Post Office Time Deposit – An Investment Option to Save Tax

Getting a regular savings from your income is a major step towards a robust financial planning. These savings help you to tackle any unforeseen financial contingency. A habit of regular savings facilitates you to invest in one of the small savings schemes which can ensure a fixed interest income along with risk-free investment. One such investment is Post Office Time Deposit (POTD) Scheme.

Table Content

- What is Post Office Time Deposit Scheme?

- Highlights of this Scheme

- Wealth Accumulation

- Tax Benefits

- Premature Withdrawal

- Nomination

- Transfer

- Eligibility for Investment

- Who can open this account?

- Limit of investment

- Tenure

- How Post Office Time Deposit helps you accumulate funds?

- How Post Office Time Deposit helps in saving Tax?

- How to open Post Office Time Deposit Account?

- Conclusion

- Related posts:

What is Post Office Time Deposit Scheme?

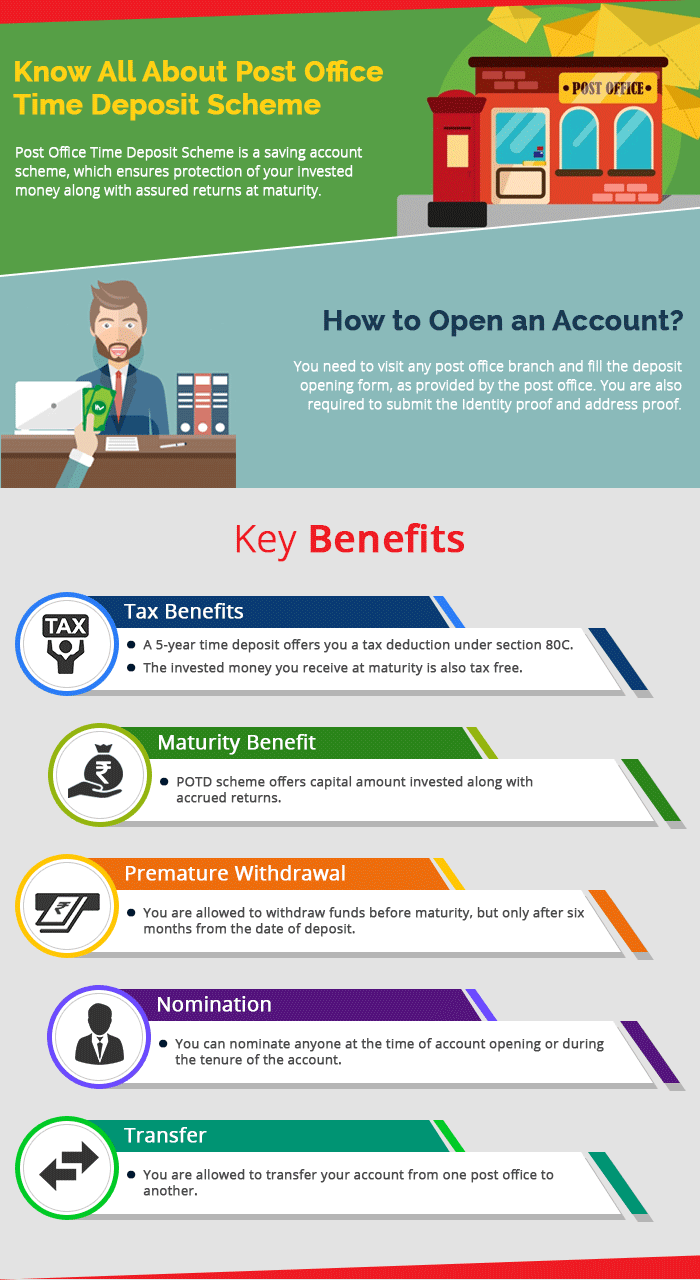

Post Office Time Deposit (POTD) Scheme is one of the widely preferred saving account schemes offered by the post offices. You only need to invest the surplus funds for a definite time period, which offers you a guaranteed return through the entire tenure of the deposit. At the end of the tenure, the maturity amount payable comprises of your deposit and the interest income.

Highlights of this Scheme

Wealth Accumulation

The investment in POTD scheme is completely protected, as it is backed by the Government of India. Investing in this scheme also offers a fixed rate of interest, which ensures an assured return on the deposit that result in risk-free wealth accumulation that you can further utilize to fulfill your financial goals.

Tax Benefits

The investment under 5-year time deposit is eligible to avail tax deduction under section 80C of the Income Tax Act, 1961. The invested money you receive at maturity is tax exempted.

