If you want your family to have an income to continue even in your absence, Aegon’s I income is the right plan for you. His plan provides lumpsum pay out on death of the insured plus the regular flow of money as a form of income will keep the family’s financial requirement on track. This plan is now discontinued by Aegon Life.

Get QuotesIn the event of the demise of the life insured, the nominees receive 12 times of the monthly income benefit in the policy year of death will be paid as lump sum immediately.

Monthly income benefit on death will start from the next monthly policy anniversary upto the end of the policy term or for a tenure of 60 months, whichever is later. Also, the monthly income benefit will increase by 5% p.a. on every policy anniversary upto the age of 59 years.

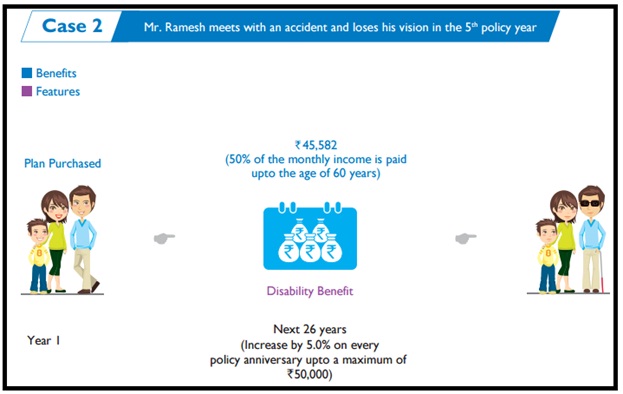

In case of Partial and Permanent Disability due to accident or sickness, all future premiums will be waived off. The monthly income for disability benefit will start from the next monthly policy anniversary upto the maturity of the policy or for a period of 60 months, whichever is later. The monthly income for disability benefit will increase by 5% p.a. on every policy anniversary upto the age of 59 years.

Under this plan, the premium payment is eligible for tax benefits as per Section 80C of the Income Tax Act and the policy proceeds are also entitled to the tax exemptions as per Section 10 (10D) of the Income Tax Act.

| Factor | Minimum | Maximum |

| Age (as on last birthday) | 25 Years | 50 Years |

| Age at Maturity | - | 60 Years |

| Policy Tenure | 60 Years Minus Entry Age | - |

| Premium Paying Term | Same As Policy Term Years | - |

| Premium Paying Mode | Annually,Semi-annually And Monthly | - |

| Monthly Income | 30,000 | No Limit |

| Maturity Benefit | Nil | - |

| Plan Types | Online | - |

This plan offers one rider, which is Aegon Life WoP on CI Joint Life Rider which covers 4 critical illness conditions.

Let us understand the plan with the following example of Mr.Ramesh

Age: 30 years

Profession: Software Engineer

Family Details: His wife is a homemaker and they have a son Amol, who is 3 years old.

Ramesh opted for Aegon Life iIncomeInsurance Plan with Monthly Income Covered for: Rs.75,000, Policy Term: 30 years,Annual Premium: Rs.22,635/- (exclusive of service tax).