Why Health Insurance can’t be ‘optional’ in today’s time?

Why Health Insurance can’t be ‘optional’ in today’s time?

Keeping good health is always imperative. We just cannot afford to lose on our health front as there are so many direct and indirect downsides with it. so we constantly finding new ways to keep up good health. We are getting more and more aware of ways and changes in lifestyles that can help us to lead a healthy life. But due to growing stress and hectic lifestyles, health has taken a step back and we get no time or less time to take care of our health resulting in multiple health issues. Health insurance become a basic need for everyone.

Health issues, when arise, can’t be ignored. They need treatment as soon as possible. But what if you are unable to do so? Many instances have come to light when people are not able to fulfill their healthcare needs. Even those who are doing decently well in their financial life and/or belong to a well-to-do family are unable to take the right steps during emergencies. Some of them do have the resources but immediate need and no planning makes a hole in their pocket. A major reason seen behind these kinds of instances is the lack of financial resources and planning. Health insurance comes in handy during these kinds of situations and helps an individual when medical needs come an instant basis.

So by no means, health insurance is a matter of choice. Let’s find out why health insurance can’t be an option but a necessity in today’s life.

Table Content

Increasing Number of Lifestyle Diseases

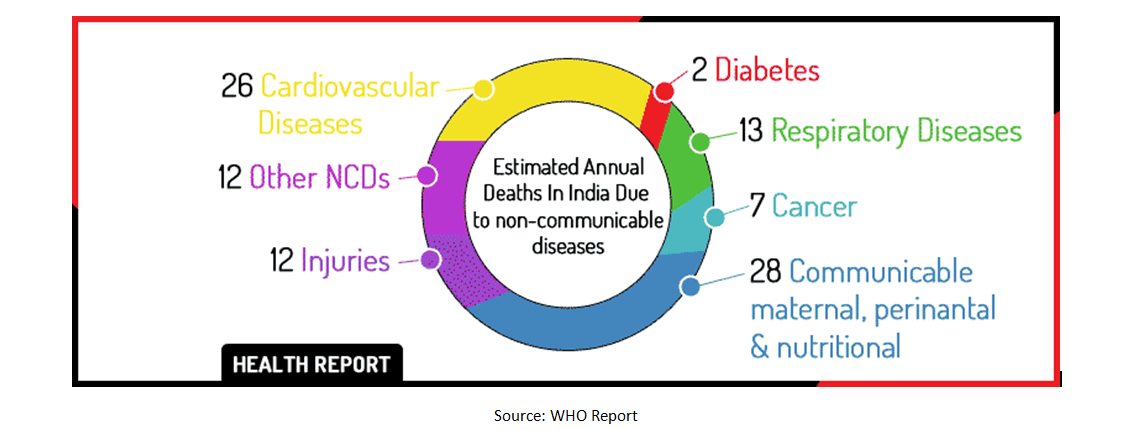

If the report from World Health Organization (WHO) is true, cardiovascular and respiratory disorders are posing a threat to the entire world. These kinds of disorders fall into the category of lifestyle ailments and account for 38 million deaths every year globally, out of which approximately 28 million deaths occur in middle and low-income countries, and that indeed includes India.

The shocking news is, that you don’t have to be 50+ to be a diabetic patient. People under the age of 25 are being diagnosed with this problem. Similarly, cholesterol problems can be seen to the onset of heart diseases. Thanks to the sedentary lifestyle that consists of long sitting hours and no physical endurance.

So, you should not wait for a certain age to approach buying an adequate health insurance policy. In fact, when you buy a health plan at a young age, you are more likely to get better deals and discounts on the premium. Health insurers did not just provide policies but they have wellness and preventive programs too through which they help the policyholders to adopt a healthier lifestyle. So, if you are not able to give some time to yourself and pursue some fitness regime, having a health policy will definitely help you to take care of yourself through their wellness programs.

