What is a Money Back Insurance Policy?

A variety of benefits in one package is what attracts everyone. If you are paying for a single product and getting the benefit of various products, then it becomes the deal of a lifetime for you. The same goes for the Money-back plan which is one of the most popular products among the middle-income group. It offers a dual benefit of life cover and investment for the policyholder which allows him to get regular periodic income as money back with a life cover during the policy term.

Many people keep looking for an option through which they can get financial protection against life along with a source of income and a money-back plan that fits perfectly into such requirements. A money-back plan gives you survival benefit, maturity benefit, and a death benefit (as per condition) also which makes this plan a complete coverage policy for you. So let us understand about Money back policy through this article, so that you can take advantage of the dual benefit of the Money back plan.

Table Content

Money-back insurance policy

Instead of giving a lump sum amount at the end of the term, a money-back plan gives a percentage of the sum assured to the insurer at a regular interval of time. You can consider a Money back plan as an endowment plan with liquidity benefits. It is best for people who want to maintain liquidity while saving through an insurance plan. This policy allows you to create a long-term saving opportunity with an adequate rate of return, especially since the payout is exempt from tax.

How does it work?

In addition to maturity benefits, a money-back plan offers survival benefits as well as an investment opportunity to the policyholder. So let us understand the working of money-back policy through an example.

Sagar Roy purchased a Money-back insurance policy of 20 years with a sum assured of Rs.2,00,000 for which he has to pay a premium for 15 years. So, if Sagar survives the policy term of 20 years, he will get a portion of the sum assured at the end of 5,10, and 15 years (payout interval varies from plan to plan). At the end of the policy term, Sagar will get the maturity benefit along with the accrued bonus.

But if Sagar dies during the policy term, his beneficiaries will get the sum assured (the amount of which varies from plan to plan) beside the additional sum assured and accrued bonus. Also, the survival benefit paid during the survival of the policyholder during the policy term is not deducted from the amount paid on death. After the death of the policyholder during the policy term, the policy is terminated after paying the sum assured as a death benefit to the nominee.

Features of Money Back Policy

Following are the most important features of a Money back policy:-

- Money-back plans offer the dual benefit of low-risk investment option along with life cover

- Availability of adding useful riders.

- A money-back plan offers you all three benefits, death benefit, survival benefit, and maturity benefit.

- The death benefit paid to the policyholder during the policy term is the entire sum assured and the amount paid in the form of survival benefit is not deducted from it.

- Instead of paying the sum assured as a lump sum, a money-back policy provides a regular source of income for the policyholder in the form of Survival benefit during the policy term.

Benefits of Money Back Policy

A Money back policy comes with various benefits and flexibilities.

So let’s have a look at some of the most highlighted benefits of a Money back policy.

- Gives regular payout throughout the policy term

- Offers life insurance cover during the policy term

- Gives you a long term and low-risk investment option

- Offers a tax benefit

- Allows long term saving and regular income for the policyholder

- Ensures that the amount is paid regularly

- Flexible premium payment options

Riders available with Money Back Policy

You can also extend your cover by adding riders to your Money back policy. These riders come at an additional cost and allow you to be covered for additional possibilities like accidental death, permanent disability, critical illness, etc.

Following are the riders available with a Money back plan:-

Accidental Death Rider: This rider allows the policyholder to be covered for death due to an accident. In case of death due to an accident during the policy term, the family members of the policyholder receive a lump sum amount as an additional benefit. Road accident is a common thing in India, as per fact almost 3.54 lakh people are died by road accident in the year 2020, accidental benefit rider is the basic need and if you are riding your bike whole day then you should opt accidental rider.

Critical Illness Rider: A critical illness rider allows the policyholder to be covered for the financial expenses in the case he contracts any critical illness. Basically, critical illness riders cover critical illness disease but this rider covers a fixed number of critical illness diseases. Critical illness riders mean to you is base plan offers you a wide range of coverage of some of the best benefits that you can utilize in every possible way as you want.

Term Rider: This rider waives off the premium for the policyholder under certain situations while the policy continues.

Hospitalization Rider: If the policyholder gets hospitalized during the policy term, then this rider provides the policyholder with assistance in paying hospital bills. In this era of getting expensive, health care costs, it is essential to have a health insurance plan to shield yourself from the financial burden during hospitalization due to illness or injury.