Premature Withdrawal

With this option, you are allowed to withdraw funds before maturity, but only after six months from the date of deposit, subject to certain norms as specified below.

For accounts opened on or before 30th November, 2011: For deposits of one year tenure, no interest is payable, when the deposit is withdrawn prematurely after 6 months but before 1 year. For deposits of two, three or five years, the interest rate is 2% less than the actual rate for the entire term in case the amount is withdrawn prematurely after one year but before the completion of tenure. The interest payable would be for the period of investment till you withdraw the deposits.

For accounts opened on or after 1st December, 2011: For deposits of one year tenure, simple interest rate equal to the rate applicable to post office saving account shall be payable when deposits withdrawn prematurely. For deposits of two, three or five years, the interest rate payable is 1% less than the actual rate specified for the entire tenure.

Nomination

You are allowed to nominate one or more nominees under this scheme. Upon your death before the maturity, your nominee/legal heir has the option to continue the account and receive the outstanding amount at maturity. In case he/she does not continue the account, it shall be closed and the outstanding deposit in the account shall be paid with accrued interest. The interest rate shall be applicable for the period the deposit has remained in the account.The nomination facility is available at the time of opening of account and it can also be done during the tenure of the account.

Transfer

You have the flexibility to transfer your account from one post office to another.

Eligibility for Investment

Who can open this account?

Any adult resident Indian is eligible to open account under POTD scheme. A joint account can also be opened by two adults. A minor of 10 years of age or above can open and operate the account. An adult individual can also open POTD account on behalf of a minor.

Limit of investment

The minimum amount of investment is Rs 200 and there is no limit for maximum deposit (in multiples of Rs 200) under this scheme.

Tenure

You can invest in Post Office Time Deposit Scheme for 1 year, 2 years, 3 years & 5 years. For deposits under 5-year scheme, you can claim tax benefits under section 80C of the Income Tax Act.

How Post Office Time Deposit helps you accumulate funds?

In order to start investing in POTD Scheme, you are required to make a one-time deposit for the chosen tenure. You are entitled to receive the deposit amount along with accrued interest at the time of maturity. Under this scheme, the interest is calculated on quarterly compounding basis and payable annually. The interest rate is guaranteed for the tenure of the deposit and thus offers the fixed returns on your deposit amount. The returns offered will help you to grow your funds.

The interest rate % under POTD Scheme for 5 year tenure.

| Financial Year | Tenure |

|---|---|

| 2017-18 (Q4) | 7.4% |

| 2017-18 (Q3) | 7.6% |

| 2017-18 (Q2) | 7.6% |

| 2017-18 (Q1) | 7.6% |

| 2016-17 | 7.9% |

| 2015-16 | 8.5% |

| 2014-15 | 8.5% |

| 2013-14 | 8.4% |

How Post Office Time Deposit helps in saving Tax?

Post Office Time Deposit Scheme is a government backed investment option which holds zero investment risk. For the conservative investor can consider this investment avenue to avail risk free investment returns along with reducing the tax liability. The five-year deposit under POTD Scheme qualifies for tax deductions under section 80C of the Income Tax Act, 1961. The maximum permissible limit for availing tax deduction is up to Rs 1.5 lakhs. You can deduct this amount from your taxable income that will help you to save tax. The deposit amount that you receive at maturity is tax free. The interest earned is considered as income and thus entirely taxable, in the year you receive it.

How to open Post Office Time Deposit Account?

You can open a time deposit account in any post office. The account can be opened by making a minimum investment via cash or cheque. In case of payment through cheque, the date of realization of cheque shall be the date of opening of account.

For opening a POTDS account, you need to furnish the following documents.

- A duly filled deposit opening form.

- Identity and address proof such as PAN card /form 60 or 61, passport, driving license, Adhaar Card, voter’s ID or ration card.

- Also, carry original identity proof for verification.

- Make nomination and get a witness signature at the time of opening the account.

Conclusion

Post Office Time Deposit (POTD) Scheme is a savings account scheme and you can visit any post office branch or head post office for opening the account under this scheme. As, it is a government backed scheme, the money invested is completely protected and it also offers risk-free guaranteed returns.

In addition to the fixed returns, it also offers tax benefits. The five-year deposit under POTD Scheme helps you to avail tax deductions under section 80C of the Income Tax Act. The invested money that you receive at maturity is also tax free.

I am very new to this website but it really helping me a lot for comparing all the policy available with different companies. I recently talked to customer service. They are ready help like anything.

Thank you Manish. Appreciate your time and effort.