Expensive Medical Care is a reason for Health Insurance

Health care is getting expensive with each passing day. The cost of treating ailments pertaining to the heart, kidney, and other organs can run into several lakhs. If someone has any critical illness such as cancer or organ transplant, there is just no end to hospital expenses. Neither you can compromise on the quality of treatment nor its efficacy. Moreover, these expenses may only increase in the future. And yes, health adversities do not hit as per the individual’s financial profile.

If you do not have a health insurance policy in place, it can wipe out a large amount of your savings that you had accumulated for years to fulfill your financial goals. Thanks to the advent of private insurance companies in India, the cost of health insurance is getting competitive and efficient.

Let’s assume there is a 30-year-old person who has two children. His annual income is Rs 14 lakh. This makes his monthly income Rs 1.16 lakh. He has been diagnosed with a high coronary heart problem due to the build-up of plaque. He has been asked to get operated on to remove this plaque. But this surgery outrightly costs him around Rs 5 lakhs. If we assume he used to save Rs 30,000 per month, he would have to use his savings of approx. 17 months. If he had a health insurance policy, he could have simply understood his health insurance company and got the expenses reimbursed or could have gone for cashless treatment.

Better Financial Planning With Health Insurance

All insurance plans work as a risk management tool for you. Health insurance provides coverage of risks against possibilities of financial distress during health emergencies. In this way, it safeguards your other investments. You do not have to liquidate other investments in a haphazard manner.

Let’s take a case example here. Mr. Wadhwa is a successful businessman with an annual income of Rs 40 lakh. He has diversified his funds in real estate, mutual funds, equity, bonds, fixed deposits, etc. One day he is diagnosed with a brain tumor.

The doctor asks him to go to the hospital to get treatment immediately and deposit an advance of Rs 4 lakh. Since he does not have that much cash in hand, he will have to disinvest in an unsystematic way and this can also bring him losses. On the other side, Mr. Gupta has an annual income of Rs 20 lakhs. Whether he has a diversified portfolio or not, it doesn’t matter, since he has an individual health insurance policy that covers critical illnesses, he will never have to go through the kind of situation Mr. Wadhwa has. His investments will remain safe during these kinds of exigencies.

Availability of Medical Treatment in a Systematic Way

A health insurance policy also assists you to avail of medical treatment in a planned manner as health insurance companies have a network of hospitals impaneled with them. During an emergency, the policyholder has to simply visit the hospital impaneled with his insurance company, and intimate the insurance company regarding his admission to the hospital. The insurance company gets in touch with the respective hospital and expedites the medical treatment. This brings convenience for the insured as he gets his hospital bills payment by his insurer or reimbursed later.

Tax Benefits -Icing on the Cake

Health insurance covers you against health-related risks and provides additional benefits like tax exemption, which serve as icing on the cake. Premium paid towards health insurance policies of individuals below the age of 65 is eligible for tax deductions up to the limit of Rs 15,000 under section 80D of the Income Tax Act. This exemption increases to Rs 20,000 wef A.Y. 2016-17 annually if the premium is paid towards a health insurance policy with an additional Rs 15,000 for parents. Additional deduction of 20,000/- (Rs. 30000/- wef A.Y. 2016-17) could be availed in the case of a senior citizen. You can claim a separate deduction for the medical premium of your parents. Deduction U/s 80D for Mediclaim Premium is applicable to individuals, HUF, and Senior citizens.

Always remember that insurance is a risk management tool before anything else. However, people have been using it increasingly as a tax-saving instrument. Consequently, they end up procuring health insurance plans, which either over-insure them or do not meet their actual needs. Procuring health insurance without understanding your needs can be detrimental to your financial well-being.

The basic purpose to buy a health insurance plan should be to manage and improve your risk-handling capacity. Therefore, always figure out your needs with due care and conduct some basic online research about various plans before making any decisions.

great and helpful post, as i was looking for an insurance

company, i will keep your advice in mind.