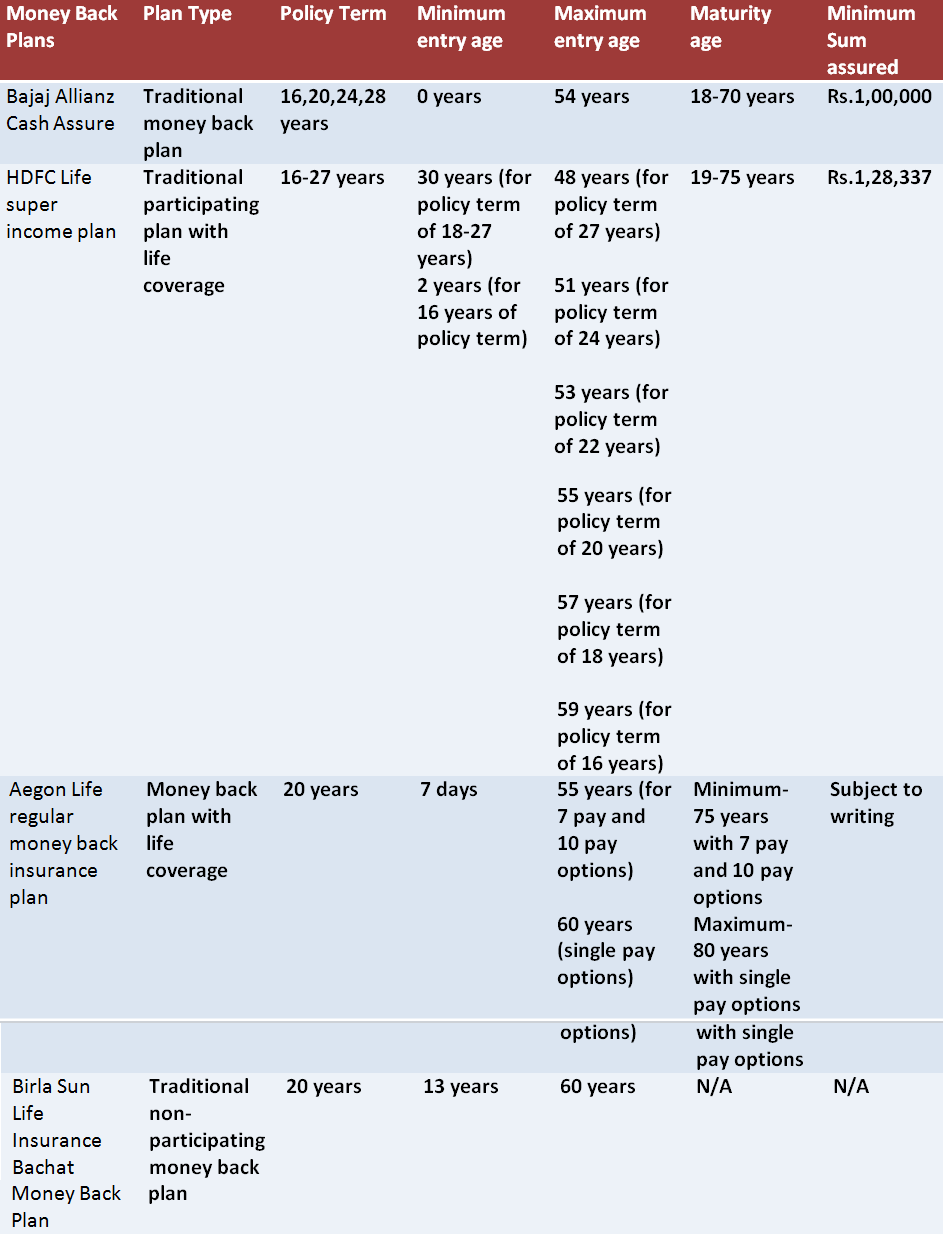

Best Money Back Policies in India

So a Money back policy is suitable for those people who want to avail the dual benefit of insurance and saving in one package. A money-back plan allows you to build a corpus for long-term goals while getting payout at regular intervals of time. Along with survival and maturity benefit, a money-back plan gives you death benefits also. To understand your money-back policy and take advantage of this unique product of insurance.