Role and Importance of TPA in Health Insurance Policy

The increasing number of health-related issues due to our current lifestyle and the environmental condition has shifted the perception of health insurance from a luxury product to a necessity. Now people are more aware of the benefits of a Compare health insurance policy which was earlier considered a very less fruitful product. A health insurance policy also helps in tackling the rising cost of health care which can burn a deep hole in your pocket. there is many Role and Importance of TPA in Health Insurance Policy.

Such growth of the health insurance sector has helped in the evolution of health insurance, which has widened the area of benefits and flexibility for the customers. Now a health insurance sector comes with a bundle of benefits but to take advantage of these benefits, you must be aware of the fine prints of your policy and the facilities provided by your insurer, and one such important facility of health insurance policy is TPA.

So let us understand the various aspects of TPA in health insurance through this article.

Table Content

What is TPA?

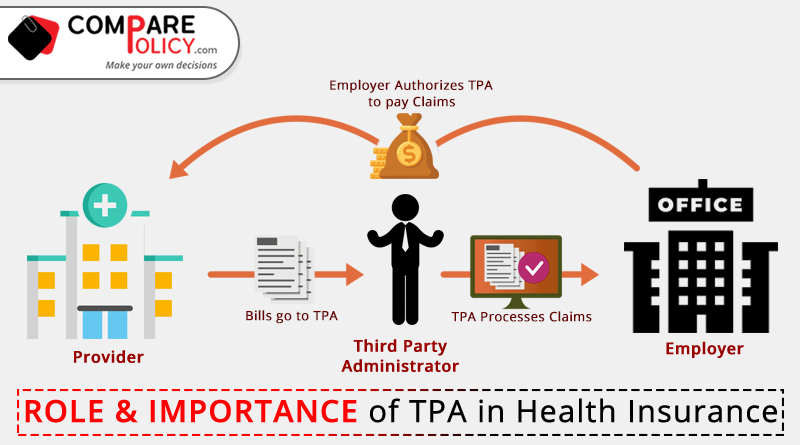

TPA is an organization that processes claim settlement or provides the cashless facility in a cost-effective, timely, and hassle-free manner for both corporate and retail policies. The TPA works as an intermediary between the insurance provider and the insured and is hired by the insurer for specialized health insurance processes.

Handling the above-mentioned processes of health insurance requires a specialized set of manpower and technology, therefore hiring a TPA for the same comes out to be a more cost-effective process. Some of the TPA in insurance work as a unit of health insurance companies while others work independently. The TPA was introduced by IRDAI in the year 2001.

The IRDAI defines TPA as one who, for the time being, is licensed by the authority, and is engaged, for a fee or remuneration, in the agreement with a health insurance company for the provision of health service.

Role of TPA

The role of TPA starts after the policy has been issued. Following are the important roles of TPA in health insurance

Claim Settlement– One of the most important roles of TPA is claim settlement of health insurance policy. The bills of the hospitals which need to be claimed are shared with TPA by the hospital and the TPA cross-checks the same according to the terms and conditions of the policy. The TPA can take a second medical opinion for complicated cases and can also investigate hospital records in case of suspicious claims.

Cashless processing– In the case of treatment in-network hospitals, a TPA helps in cashless processing under a health insurance policy. The insured person needs to inform the TPA about the details of treatment and facilities availed with required documents proof, which is then verified by the TPA, and then all the bills of hospitals that come under the policy cover are paid directly by the company.

Maintaining Database- TPA also helps in maintaining the database record. After the issuance of the policy, all the policy documents are transferred to TPA and all the further communication of the policyholder is with the TPA, not with the insurance company. The TPA maintains the policy documents of the policyholder and issues an identity card with unique identification numbers.

Maintaining service center- The TPA in insurance is also responsible for maintaining a 24-hour customer service center, which can be accessed from anywhere in the country and can be used for queries and information such as eligibility for the claim, claim settlement process, the status of claim settlement, the network of hospitals, etc.

Value-added services– Instead of the above-mentioned roles, a TPA in insurance also helps in value-added services such as ambulance services, availability of beds, lifestyle management, medicine supplies, health facilities, etc.

Importance of TPA

Better delivery of services- The involvement of TPA helps in improving the services of the health insurance policy. Because of the ease of contacting TPA and its everywhere availability, the customer finds it easy to deal with various processes of health insurance like claim settlement, network hospital information, cashless treatment, etc. The 24-hour customer service by the TPA also improves the quality of service delivered.

Better standardization- Due to the specialized skill set and technology, the TPA is able to make better standardization of all the processes which they carry with due diligence. It wipes out the confusion of the customers regarding the various processes of health insurance carried out by TPA.

Greater penetration of health insurance- The involvement of the TPA has also allowed a greater penetration of health insurance and this is because of the better services provided by the TPA which makes managing and understanding the health insurance policy very easy. That’s why more people are becoming aware of the benefits of health insurance policy and their perception of health insurance policy as an unfruitful and complex product is changing.

Lower insurance premium- The TPA includes a team of professionals who help the claim process which helps in avoiding fake claims and restricts unnecessary treatments, thus improving the quality of service which leads to low insurance premiums.

Other than the above-mentioned importance, TPA in insurance also helps in increasing the knowledge base of healthcare services, minimizing the expenditure of the insurer, and introducing a new management system.

Some of the Third Party Administrators in India:-

- United Healthcare Parekh TPA Pvt. Ltd.

- Medi Assist India TPA Pvt. Ltd.

- MD India Healthcare (TPA) Service (Pvt.) Ltd.

- Paramount Health Services & Insurance TPA Pvt. Ltd.

- E Meditek (TPA) Service Ltd.

- Heritage Health TPA Pvt. Ltd.

- Focus Healthservices TPA Pvt. Ltd.

- Medicare TPA Services (I) Pvt. Ltd.

- Family Health Plan (TPA) Ltd.

- Raksha TPA Pvt. Ltd.

The involvement of TPA in insurance makes the various processes of Health insurance policy like claim settlement, cashless treatment, customer service, etc., very easy and quick for you. But still, due to unawareness, many policyholders still contact their agent for such kinds of needs which can delay your request and make things more complicated for you. So take advantage of the TPA of your health insurance and enjoy a hassle-free and more beneficial health insurance policy.