You work hard to give your family the best of life. You always want to give them every possible comfort, but how would you ensure the financial security for your family or loved ones, in the event of a mishap. Aegon Life iTerm plus offers complete financial protection for the family, so their dreams are not compromised, even after your demise. This plan also provides terminal illness & critical illness cover, accident and disability, depending on the plan option you have chosen.

Get QuotesOption 1- Life Option

Under this option, 100% of the Death Benefit Sum Assured as a lump sum is payable on death. An additional 100% of Accidental Death Benefit (ADB) Sum Assured is also payable in a lump sum, on death due to an accident.

Death Benefit + Accidental Death Benefit

Option 2- Life Plus Option

Under this option, a lump sum benefit on death or diagnosis of Terminal Illness (whichever is earlier) is payable to the nominee. An additional 100% of Accidental Death Benefit (ADB) Sum Assured is also payable in a lump sum, on death due to an accident. It also waives off all the future premiums, in case benefit on accidental permanent disability is payable.

Death Benefit + Terminal Illness + Accidental Death Benefit + Waiver of Premium for Accidental Permanent Disability

Option 3- Life & Health Option

Under this option, a lump sum benefit on death or diagnosis of Terminal Illness (whichever is earlier) is payable to the nominee. An additional 100% of the Critical Illness (CI) Sum Assured is payable as a lump sum on diagnosis of any one of the covered 10 Critical Illnesses. All the future premiums are waived off from the date of diagnosis of critical illness.

If any critical illness results in terminal illness, then both the Terminal Illness and Critical Illness benefit is payable.

Death Benefit + Terminal Illness + Critical Illness + Waiver of Premium on Critical Illness

Option 4- Life & Health Plus Option

Under this option, a lump sum benefit on death or diagnosis of Terminal Illness (whichever is earlier) is payable to the nominee. An additional 100% of the Critical Illness (CI) Sum Assured is payable as a lump sum on diagnosis of any one of the covered 36 Critical Illnesses. All the future premiums are waived off from the date of diagnosis of critical illness.

If any critical illness results in terminal illness, then both the Terminal Illness and Critical Illness benefit is payable.

Death Benefit + Terminal Illness + Critical Illness + Waiver of Premium on Critical Illness

Note: The Lump Sum Death Benefit payable to the nominee depends on the policy term chosen and the age at entry of the life assured.

The policyholder has the option to increase the sum assured on happening of any one or all of the following events:

The Lump-sum Sum Assured (SA) will increase by the above mentioned percentages, upon exercising the option. The Policy Premium payable shall be increased by the premium applicable to the Additional Sum Assured.

The option to increase the SA needs to be exercised within 180 days of the happening/incidence of the event(s).

It is a pure protection plan and no maturity benefits are payable if the life insured survives the policy term.

There is no surrender value payable under this policy.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 18 Years | 65 Years |

| Age at Maturity | 65/70/75 Years | 80 Years |

| Policy Tenure | 5 Years | 62 Years |

| Premium Paying Term | Equal To Policy Tenure | - |

| Premium Paying Mode | Annually, Semi Annually & Monthly | - |

| Death Sum Assured | 25 Lacs | No Limit (Subject To Underwriting) |

| Accidental Death Benefit (ADB) Sum Assured | 50,000 | No Limit (Subject To Underwriting) |

| Critical Illness (CI) Sum Assured | 5 Lacs | No Limit (Subject To Underwriting) |

| Freelook Period | 15 Days/30 Days (for Distance Marketing Channel) From The Receipt Of The Policy | - |

| Grace Period | 30 Days (15 Days For Monthly Mode) | - |

| Plan Type | Online | - |

Following riders are available under this plan, depending on the variant opted:

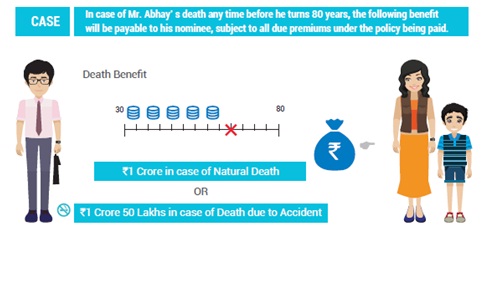

Let’s understand this plan with an example:

Mr. Rajesh (Age 30 years, Non-smoker) opts for Aegon Life iTerm Plus- Life Option. His plan details are:

Benefit Payable

100% of the Death Benefit Sum Assured as a lump sum i.e., Rs 1 Crore is payable on natural death. On death due to an accident, 1 Crore plus an additional 100% of Accidental Death Benefit (ADB) Sum Assured i.e., Rs 50 Lacs is also payable in a lump sum. On accidental death, the total of Rs 1.5 Crore is payable.

Aegon Life iTerm plus is eligible for Tax benefits as stated:

(Subject to the provision stated therein.)

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing