Demystifying: Third Party Administrators (TPA’s) in Health Insurance Sector

Health Insurance involves a mechanism that helps people to finance their health care needs. You only need to buy a health insurance policy that provides financial cover against health care costs for you & your family. To manage the health insurance claims in a better manner, the health insurance industry has a concept of Third Party Administrators.

Table Content

- What is a Third Party Administrator?

- How TPA’s Work?

- List of TPA’s licensed by IRDAI

- Benefits of Third Party Administrators

- From Insurer’s Perspective

- 1) Standardizing Treatment Norms & Its Cost

- 2) Reduced claim settlement turn around time

- 3) In-house Expertise

- From Insured’s Perspective

- 1) Services and Consumer Education

- 2) Assistance in Hospitalization & Claims Processing

- Knowledge about Coverage and Exclusions

- Challenges faced by Third Party Administrators

- Conclusion

- Related posts:

What is a Third Party Administrator?

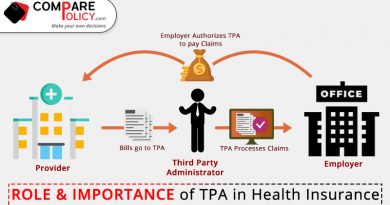

A Third Party Administrator or TPA is a person or organization that helps an insured in processing claims and performs administrative services when it comes to health insurance claims.TPA’s are neither the insured nor the insurer, but handle the administration of the health policy, such as processing, settlement & negotiation of claim applications, record keeping, and maintenance of the plan. TPA’s plays a key role in ensuring better services to policyholders and facilitating them with cashless hospitalization.

Third-Party Administrators provide a broad range of services to the health insurance industry. For some insurers, they help expedite the claims along with convenient customer service that help insurers to keep the policyholders pleased with their serviceability. They also provide billing services, data, and analytics to name a few.

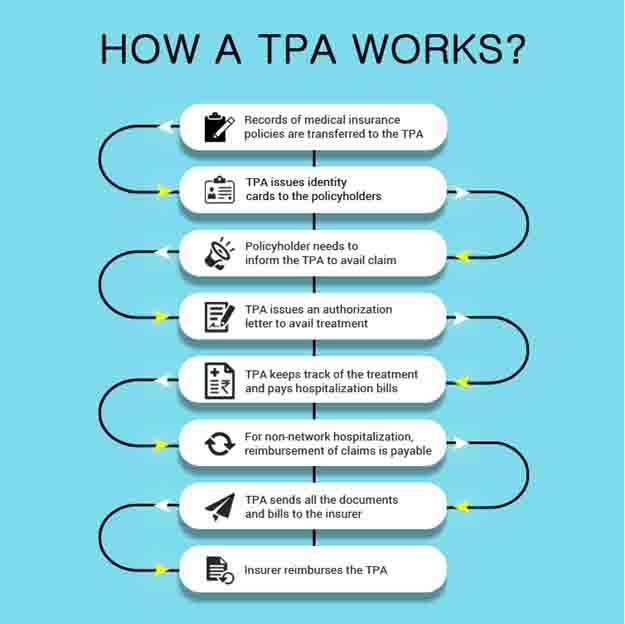

How TPA’s Work?

Given below are the steps being followed by the TPA’s from the initiation until the settlement of the claims.

- Once the insurer has given the authority to a TPA for handling and settlement of claims, all records of medical insurance policies are transferred to the TPA.

- TPA will issue identity cards to the policyholders, which they have to produce to avail of any cashless hospitalization services.

- To get the claim, a policyholder needs to inform the TPA on a 24-hour toll-free number. Upon informing the TPA, the policyholder is directed to a network hospital where he/she can avail of cashless hospitalization. Moreover, the policyholder also has the option to get hospitalization in a non-network hospital, but in this scenario, payment will be made on a reimbursement basis.

- TPA issues an authorization letter to the hospital for treatment and agrees to pay for the treatment based on policy terms and conditions.

- TPA keeps tracking the treatment of the insured at the hospital and at the time of discharge, all the hospitalization bills and other claim-related documents are sent to TPA.

- TPA pays the due bills to the hospital. In the case of hospitalization in a non-network hospital, the insured needs to pay bills and TPA asks to send them the bills paid to release reimbursement of payments.

- TPA sends all the necessary documents along with bills to the insurer.

- The insurer then reimburses the TPA.

