New Tax Benefits Under Section 80D

The health insurance policy is an ideal form of financial arrangement to take care of the treatment costs in case of hospitalization due to illness, disease, or accident. A health insurance plan averts “out of the pocket expenses” and offers you financial protection to get yourself a worry-free medical treatment. Under the ambit of a health insurance plan falls various benefits like cashless hospitalization, daycare treatment, pre & post-hospitalization, organ donor, etc. Apart from the core benefits, a health insurance plan also allows you to avail of tax benefits under Section 80D of the Income Tax Act.

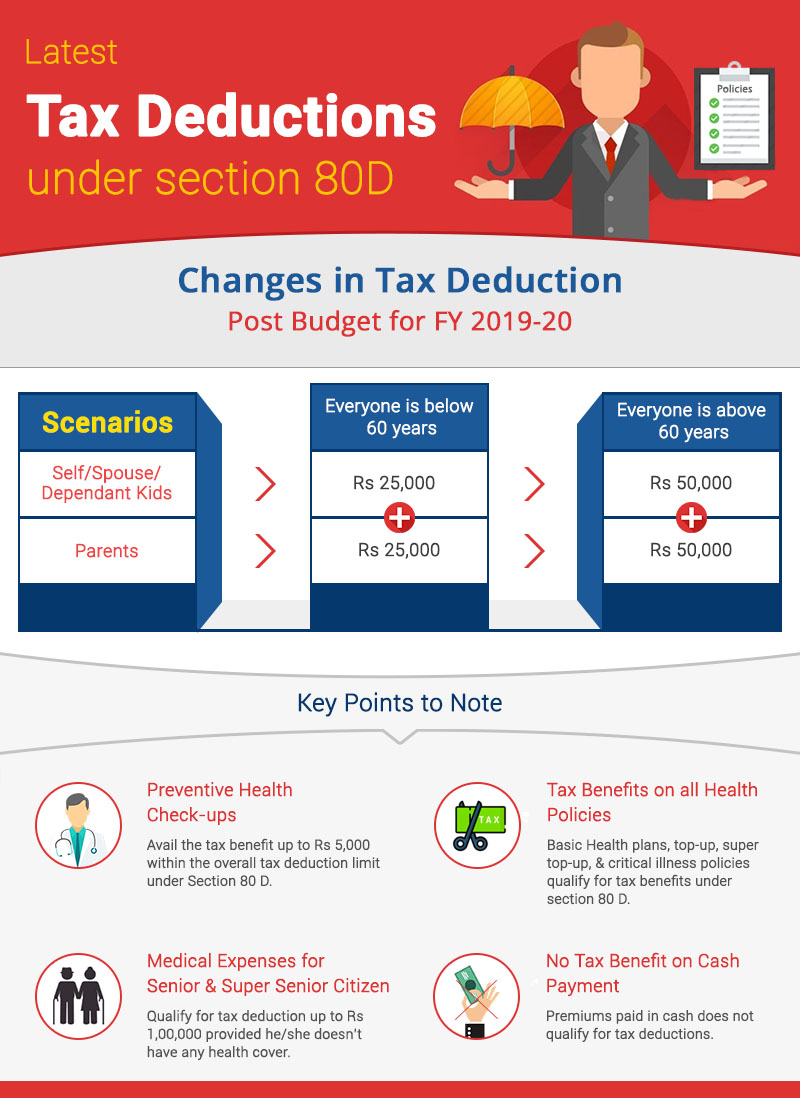

Section 80D allows you to claim the tax deduction on the premium paid towards medical insurance. Medical insurance may include any type of health insurance policy, such as regular health policy, top-up/ super top-up, critical illness fixed benefit health plans, and also the critical illness rider opted under a life insurance policy. The premiums paid in cash do not qualify for the tax deduction.

Table Content

Who Can Claim a Tax Deduction?

The tax deduction under a health insurance policy can be availed by both the Individual & Hindu Undivided Family (HUF).

- As an individual taxpayer, you can claim tax deduction under section 80D towards the premiums paid for health insurance for yourself, your spouse, dependent children, and parents. Any premium amount paid towards the central government health scheme or any other scheme also qualifies for a tax deduction. You can also avail of the deduction for the expenses incurred by you towards preventive health check-ups.

- A Hindu Undivided Family (HUF) is also eligible to claim a tax rebate. The tax deduction can be availed for the premium paid towards the medical insurance for a HUF member only.

- Being an individual or HUF, the medical expenses incurred on the health of a very senior citizen person also qualify for tax deduction under section 80D. This tax benefit can be availed, in the absence of having health insurance coverage in force for such a person.

