Reliance Nippon Life Child Plan is a non-linked, non-participating child insurance plan that helps secure your child’s future. This plan provides funds for your child and thus ensures much-needed financial security in the future for your child.

Get QuotesIn the event of death of the life insured during the term of the policy, the Sum Assured is payable immediately and all future premiums are waived.

25% of Sum Assured is payable every year on the last four Policy Anniversaries irrespective of the survival of the life insured.

At the end of the policy term irrespective of survival of the life insured, accumulated bonuses are payable.

In case of unfortunate loss of life, your child is completely protected. The Company pays the Sum Assured to the Beneficiary and also waives the entire future premium. Moreover, all the Fixed Benefits are paid as and when due.

Simple reversionary bonus is payable at maturity of the policy.

The maximum loan amount that can be borrowed under this policy is 90% of the surrender value. This facility is available after the premium payment of three full policy years.

This policy acquires a Surrender Value after three years’ premium has been paid. There is a guarantee of minimum Surrender Value of 30% of the total premiums paid following the first year premium, less the total of any periodic lump sum Fixed Benefits already paid.

Premiums paid under this policy and riders opted is eligible for tax benefits. Income Tax benefits under this plan and rider benefits are applicable as per the prevailing Income Tax Laws.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 20 Years | 60 Years |

| Age at Maturity | 25 Years | 70 Years |

| Policy Tenure | 5 Years | 20 Years |

| Premium Paying Term | Equal To Policy Tenure | - |

| Premium Paying Mode | Annually, Semi Annually, Quarterly & Monthly | - |

| Sum Assured | Rs 25,000 | No Limit |

| Freelook Period | 15 Days | - |

| Grace Period | One Month Or 30 Days | - |

| Plan Type | Offline | - |

Following riders can be opted under this plan, on payment of additional rider premium.

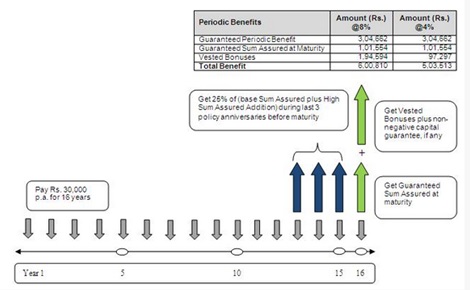

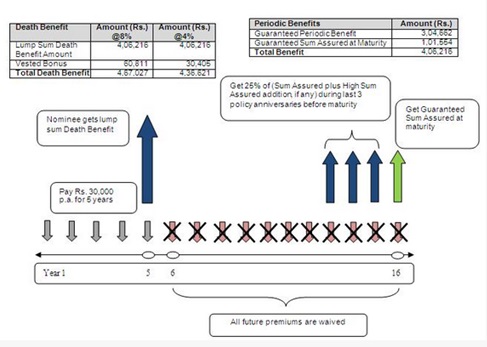

Rajesh at 30 years of age, buys Reliance Nippon Life Child Plan with the policy term of 16 years, annual premium of Rs 30,000 and sum assured of Rs 4,05,405.

Scenario A: Rajesh Survives the Policy Term

In case Rajesh survives till maturity of the policy term, accumulated bonuses are payable. Guaranteed fixed benefit as 25% of Sum Assured is payable every year on the last four Policy Anniversaries. This payout helps fulfill your child’s aspirations.

Scenario B: Rajesh dies during the Term of the Policy

In the event of Rajesh’s death at the end of the 5th policy year, the death benefit is the Sum Assured payable immediately and all future premiums are waived. Guaranteed fixed benefit on specified dates are also payable.

Unbiased information on plans from varied insurance companies

Unbiased information on plans from varied insurance companies

Easy comparisons to choose the best insurance plan

Easy comparisons to choose the best insurance plan

No hidden costs, pay the same premium as offered by the insurer

No hidden costs, pay the same premium as offered by the insurer

Pre and post sales expert assistance for smooth online buying experience

Pre and post sales expert assistance for smooth online buying experience

Reliable, Accurate and Quick policy servicing

Reliable, Accurate and Quick policy servicing