List of TPA’s licensed by IRDAI

As of 31st March 2017, there is a total of 27 TPA’s which are licensed by IRDAI.

| S.No. | Name of TPA | Contact Details |

| 1 | UnitedHealthcare Parekh Insurance TPA Private Limited | Phone: 022-28532400, Fax: 022-28527776 E-mail: shiva.belavadi@uhcpindia.com |

| 2 | Medi Assist Insurance TPA Private Limited | Phone: +91 80 49698036, Toll Free Fax No.: 1800 425 9559 E-mail: ganeshk@mediassistindia.com;cao@mediassistindia.comWeb: www.mediassistindia,com |

| 3 | MD India Health Insurance TPA Private Limited | Phone: 020-25300000, Fax:020-25300003 E-mail: skarandikar@mdindia.com Web: www.mdindiaonline.com |

| 4 | Paramount Health Services & Insurance TPA Private Limited | Phone: 022-6644 4600/6662 0800, Fax: 022-66444754/755 E-mail: nayan.shah@paramounttpa.com Web: www.paramounttpa.com |

| 5 | EMeditek Insurance TPA Limited | Phone: 0124-4466600, Fax: 0124-4466677 E-mail: bskaintura@emeditek.com customercare@emeditek.com |

| 6 | Heritage Health Insurance TPA Private Limited | Phone: 033-22482784, 22486430, Fax: 033-22100837/22310287 E-mail: stiwari@bajoria.inToll free: 1088-345-3477 |

| 7 | Focus Health Insurance (TPA) Private Limited | Phone: 0120-4881400, Toll free: 1800 112 999 E-mail: cao@focustpa.comWebsite: www.focustpa.com |

| 8 | Medicare Insurance TPA Services (India) Private Limited | Phone: 033-2281 2826, 9831184120, 22809510/22809791 Fax-033-22806111 Email: medicareho@medicaretpa.co.in |

| 9 | Family Health Plan Insurance TPA Limited | Phone: 040-23556464, Fax: 040-23541400 E-mail: bharathig@fhpl.net |

| 10 | Raksha Health Insurance TPA Private Limited | Phone: 0129-2564057, 2564083, 2250000 Fax: 0129-4018012/ 2250002 E-mail: raksha@rakshatpa.com, pawan@rakshatpa.com |

| 11 | Vidal Health Insurance TPA Private Limited | Phone: 080-40125678, Toll free: 1800 345 4051 Fax: 080-28418216/17 E-mail: sudha@vidalhealth.com |

| 12 | Anyuta Insurance TPA in Health Care Private Limited | Landline/Fax: 080-41128311 / 25364766 E-mail: anyuta.anyuta@gmail.com, ravi@anyuta.com Website: www.anyutatpa.com |

| 13 | East-West Assist Insurance TPA Private Limited | Phone: 011-47222666, Toll free: 1800-1111-46 Fax: 011-47222640 E-mail: assistance@eastwestassist.com nbatra@eastwestassist.com |

| 14 | Medsafe Health Insurance TPA Limited | Phone: 011-29521061-66, 39001234 Fax – 29521067/71 Email: vt@medsave.in Website: www.message.in |

| 15 | Genins India Insurance TPA Limited | Phone: 0120- 4144 123 (10 lines) Toll-free: 1600-345-3323 Fax: 0120-2430064, 4144 170/ 171 E-mail: sckhanna@geninsindia.com |

| 16 | Alankit Insurance TPA Limited | 011-49355621 to 49655627 E-mail:alok@alankit.com |

| 17 | Health India Insurance TPA Services Private Limited | Phone: 022-42471900 (80 lines) Fax: 022-42471910/911/946, 25783382 E-mail: kamaljeetg@healthindiatpa.com |

| 18 | Good Health Insurance TPA Limited | Phone: 040 – 66825001/003, 23735006 Fax: 040-66828081/88 /89 E-mail: saigeeta@ghpltpa.com |

| 19 | Vipul MedCorp Insurance TPA Private Limited | Phone: 0124-2438270-75 Fax: 0124- 2438276 E-mail: rs@vipulmedcorp.com |

| 20 | Park Mediclaim Insurance TPA Private Limited | Phone: 4153 9498 (4 lines), 25747454-55 Fax: 41539390-91Email: park@parkmediclaim.comWebsite: www.parkmediclaim.com |

| 21 | Safeway Insurance TPA Private Limited | Phone: 011-4142 5671, 25464823 Fax: 011-41425672/912266466797 E-mail: support@safewaymediclaim.com drdivneet@safewaymediclaim.com |

| 22 | Anmol Medicare Insurance TPA Limited | Phone: 079-40009926, 40009936, 40009999 Fax: 079-40009990 |

| 23 | Dedicated Healthcare Services TPA (India) Private Limited | Tel: 022-66275900 Toll-Free 18002090201 Fax No. 022-22874235 Email: contactus@dhs-india.com anahita@dhs-india.com |

| 24 | Grand Insurance TPA Private Limited | Tel: 033- 40274747 Mobile number: 9830063492 / 9051288050 Toll Free: 1800 102 4747 Fax: 033-400433344 E-mail: adm.grandtpa@gmail.com help.grandtpa@gmail.com |

| 25 | Rothshield Insurance TPA Limited | Tel: 022- 2202 2147/22048144 Toll-free: 1800 22 8144 Fax Number 022-2285 4415/ 39167430 E-mail: janki@rothshield.co.in Website: www.rothshield.co.in |

| 26 | Ericson Insurance TPA Private Limited | Phone: 022 – 25280280 E-mail: krishna@ericsontpa.com |

| 27 | Health Insurance TPA of India Limited | Phone: 0120-4765800 Fax: 0120-4765899 E-mail: sk.mehra@hitpa.co.in |

Benefits of Third Party Administrators

In the healthcare industry, an introduction of TPA is beneficial to both the insured and the insurance company. Third-Party Administrators’ benefits are listed below.

From Insurer’s Perspective

1) Standardizing Treatment Norms & Its Cost

The biggest problem with the private healthcare sector is its uncontrolled and unregulated expansion. Lack of regulation and standardization of the private health care sector results in serious issues such as under-reporting leading to the lack of availability of information for decision making and a poor billing system could lead to over-billing.

TPA’s work diligently arranges a specialized consultation for the patient, makes a comprehensive review of medical records, assesses the outcome of treatment, and ascertains a false claim helps to reduce the moral hazard and provider-induced demand.

TPAs collect bills, make reimbursement and send the necessary documents to the insurer. They analyze data related to hospital admissions, availability of adequate treatment facilities, tracking documents related to each case, and identifying the health needs of patients that further help an insurer serve the insured with better health care services.

2) Reduced claim settlement turn around time

Third-Party Administrators work as an intermediary to ensure smooth claim settlement between the insurer and the insured. The introduction of TPA services helps to simplify the claim settlement process.

The tie-up between TPA’s and health care providers supports the collection and monitoring of necessary information, relevant documents, and medical bills. Records are examined thoroughly and sent to the insurer for consideration of claims. TPA’s are responsible for managing claims, getting reimbursement from the insurer, and paying for the healthcare facilities. Outsourcing claim-processing services help an insurer reduce the time required for settling the claims.

3) In-house Expertise

Typically, TPA’s has the in-house expertise of medical doctors, insurance consultants, hospital managers, IT professionals, legal experts, and management consultants. The high-end knowledge of TPA’s helps insurers to provide the insured with quality health care services. The team of competent medical professionals with a third-party administrator will advise the insurer and the insured on various matters.

From Insured’s Perspective

1) Services and Consumer Education

TPA’s provide value-added services to the policyholders/insureds such as the arrangement of ambulance services, assisting them in availing specialized consultation, and providing medicines & supplies. They also provide information about impaneled hospitals, health facilities, bed availability, 24-hour helpline, etc. that help them to avail quality medical care.

2) Assistance in Hospitalization & Claims Processing

The introduction of TPA’s is aimed to manage administrative activities related to health policies. Their activities include issuing identity cards to the policyholders and helping the policyholders access quality health care along with cashless hospitalization. They also contribute to arranging a specialized consultation and help insureds to process health claims. TPA’s ensure you, faster and more focused claims management.

Knowledge about Coverage and Exclusions

The majority of buyers don’t take the time to read through the coverage and exclusions available under a health policy that is resulting in a wrong buying decision. TPA’s help you get the complete information regarding the coverage available and exclusions applicable, which facilitate you in buying the right health cover.

Challenges faced by Third Party Administrators

No doubt, TPA’s are benefitting both the insured and the insurer. Still, they are suffering from the following problems.

- Delay in the issuance of identity cards to policyholders

- Poor standardization of billing procedures in hospitals

- Weak hospital networking

- Lack of communication between corporate hospitals and insurance companies

- Absence of an appropriate system of financing their operations

- Low awareness among policyholders regarding TPA’s roles & functions

- Need to focus on developing their competencies

- Lack of mechanisms to assess the performance of the TPAs. It is more based on financial performance rather than customer satisfaction.

Conclusion

In a nutshell, a third-party administrator (TPA) is an organization that handles the administration of the health policies such as record keeping, processing & settlement of claims, etc. The key role of a TPA is to ensure better & quality health care services to policyholders, providing easy access to cashless hospitalization along with quick & hassle-free claims settlement.

By providing better services to the insured members, a TPA helps the insurer to safeguard the customer relationships along with the reduced cost of claims management.

Hi

Can you recommend a TPA with Christian healthcare experience?