Tax Deductions under Section 80D for FY 2019-20

When it comes to tax benefits, you can avail of tax deduction under section 80D of the Income Tax Act for the health insurance premium paid for:

For the premium paid by you towards medical insurance bought for yourself, your spouse, and your dependent children, you can avail of the deduction up to a maximum of Rs 25,000 during a financial year if your age is less than 60 years. If your age is above 60 years, with the new budget announcement you can claim the deduction up to the maximum of Rs 50,000.

When you pay the premium for your parents, you are eligible to avail additional tax deduction up to Rs 25,000 (if parents are less than 60 years). If parents are senior citizens, this deduction is available up to the maximum of Rs 50,000.

Preventive Health Check-up

If you have incurred any health check-up expenses for yourself, your family, and your parents, you can avail of the tax deduction of up to Rs 5,000. This tax deduction is available within the total ambit of deduction you can claim under section 80D.

Illustrative Example

Let’s understand the tax exemptions under section 80D, with the help of an example.

Case 1: Mr. Akash aged 40 years, will make the following payments during the financial year 2018-19.

- He paid the insurance premium of Rs 12,000 for his medical insurance policy.

- The medical insurance premium of Rs 8,000 for his spouse’s policy.

- Payment of medical insurance premium of Rs 3,000 for his dependent daughter’s policy.

- Expenses incurred on preventive health check-ups is Rs 5,000.

Considering the above scenario, Akash’s money outflow towards medical insurance and health check-up is Rs 28,000 (Rs 12,000 + Rs 8,000 + Rs 3,000 + Rs 5,000) but as per section 80D, the maximum deduction which Akash can claim is Rs 25,000.

Case 2: Mr. Akash aged 40 years, will make the following payments during the financial year 2018-19.

- He paid the insurance premium of Rs 12,000 for his medical insurance policy.

- The medical insurance premium of Rs 8,000 for his spouse’s policy.

- Payment of medical insurance premium of Rs 3,000 for his dependent daughter’s policy.

- Expenses incurred on preventive health check-up is Rs 2,000.

- The medical insurance premium of Rs 50,000 for his senior citizen parent’s health insurance policy.

Akash’s Individual tax deduction benefit:

Considering the above scenario, Akash’s money outflow towards medical insurance and health check-up is Rs 25,000 (Rs 12,000 + Rs 8,000 + Rs 3,000 + Rs 2,000). So, Akash can claim entire Rs 25,000 under section 80D as the maximum deduction allowed is Rs 25,000 for someone less than 60 years of age.

Akash’s Parent’s tax deduction benefit:

Akash paid Rs 50,000 for his parent’s health insurance. He can additionally claim Rs 50,000 on his parent’s health insurance premium with the new increased tax deduction limits applicable post Budget announcement.

Akash’s Total tax deduction benefit under Section 80 D:

Rs 25,000 (for self, spouse & kid) + Rs 50,000 (for senior citizen parents) = Rs 75,000

Subsections under Section 80D

Section 80DD

An individual/HUF can avail of a tax deduction under section 80DD, in case of expenditure incurred on medical treatment, training, maintenance, rehabilitation of a dependent with a disability. In case of disability is 40% or more but less than 80%, a fixed deduction of Rs 75,000 can be claimed, irrespective of the amount of actual expenditure incurred. In case, the dependent person is suffering from a disability of 80% or higher, the amount of the tax deduction will be Rs 1,25,000.A copy of the certificate issued by the medical authority regarding the assessment of disability.

Section 80DDB

An individual/HUF taxpayer can claim a tax deduction for expenses incurred towards medical treatment of specified illnesses. Some of the specified illnesses include Neurological diseases, Full Blown Acquired Immuno Deficiency Syndrome (AIDS), Chronic renal failure, Hematological disorders, etc.

- Below Age 60The amount of the deduction you can avail of is the lower of actual expenses incurred for treatment of illnesses as specified under rule 11DD for prescribed disease/ailment or Rs 40,000.

- Above Age 60There is a common deduction of Rs 1 lakh available for senior citizens & super senior citizens.

Concluding Words

Tax benefits under Section 80D of the Income Tax Act, allow you to avail tax deductions against the medical insurance premium that you pay for yourself, your spouse, dependent children & parents, up to the limits specified. Under this section, you can avail of the tax deduction of up to Rs 25,000 for the premium paid for self, spouse, and dependent kids. If you fall in the category of a senior citizen, you may avail of a higher tax deduction of up to Rs 50,000. Health plans can be categorized as Individual Health Plan, Family Floater Health Plan, Senior Citizen Health Plan, and Critical Illness Health Plan (also known as fixed benefit plans).