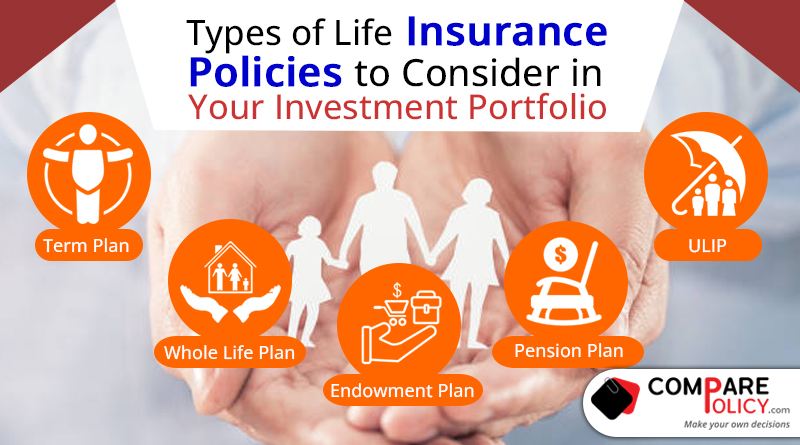

Types Of Life Insurance Policies To Consider In Your Investment Portfolio

Insurance seems to be a complicated financial product to most people as they don’t want to understand the simpler details of it. But in reality, it is one of the most beneficial financial products that anybody can own to safeguard their future from any financial losses. Insurance provides protection against financial losses whether huge or mere. Life insurance is mandatory for every individual especially the bread earner of the family, as any mishap with him or she can cause a great deal of financial as well as other problems to the family. Types of Life Insurance Policies, you should know because every single life insurance policy provides you different kinds of services for different propose.

Table Content

Need for Insurance

Life insurance policies hedge the risk of financial losses due to the demise of the insured person and provide a specific amount (insured amount) to the family after they claim the money. Though money cannot compensate for the loss of the person at least it can help the family to survive the rough days. The way every year new diseases are discovered, it’s necessary for us to have an insurance policy, not only protecting our health but also providing financial support and it’s a matter that we are all worried about.

Insurance policy is basic need for today, and with speed medical are rising it would be a quite hard to get treatment in private hospital. So, if you want to get best treatment then you have money or you have insurance policy, we know the expensive side of private hospitals and doctor’s fee, maybe that’s why you need insurance policy.

Statistics

In India, the insurance penetration rate is near about 3.4% as per the latest report of the IRDAI. It is advised to combine at least 2-3 different types of insurance policies plans together to get the ultimate security and benefit.

Types of Life Insurance Policies in India

Term Plan

It is an insurance plan which provides life coverage for a particular time period and the death benefit is payable to the nominee if the insured person expires within the term of the plan. There is a specific amount of money that is insured under this plan and payable in case of death or other uncertainty of the insured person so that the family can survive without much financial obstacle. It is designed according to the basic financial needs of any family.

The premium of term insurance policies is the lowest amongst all types of life insurance policies because there is no maturity or survival benefit. The entire amount of premium goes into reimbursement of the policy if the insured person expires before the maturity of the policy. Moreover, the premium is lesser because there is no investment component attached to this plan.

- Decreasing term plan: This plan is unique from all the types of life insurance policies as the policy amount or payout amount decreases over the years or on monthly basis. It also provides a death benefit to the insured and his family but the payout amount decreases at a rate that is determined at the beginning of the policy. This insurance plan can help get rid of any loan burden after the demise of the insured person like a home loan.

Whole Life Plan

This is the basic form of a cash-value type of life insurance where an investment component is involved. Whole Life policy offers life coverage till the life insured turns 99 or 100 years of age. The investment component helps in the accumulation of cash flows over years during the period of the plan which can be withdrawn by the insured person or he can also borrow money keeping the insurance policy as a mortgage. The insurance component of the policy helps in mitigating the risk of financial loss from the death or any uncertainty of the insured person.

ULIP

Ulips offer you the dual benefit of life insurance plus investment. Under this plan, the investment steering is in your hands which helps you to decide the type of investment where you want to put in your money for accumulated growth. The investment option can be chosen as per your risk appetite for higher risk-bearing capabilities you may invest in an equity-based fund and for lower risk-bearing capabilities you may choose debt based fund or a combination of both. The investment plan allows you to build a robust corpus to meet your future financial goals along with providing financial protection to your loved ones in case of your unfortunate death during the policy term.

Pension Plan

After retirement to be financially independent, pension plan life insurance can help a lot. It provides steady and regular income flow to the insured and his family after he retires. It is a different type of life insurance that helps the insured live life peacefully and without depending on others’ income after retirement.

Endowment Plan

It is more of a saving instrument along with a life coverage benefit. An endowment plan is for those who want a steady saving which is less risky than other investments but provides assured income generation. The premium amount is lower on this plan but it is the most beneficial if you consider it a safe investment. If the insured person dies within the period of the policy, the nominee gets the insured amount. If the policy matures, the insured gets the sum that was assured along with a bonus (if applicable).

Need for diversification

It is always advised not to keep all the eggs in one basket. If you just have one term insurance you can miss out on the opportunity of saving and have a steady cash flow. To have perfect financial safety, you must diversify your investment in insurance by buying different types of insurance policies.

Conclusion

Insurance not only provides life cover but also regular savings and helps in cash flow generation. A mix of these Compare Insurance Plans can help in optimizing the benefit from individual plans and help in attaining a great deal of financial safety.