Things to Know About Endowment Plans

Endowment plans have always been a popular form of Life insurance in India because of its dual benefit of life cover and investment. A part from an insurance cover, it offers the policyholder to save regularly over a specific period of time, so that he can get a lump sum at the policy maturity in case the policyholder survives the policy term.

The full sum assured is paid by the insurer if the policyholder dies before the maturity or if the policyholder survives the policy term. Thus an endowment plan encourages goal based saving along with financial security for your loved ones.

With so many benefits under a single policy, it is very much necessary for a buyer to understand the key aspects about endowment plans.

Table Content

1) Types of Endowment Policies

There are two types of Endowment plans in India, one is with profit and another one is without profit. An endowment plan without profit guarantees only the sum insured to be paid to the nominee in case of death of the policyholder without any bonus, profit or any other benefit while an endowment plan with profit gives you sum assured along with the profit, bonus and all other benefits accumulated during the policy term. An endowment plan without profit is simply a non-participating policy while an endowment plan with profit is a participating policy.

2) Higher Premium Amount

The premium amount which you pay for an endowment plan is generally higher than the traditional term plan. This is because in an endowment plan, money is invested in various instruments in addition to the life cover and thus the liability of the insurer increases towards you. While in whole life plan and term plan, the liability of the insurer is limited to your life only. Even within the endowment plan, the premium price varies according to the plan.

3) Bonus

Every year of the policy term, a specific amount of bonus (based on the performance of your investment) is declared for your endowment policy. This bonus is added to your sum assured and paid at the time of maturity or in the form of death benefit. There are generally two types of bonuses in an endowment plan, revisionary bonus and terminal bonus. A revisionary bonus is declared regularly and paid at the time of claim. A terminal bonus is an additional loyalty bonus which is paid once only at the maturity of the policy.

4) Availability of Riders

You can add a rider to your endowment policy by paying an extra amount on your premium. These riders widen your area of coverage at a nominal cost. Some of the riders available with an endowment plan are accidental death benefit, waiver of premium benefit, family Income benefit, critical illness benefit, etc. One must choose riders wisely as adding unnecessary riders will only become a financial burden for you. So it is necessary to understand each and every rider available with your policy.

5) A Guaranteed Policy with Guaranteed Benefits

A guaranteed benefit of an Endowment Plan is what sets it apart from all other policies available in the market. There is a guaranteed amount of money which is paid at the time of claim in endowment policies, whether it is policy maturity or at the time of death of the policyholder during the policy term. The amount which is received at the time of death of the policyholder during the policy term is known as guaranteed death benefit while the lump sum amount received at the time of maturity is known as a guaranteed maturity benefit.

6) Dual Benefit

An endowment plan offers a dual benefit of investment and insurance. Along with the insurance cover, an endowment policy gives you the opportunity to build a corpus to meet your future goals. The sum assured keeps on increasing with bonus and other benefit which makes your endowment policy, an ideal investment tool.

7) Premium Flexibility

Flexibility in premium payment is one of the best advantages of an endowment policy. It gives you the option to pay the premium for shorter duration of time and enjoy the benefits for a longer term. Even if you stop paying the premium after certain minimum years, you can still secure the free paid-up policy for a lower assured sum.

8) Beneficial for Long Duration

Endowment plan is beneficial if you hold it for a longer duration. You must stick to the policy after buying it, so that you can enjoy the actual benefits of the policy. The return in the policy is paid only on death and maturity, and since the surrender value is very low, there is no point of buying an Endowment Plan if you don’t want to continue it for longer duration.

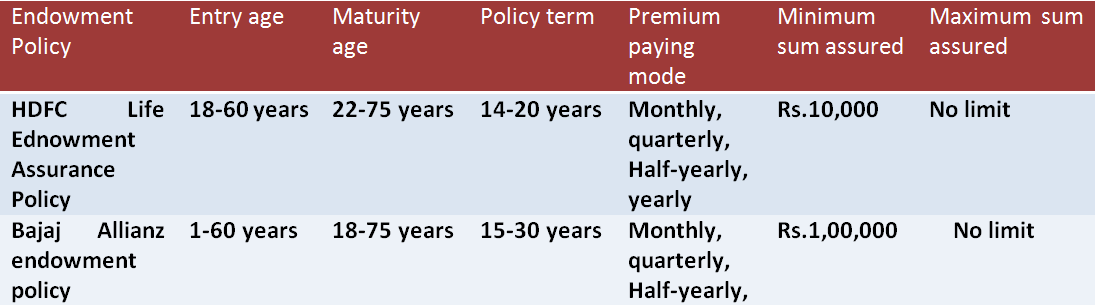

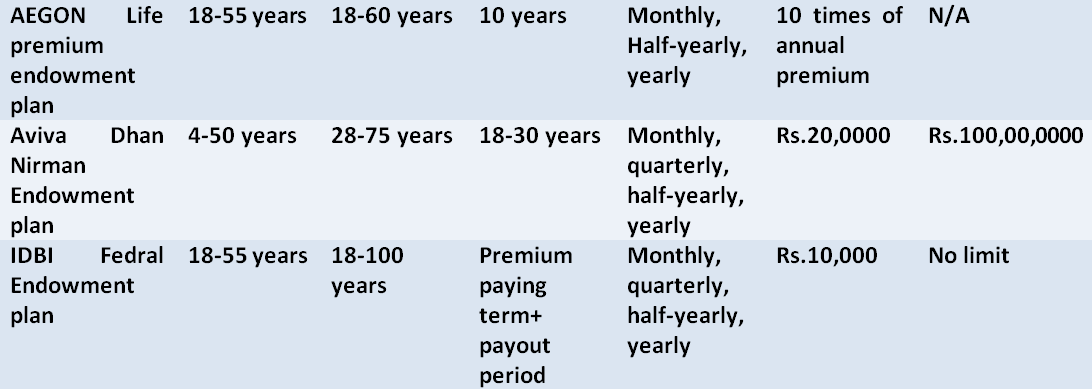

Best Endowment Policies in India

So an endowment plan comes with a dual benefit of investment and insurance, which gives you the option to build a corpus for your future goal with life security through insurance. It is advisable for people with regular income or salaried people because the continuity of the plan for a longer duration is very much necessary to avail maximum benefit from the policy.