Scope of Non-Allopathic Treatment under Your Health Plan

The scope of coverage and benefits of health insurance policy has expanded a lot since its introduction. With the changing needs and demands of people, health insurance policy has evolved to match the same. IRDAI has played a major role in shaping health insurance regulations to fit into the requirements of people perfectly by recommending changes and adding benefits to the health insurance policies. Earlier, the Health insurance policy provided cover for only allopathic treatment, but in a country like India, where we have a number of options available for treatment, it is imperative to realize the need to cover non-allopathic treatments like Ayurveda, Homeopathy, Yoga, Unani, etc. Because in India, there are many traditional ways of treatments available which are very natural and successful, and a big chunk of people prefers non-allopathic treatment over allopathic treatment for specific medical conditions. This has led to one of the biggest changes in the health insurance policy framework, which is the inclusion of the cover for AYUSH treatment in many health plans offered by insurers.

Table Content

What is AYUSH Treatment?

AYUSH treatment is the procedure of treatment through Ayurveda, Yoga, Unani, Sidha, and Homeopathy. There is also a ministry, known as the AYUSH Ministry under the Government of India which was formed on 9th November 2014. Ayurveda has strong roots because of its plant-based medicines in India. Even Homeopathy in India is showing a growth of 30% every year. But people with fatal illnesses, still prefer allopathic treatment over any other procedure.

How does Health Insurance Policy Covers AYUSH Treatment?

There is no standalone cover for non-allopathic treatment. Your general health insurance will provide cover for non-allopathic treatment (if mentioned in the policy coverage). While some of the companies are providing cover for Ayurvedic and homeopathic treatment under group policies, others are offering coverage for AYUSH treatment under individual health policies too.

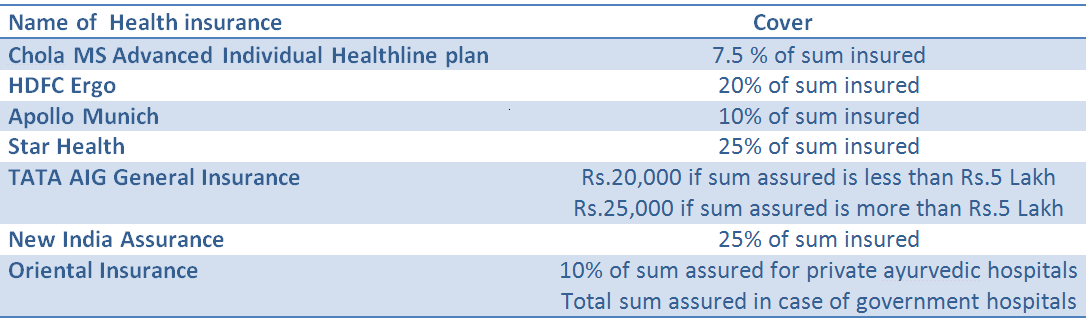

There is a limit of cover, mentioned in the health insurance policy for non-allopathic treatment. Generally, it varies from 7.5 % to -25 % of the sum assured. Every company giving AYUSH benefits doesn’t give cover any type of non-allopathic treatment. Some of them give cover Ayurveda and Homeopathy while some cover all the AYUSH treatments. But naturopathy is still not covered by any health insurance company.

Even if a company is giving cover for Ayurvedic treatment, not all forms of ayurvedic treatment will be covered by the company. The type of treatment varies from company to company. Hospitalization of more than 24 hours is required to avail of AYUSH benefits under your health insurance policy.

The insurance company will give you the AYUSH benefit if the institution in which you have undergone the treatment is certified by a government or accredited by the Quality Council of India or the National Accreditation Board on Health.

What options do I have for Covering My Non-Allopathic Treatment?

Not many companies in India are giving the benefit of AYUSH treatment under their general health insurance. And this is because the cost of treatment varies a lot and the procedure of these treatments is very unclear and not standardized.

Some of the companies which offer cover for AYUSH treatment (type of treatment covered varies from company to company) are as follows: –

With the Government and Ayush Ministry’s intervention in promoting AYUSH treatments, insurers are coming up with Health Plans offering this cover either as an out-patient benefit or under other benefits of the Health Insurance policy. But still, due to the complexity of price and procedure, it has still not become mainstream coverage in many Health Plans. Many people in India prefer non-allopathic treatment and consider it to be covered under their health insurance policy, but you should check the fine print regarding AYUSH treatment in your policy so that there will be no surprise while making the claim. It is beneficial for people who consider non-allopathic treatment as a need for health care, but it is strictly advised to go through the policy guidelines regarding AYUSH benefits.

Hi Sonia, Interesting read. Wrt the non-allopathy services that are approved by the various health insurance companies in India, is there any data available which are the treatments/programs that are covered.