured and the policy will terminate.

Avail surrender benefit, provided you have paid first two full years’ premiums if the premium paying term is less than 10 years and first three full years’ premiums if the premium paying term is 10 years or more.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 25 Years | 55 Years |

| Age at Maturity | 28 Years | 65 Years |

| Policy Tenure | 100 Minus Entry Age | - |

| Premium Paying Term | 5, 7, 10 And 15 Years | - |

| Premium Paying Mode | Monthly, Quarterly, Semi Annually & Annually | - |

| Sum Assured | 20 Lakh | No Limit (subject To Underwriting) |

| Maturity Proceeds | Nil | - |

| Riders | Not Available | - |

No rider is available with this plan.

Let us understand the plan with the example of Vishal:

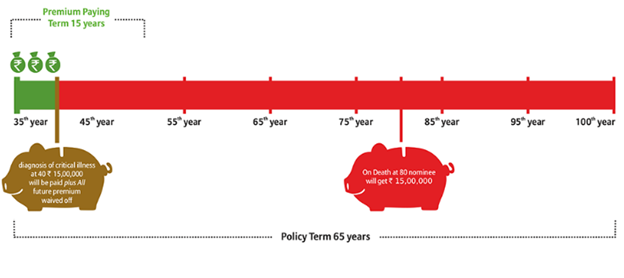

Scenario 1:

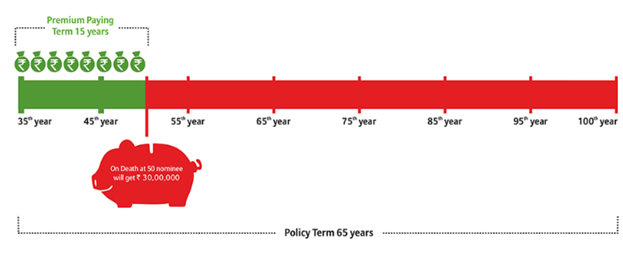

Scenario 2:

Under this plan, the premium payment qualify for tax benefits as per Section 80C of the Income Tax Act and the policy proceeds are also entitled for tax benefits as per Section 10 (10D) of the Income Tax Act.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing